The temporary closure of the Suez Canal by a grounded container ship this week has revealed the critical role played by the shipping industry in keeping European business and consumers afloat.

Research and data analysis by UK-based transport economists MDS Transmodal indicates that the blockage of the Suez Canal by the 22,000 TEU Ever Given highlights the dependence of the global economy on a handful of deep-sea shipping lines and the alliances they have formed.

Mike Garratt, Chairman of MDS Transmodal, said: “This week’s events have provided a real-time lesson in the critical role that container shipping plays in the economies of European states.

“The need for timely, reliable and insightful data has never been more acute. The Container Shipping Market Quarterly Reviews are designed to track the market from the perspective of the cargo owner – the shipper and report on the effects of market dynamics on the end user.”

A fleet of around 5,000 lift on-lift off container ships moved approximately 150m loaded TEU moved around the world in 2020, a figure that fell by only around 1% lower than in 2019 despite the pandemic; Q4 2020 was the busiest ever quarter by several percentage points.

The mean value of the goods in each loaded TEU is around $40,000. Global consumption was maintained through governments’ fiscal strategies.

Of that total, 108m TEU were ‘deep-sea’ (moving between continents), of which approximately 90% were moved by just 9 shipping lines, themselves organised into 3 alliances and with other inter-company agreements in place to manage capacity.

These deep-sea services employ 3700 ships, of which 583 are above 10,000 TEU in capacity. The largest group, those over 18,000 TEU, are used exclusively on Asia to Europe services. The mean capacity of those ships on the services operated by the alliance members through the Suez Canal was 16,000 TEU.

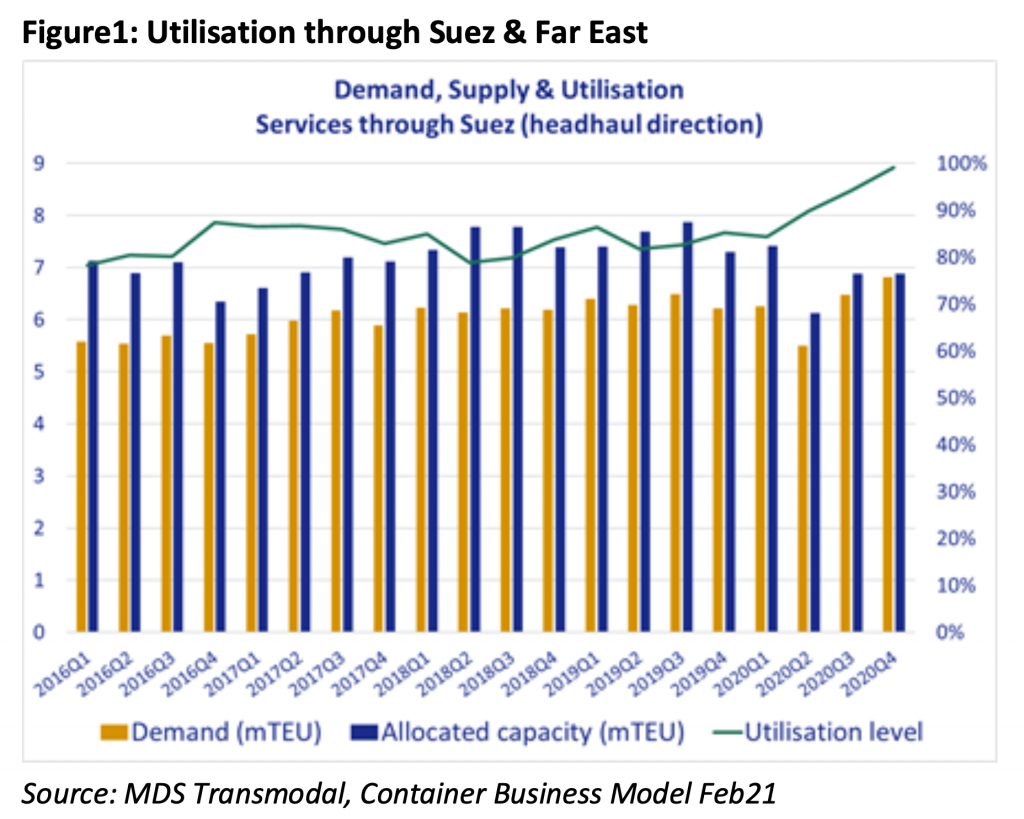

MDS Transmodal analysis of traffic through Suez suggests westbound utilization was approaching 100%, as shown in the following chart.

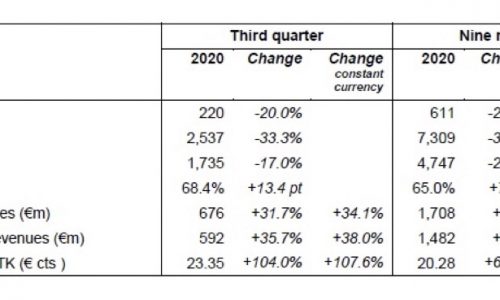

Increased demand against limited supply has led to a substantial increase in freight rates; the shipping lines’ own data shows that freight rates grew by c. 18% in Q4 2020.

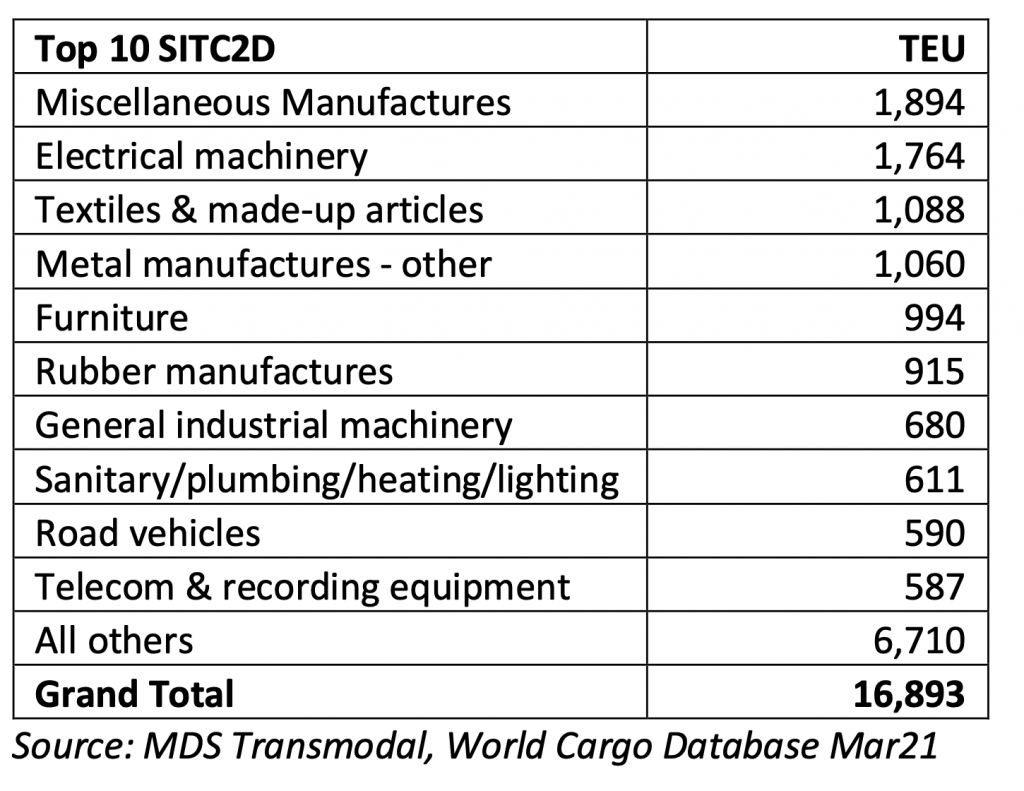

These ships carry a wide variety of goods; the following table summarises those estimated to have moved between Asia and Europe in 2020 by container services.

Table 1: Far East to North Europe & Med by SITC2D, estimated maritime loaded TEU (‘000s)

The lines could clearly deal with a blockage of the Suez Canal given time to plan and to build additional ships. In Spring 2020 two of the Alliances redirected eastbound vessels via the Cape to avoid Suez Canal tolls at a time when bunker prices were low; tolls are effectively set to reflect the cost of diverting shipping via South Africa.

However, done without warning, ships would be forced to arrive in Europe around 10 days late, impacting on supply chains while adding nearly 3 weeks to the round-trip time per ship, effectively cutting the carrying capacity of the existing fleet of 583 Large Container Ships that are dedicated to the Asia – Europe market by 20% overnight. That would have a very serious impact on the flows of goods and supply chains shown above.