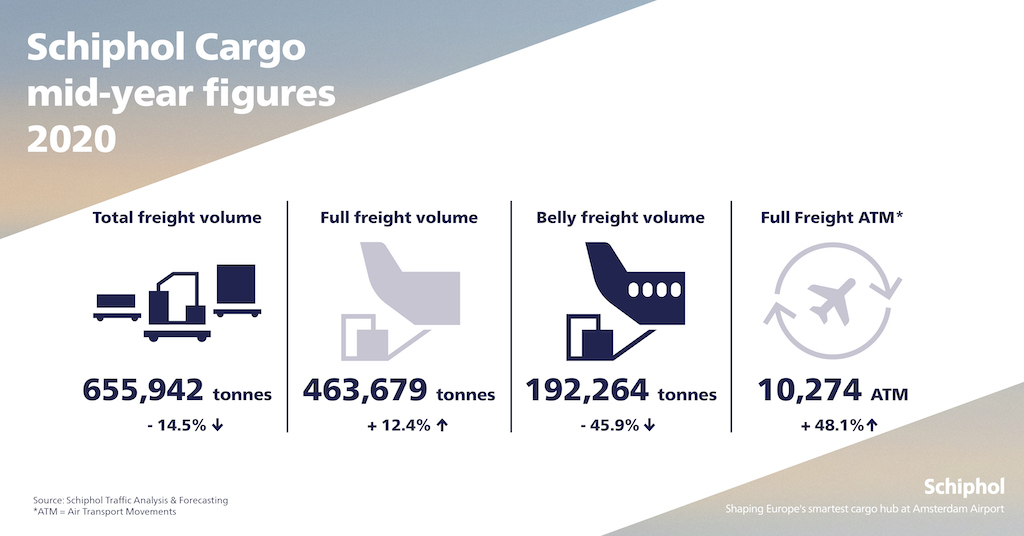

Amsterdam Airport Schiphol’s total cargo volume for the first half of 2020 declined by 14.5% to 655,942 tonnes compared to 2019, as an increase in full freighter cargo did not make up for the decline in belly traffic.

Full freighter flights were up 48.1% to 10,274 Air Transport Movements (ATM) from January to June, but the number of belly flights dropped by 51.6% to 105,665 ATMs compared to the first half of the year in 2019.

In the first half of 2020, full freighter volume increased by 12.4% to 463,679 tonnes, while belly cargo volumes dropped 45.9% to 192,264 tonnes.

Inbound cargo volumes were down 11.5% to 341,130 tonnes and outbound cargo volumes were down 17.6% to 314,812 tonnes.

Although total volume declined over the first six months of the year, Schiphol rose from fourth to third in the list of the busiest European cargo hubs during the period.

“Schiphol’s figures and operations were heavily impacted by the Covid-19 outbreak, and from early this year, the decline in passenger aircraft led to a decrease in belly volumes,” said Bart Pouwels, Head of Cargo, Amsterdam Airport Schiphol.

“ATMs are now showing signs of recovery which is positive.

“The extra belly capacity on intercontinental routes helps the air cargo market in Amsterdam to better serve its customers.”

Challenging markets

Every cargo market saw declines in the first half of the year as all regions were heavily impacted by the Covid-19 pandemic.

Inbound cargo to North America was down 17.1% to 46,680 tonnes and outbound by 17.7% to 67,729 tonnes.

In Europe, inbound cargo was down slightly by 3.0% to 46,067 tonnes, but outbound fell by 23.5% to 41,866 tonnes.

Schiphol’s biggest market, Asia, saw declines, as inbound was down 8.1% to 121,008 tonnes and outbound declined 17.5% to 107,735 tonnes.

Shanghai remained the biggest single market destination from January to June.

The Middle East region showed the only growth sector as inbound was up 9.2% to 48,682 tonnes, but outbound decreased 11.7% to 45,914 tonnes.

The Latin America market’s inbound volume fell 21.8% to 45,872 tonnes and outbound was down 14.6% to 31,762 tonnes.

Inbound to Africa was down 29.5% to 32,821 tonnes and outbound by 22.3% to 19,806 tonnes, driven by a decrease in the import and exports of flowers.

Impact of COVID-19

Schiphol was affected by Covid-19 from early this year and it led to a steep decline in overall ATMs in the first six months of 2020.

At the lowest point in April, Schiphol was averaging about 144 ATMs per day every week, a 90% decline in ATMs on 2019.

“The Covid-19 pandemic has also led to a shift in cargo flows and some usually high-volume verticals have decreased, such as the import and export of flowers,” said Pouwels.

Despite the challenges, Schiphol has played a crucial role in transporting critical cargo in the fight against the virus, such as personal protective equipment (PPE).

“The Schiphol air cargo community has worked closely together to ensure that essential cargo was moved through the supply chain,” said Pouwels.

Future outlook

The future is uncertain at Schiphol as markets around the globe are at different stages of the Covid-19 pandemic.

“We are seeing passenger flights increasing which means an increase in belly capacity, but it is important we move along with customer needs and make sure all demands are accommodated as well as possible,” said Maaike van der Windt, Director Aviation Marketing, Cargo and Customer Experience, Amsterdam Airport Schiphol.

“Sustainability remains an important focus for Schiphol, and as air traffic is picking up, it is important restarting regular flight traffic will be executed in a controlled manner, taking Schiphol’s surroundings into consideration.”

The health and safety of staff involved in cargo handling is also a focal point and Schiphol is cooperating closely with the cargo community to comply with government guidelines and ensure the correct implementation of protocols.

“We hope to continue to welcome increasing demand of our airlines and to see more routes and frequencies added to our network again,” said van der Windt.