Importers and exporters around the world are paying record high container shipping rates but receiving “appalling levels of service reliability”.

That is the conclusion of the latest quarterly review of the container shipping market issued by MDS Transmodal and the Global Shippers’ Forum (GSF).

The second in-depth survey of eight key performance indicators measuring activities in the global container shipping market reports data for the final quarter of 2020 and correlates the rapid recovery of world trade with the behaviour of rates and service performance experienced by cargo owners.

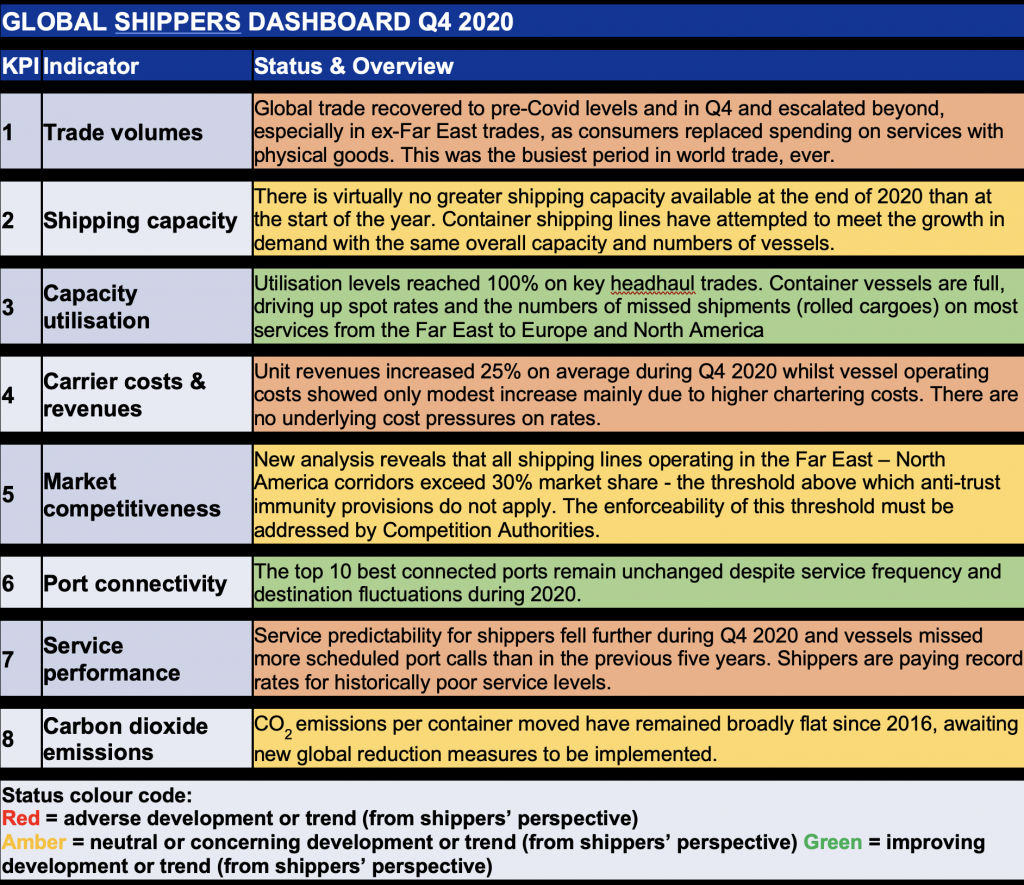

The findings are summarised in the Global Shippers Dashboardfor Q4 2020 reproduced below:

Mike Garratt, Chairman of MDS Transmodal, commented: “Q4 2020 saw the largest ever quarterly volume of container traffic globally while annual volumes almost reached 2019 levels despite the pandemic, carried on a fleet capacity that had hardly changed. Demand growth was at its strongest on the East-West routes linking Far East manufacturers with consumers in North America and Europe.

“As a mathematical consequence Q4 utilization levels hit record levels, with the apparent consequence of deteriorating service reliability, more port calls missed and rapidly rising freight rates. The impact on connectivity and emissions was broadly neutral.”

James Hookham, Secretary General of Global Shippers Forum, commented: “The recent extraordinary patterns of world trade have maxed-out the available capacity of the container shipping fleet, forcing rates to their current eye-watering levels. On top of that, shippers are having to play guess-work on the arrival dates and times of their containers. Top rates for declining service levels – this cannot continue.

“This second Review of the container shipping market shows we are serious about monitoring its behaviour and highlighting the impacts on the world’s importers and exporters as they work to restore something like normality to world trade. There is too much red-ink in this Review.”

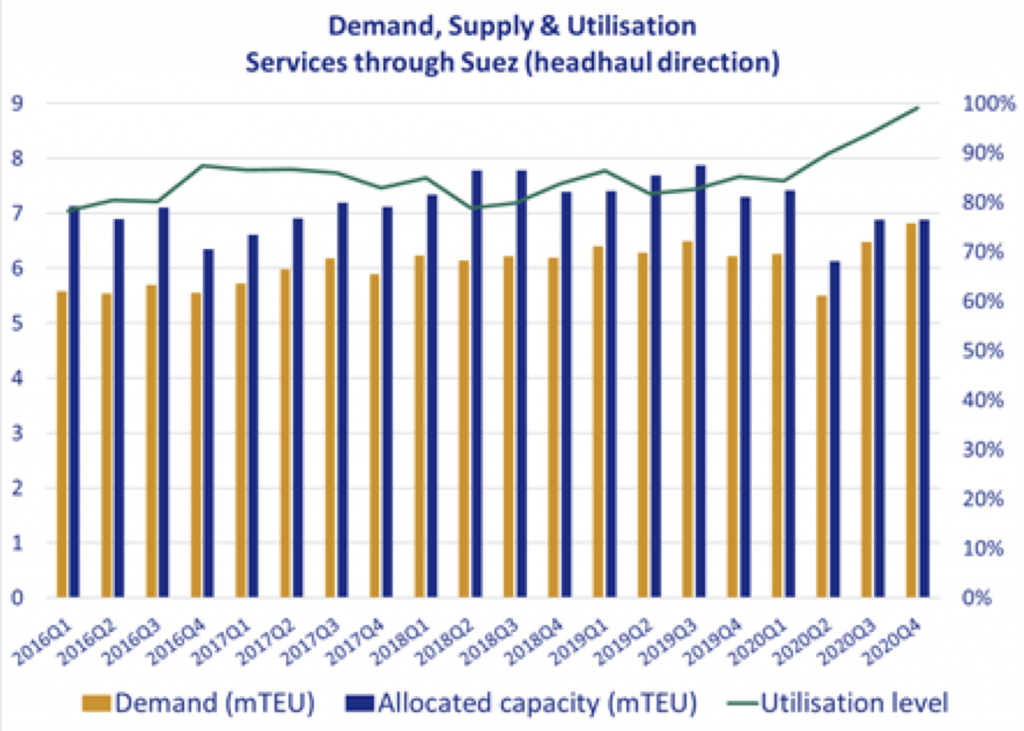

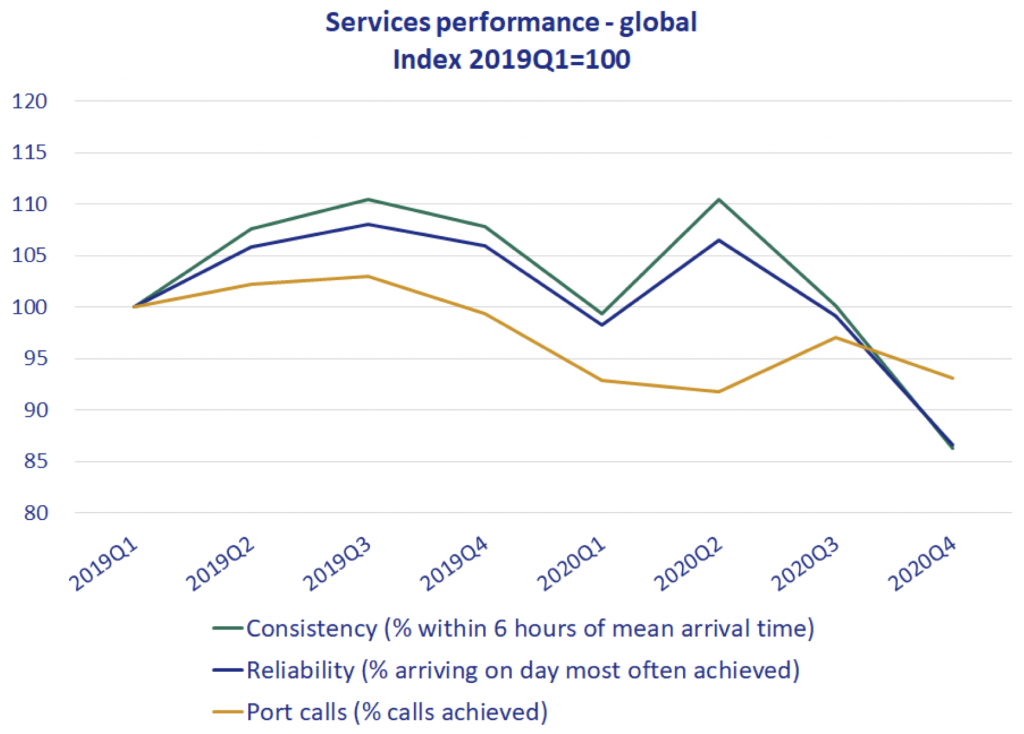

The two ‘Graphs of the Quarter’, said the GSF, show the very high levels of utilisation of deployed capacity (now effectively 100%) on head-haul trades and the dramatic decline in reliability and consistency of vessel arrivals at ports, and hence the availability of imported cargoes to shippers.

Graph 1: In Q4 2020 utilisation of container space reached 100% (green line, right-hand scale), whilst global demand (i.e. unitised world trade – orange bars, left-hand scale) exceeded 2019 levels and ‘caught up’ with the deployed capacity (blue bars).

This was no greater capacity on headhaul services available than in Q3 2020 and significantly less than in 2019. (These levels are monitored for vessels passing through the Suez Canal, the highest concentration of container shipping in the world and is considered a reliable proxy for global conditions).

Graph 2: In Q4 2020 the number of occasions vessels made a scheduled port call within 6 hours of their average arrival time fell by 15 percentage points (Green line). A similar fall was recorded for vessels arriving on the day they were expected (Blue line). The number of scheduled calls actually made fell back, meaning an increasing number of cases where the expected port call was missed all together.