Shippers found alternative means of getting their goods to market as available container shipping services maxed out and service patterns changed to serve congested routes.

Global trade continued to grow in Quarter 3 2021 but with deployed container shipping capacity fully utilized, that additional growth was being moved by a mix of air freight, rail services between China and Europe, and own-charter vessels or services provided by non-liner carriers.

Commenting on the findings of the latest Container Shipping Market Quarterly Review, published by the Global Shippers Forum and MDS Transmodal, James Hookham, GSF Director said:

“The Container Shipping Market Review shows the extent to which shippers sought out alternatives, as shipping lines priced themselves out of reach and narrowed the cost difference with offerings from other modes. A measurable share is also accounted for by vessels chartered by shippers for their own goods, or by other non-liner shipping carriers.”

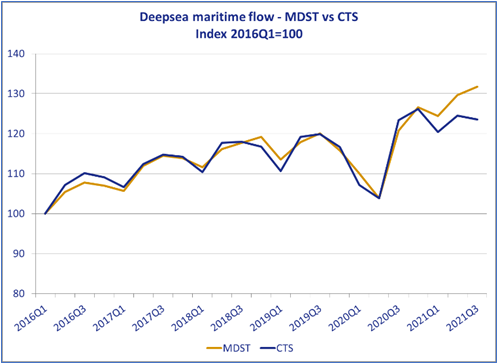

The chart shows the growth in world trade since Q2 2020, as recorded by landed imported volumes (gold line) and the slightly declining volumes carried by scheduled ocean liner services since that time (blue line). The difference being international unitisable trade that is being moved other than by scheduled liner shipping service.

James Hookham continued: “The Great Shipping Crisis of 2021 has taken many casualties as shippers trapped between record rates and very poor service levels struggled to fulfil delivery deadlines for imports destined for the holiday sales season. Shippers will be watching anxiously to see how quickly these conditions abate in 2022, and whether the use of these alternative services will continue to grow”.

“Shipping lines are attributing the cause of the Crisis to severe congestion in ports and logistics bottlenecks inland. But this means that, as these conditions ease post-peak season and output dips in Chinese New Year, container shipping capacity levels should increase to match shippers’ demand more closely. This recovery in capacity could accelerate if consumers switch spending to services rather than goods, and interest rate hikes and higher energy costs take their toll on discretionary spending”.

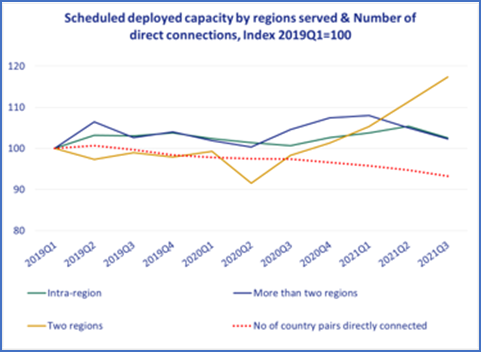

New analysis in the Review reveals the extent to which shipping lines have adjusted global service patterns with many more ‘shuttle services’ being introduced at the expense of services making multiple port calls in different regions. This reduces the number of countries with direct connections to their export markets and requires more frequent transfer of loads between services at hub ports, such as Singapore and Colombo.

Mike Garratt, Chairman of MDS Transmodal, said: “Our review this quarter has examined how alliance members have expanded their role in developing consortia and therefore market shares and the way in which they have addressed operational challenges in modifying route structures. This reduction in services linking multiple world regions has been accompanied by a decline in the number of countries that are directly connected.

“Given the dramatic growth in freight rates and declining service performance it is not surprising to see trade growing more quickly than container volumes on the established lines, as shippers have found other transport solutions; starting own shipping routes, using long-haul rail or air or semi-bulk traffics switching to conventional methods.”

The chart shows the increase in the number of scheduled liner services serving just two regions (gold line) and the decline in services making multiple port calls in more than two regions (Blue line) The number of countries benefitting from direct connections has been in decline of since 2019.