The coronavirus pandemic is proving a catalyst for shipping digitalization, prompting ocean supply chain stakeholders to abandon manual processes and embrace automated transport management solutions to drive business growth, according to a new survey by Haven Inc.

The survey was unveiled in the latest Freight Technologies Market Analysis published by Haven, the provider of Transport Management System (TMS) solutions designed specifically for international shippers.

It found that global business lockdowns had highlighted the time and cost savings available to decision makers willing to make the leap away from traditional management processes heavily reliant on paperwork.

35% of respondents said the use of manual processes caused delays, 30% said quotations took too long while 20% complained that booking processes were cumbersome.

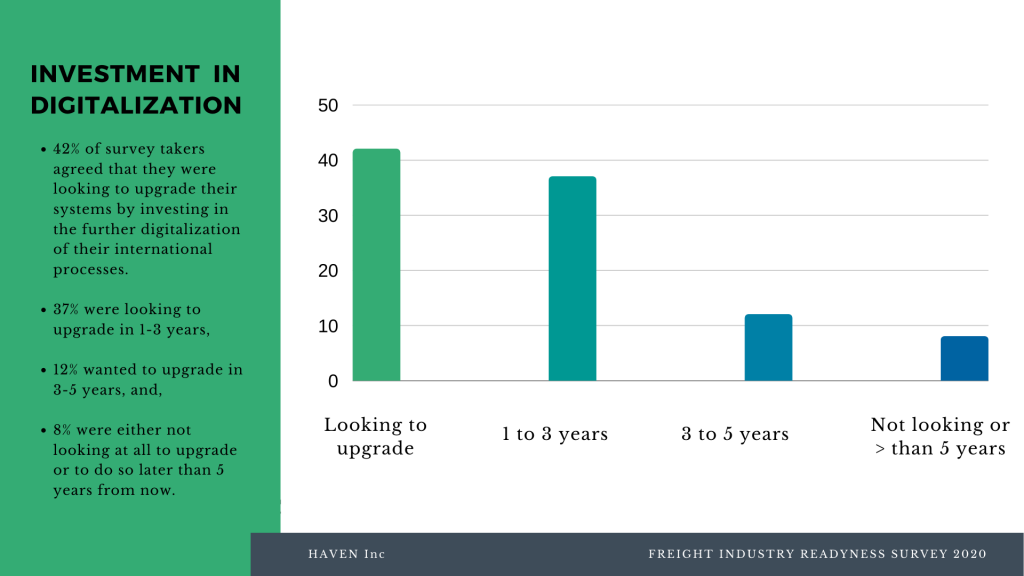

42% of survey takers also reported they were now looking to upgrade their systems by investing in the further digitalization of their international shipment processes.

37% were looking to upgrade in 1-3 years, 12% hoped to upgrade in 3-5 years, and, 8% were either not looking at all to upgrade or to do so later than five years from now.

Brad Klaus, Chief Executive Officer of Haven, commented: “With so many people working from home during the pandemic, companies were finding new ways to trade and this was opening their eyes to digital solutions across their businesses.

“This need extends to digital transport management solutions, particularly for those who are dealing with international shipments. From a management point of view, once you see the benefits, it’s hard to go back to manual systems and mountains of paper.”

The survey was conducted independently for Haven by logistics and freight educational portal Shipping & Freight Resource. A majority of respondents (67 %) were freight and logistics decision makers in Director/VP and C-Level positions while others held middle-management and supervisory positions (28.9%). Other survey takers worked in freight and shipping operations and administration including, documentation, analytics, and corporate counsels.

51% of participants used both air and sea modes for international shipments. 41% used only sea, 6% used only air and 2% operated in only the U.S. domestic market.

56% reported wanting to increase the efficiency of their booking management and 40% were on the lookout for a better freight audit solution.

61% of respondents said they wanted to improve their quotation management and track and trace visibility, while 60% were looking to improve their document management. “We want freight invoice control and cost calculation for a shipment with the easy understanding of the margin,” said one respondent.

However, while lean and automated processes were viewed by most respondents as the best solution, a number of perceived obstacles to implementation were reported. 35% of participants said budget was a major barrier to the automation of freight operations, while 21% said there was a lack of adequate technology. 19% felt the struggle was a lack of internal expertise, 13% said it was due to lack of internal resources, and 10% stated it was due to a lack of support from leadership.

Haven provides a unique platform of TMS solutions aimed at international shippers with particular focus on heavy volume users of international freight.

“Our aim is to make global trade as efficient as it can be,” said Klaus. “I think the survey proves that the current pandemic has made it crystal clear that it is possible to streamline processes using technology.

“We’ve started that journey by reimagining transport management system software with a view to making global supply chains work more efficiently which benefits everyone involved in trade. That is, from shippers and the businesses that depend on them, to consumers awaiting goods as necessary as basic food supplies.

“When trade is transparent, deals close faster, ships sail at capacity, and the entire supply chain benefits.”