Newly published US academic analysis of Amazon Air’s recent activities indicates that the carrier has:

- Successfully launched an intra-Europe network using planes registered to Amazon

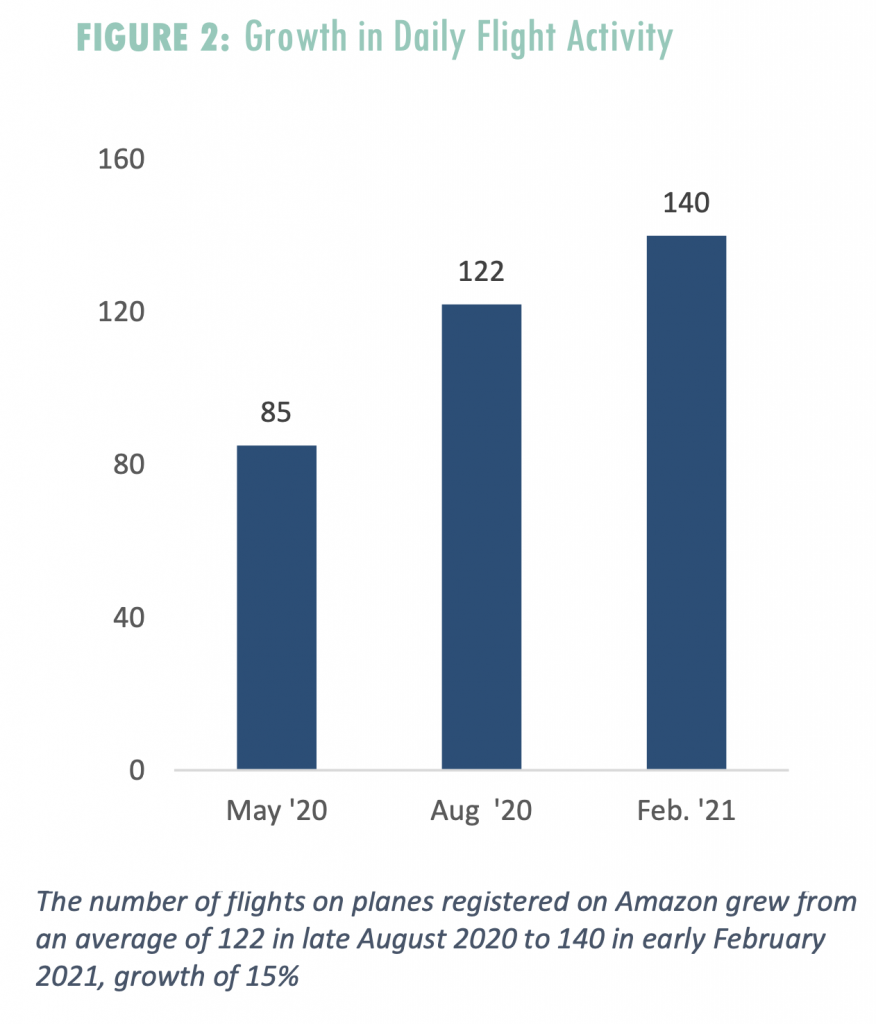

- Expanded flights by 15% since August and positioned itself for another growth spurt this spring.

- Set into motion plans to fly numerous airplanes it owns rather than leases, primarily 767s

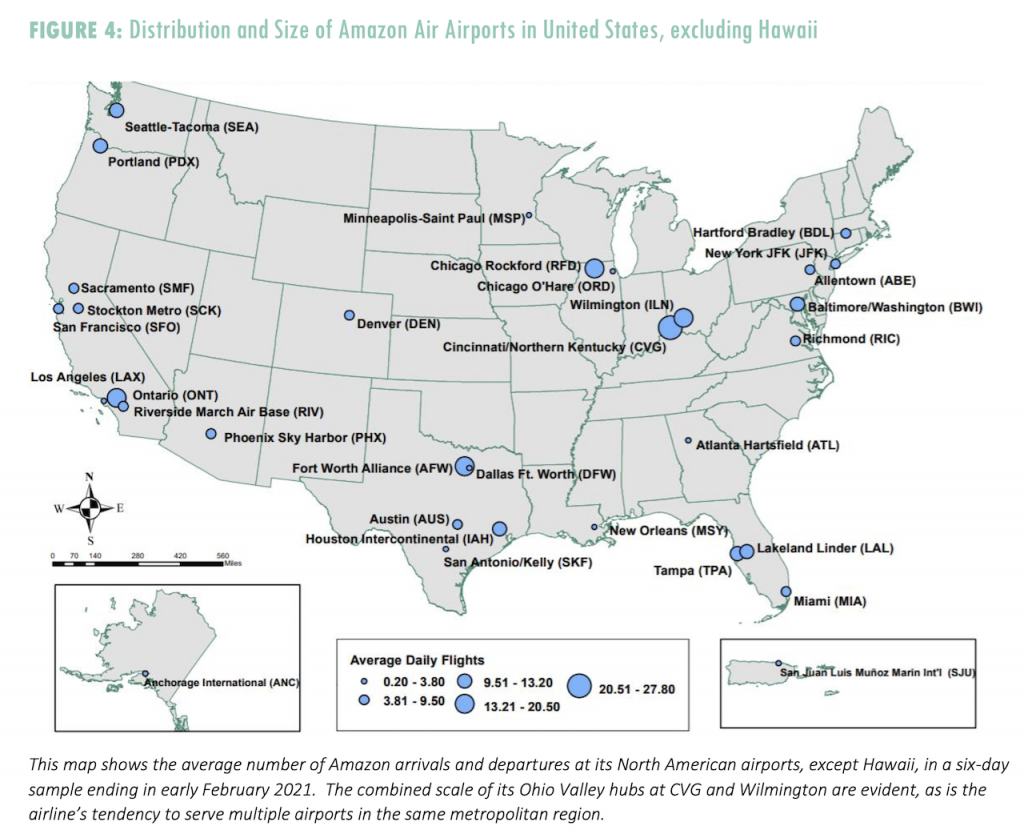

- Invested heavily in Cincinnati & Wilmington, OH, giving it new options to handle third-party shipping.

- Boosted its presence at major passenger-oriented airports in the country’s largest cities.

The latest research study by the Chaddick Institute for Metropolitan Development At Depaul University states that Amazon Air “has taken decisive steps to implement an international strategy and is positioned for sustained growth in the next six months. Retail giant Amazon’s fully owned Air subsidiary now has a significant presence on two continents.”

This independently produced brief, led by Professor Joseph Schwieterman, offers an overview of Amazon Air’s evolving orientation between September 2020 and February 2021.

The analysis draws upon publicly available data from a variety of informational sources including:

- Data from flightaware.com and flightradar24 on 1,700 Amazon Air plane takeoffs and landings in early 2021 and an equal number from 2020

- Information on fleet registration from various published sources, including planespotters.net

- Assessment of the company’s strategic direction from investment analysts

Said Prof Schwieterman: “The results of our latest analysis build upon our September 2020 Amazon Air Brief. That brief described Amazon’s “summer surge” that occurred May-September 2020, including new hub development and the company’s broadening geographic reach. Our May 2020 Brief explains why we expect its fleet to grow, possibly reaching 200 planes by 2028.”

A summary of the study’s findings are:

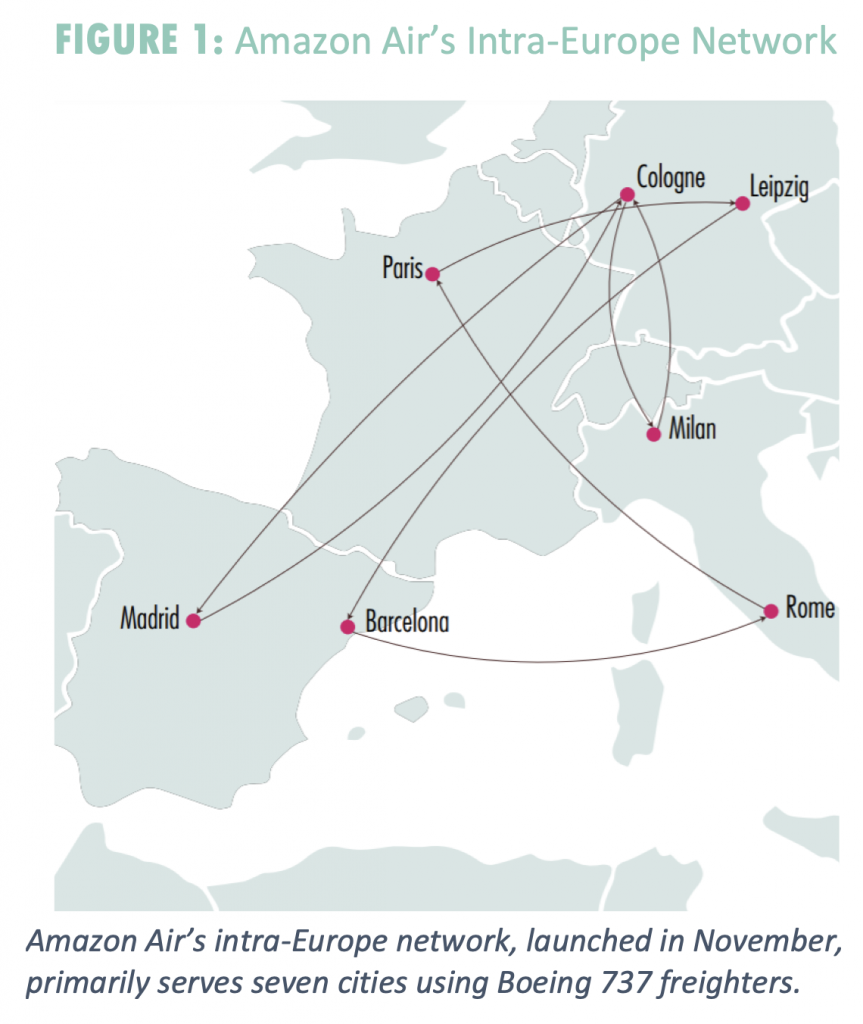

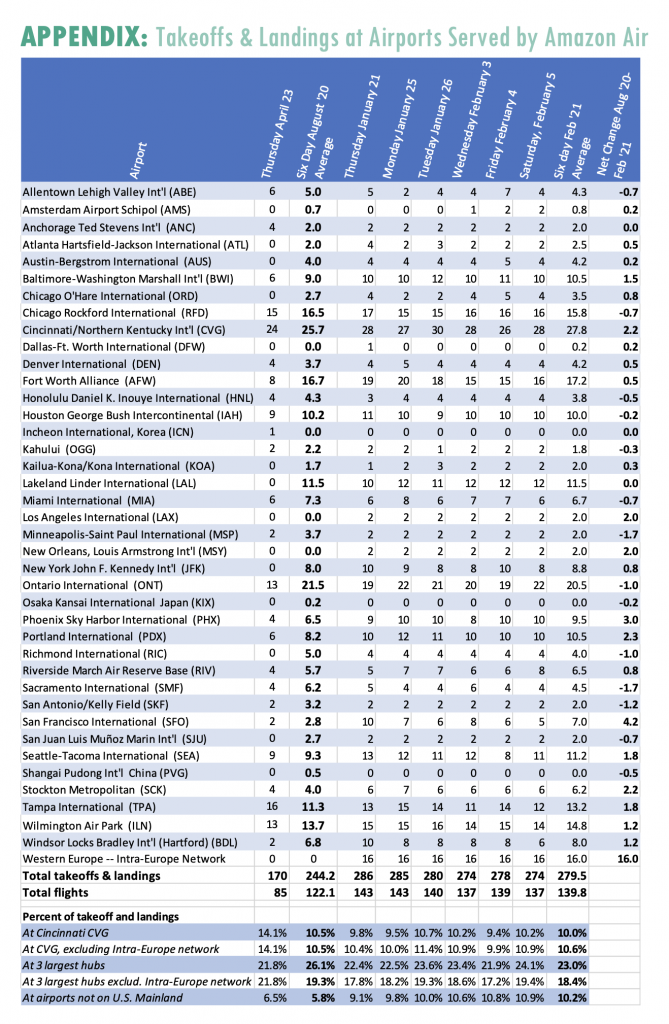

FINDING 1. Amazon Air’s intra-Europe network, operated using planes registered to the company since late last year, is a conduit for growth throughout Europe. The network is served using a pair of Boeing 737s leased to ASL Ireland Airlines, and a third plane will likely enter service soon. The Irish carrier generally operates eight daily flights on medium-distance routes such as Leipzig–Barcelona and Cologne–Madrid.

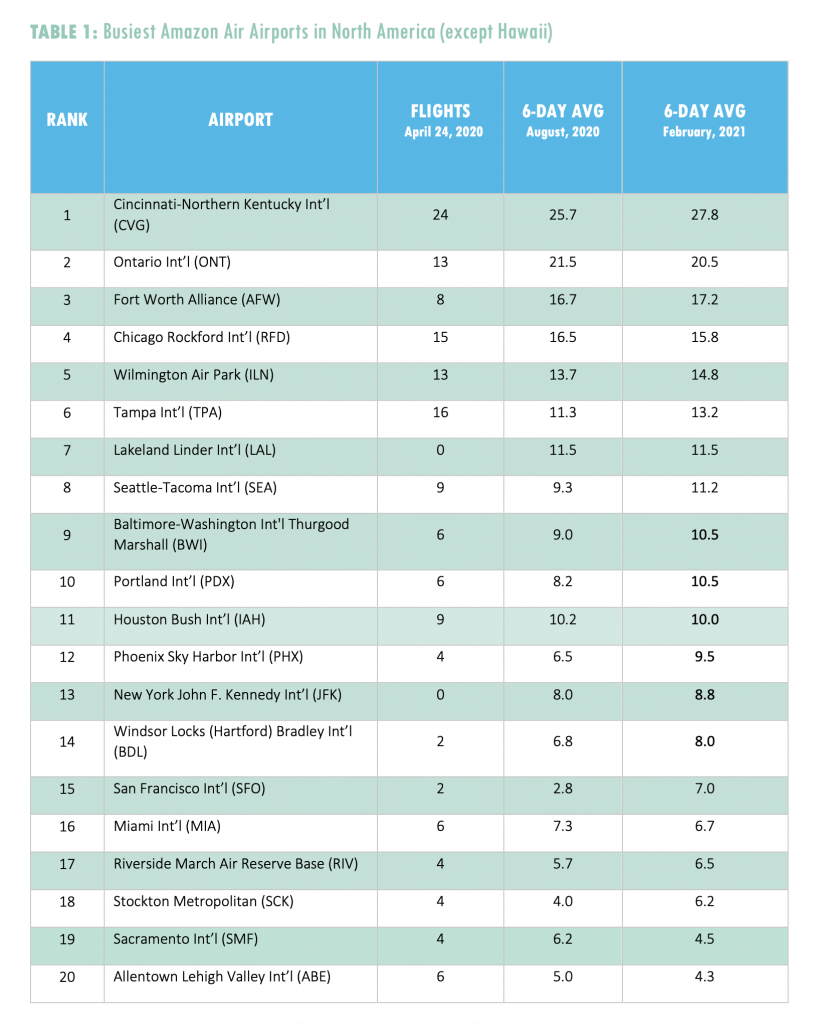

FINDING 2. Amazon Air’s flight activity grew by 15% between August 2020 and February 2021, despite the slowdown in retail shipments that typically occurs after the start of the new year. The airline now regularly makes an average of 140 flights daily, and we expect that number to grow to more than 160 by June 2021.

FINDING 3. Amazon Air is poised for another expansionary wave this spring. The airline has at least 10 planes registered to it that are not presently flying (some undergoing conversion to freighters) and another four slated to join its fleet soon. This growth will be undergirded by eleven Boeing 767 passenger models acquired from Delta Air Lines and WestJet.

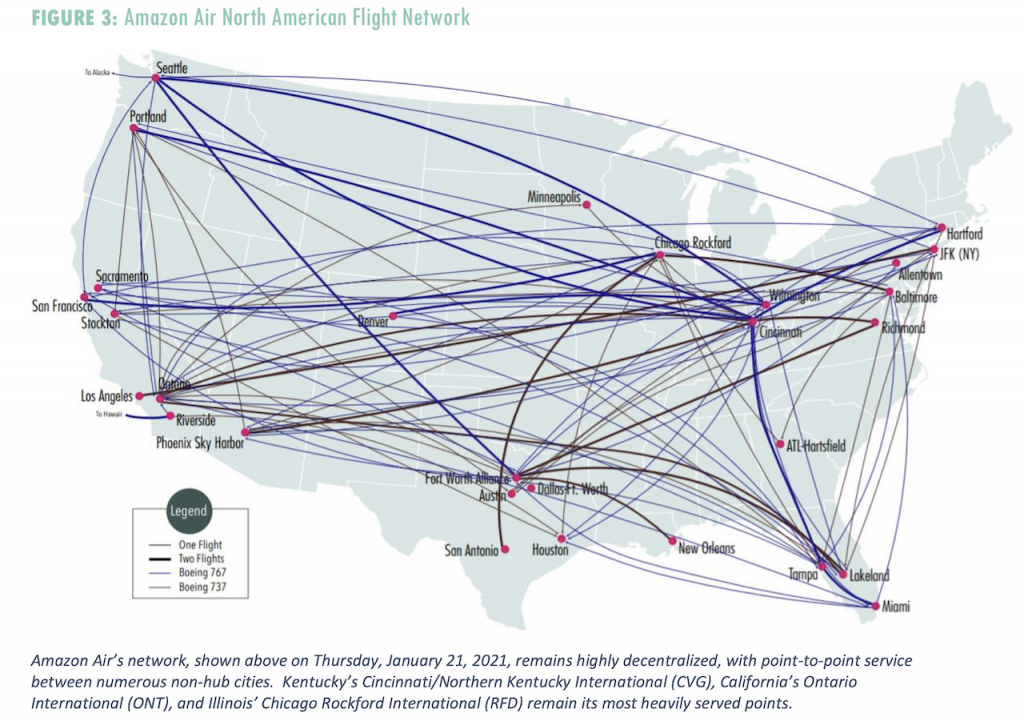

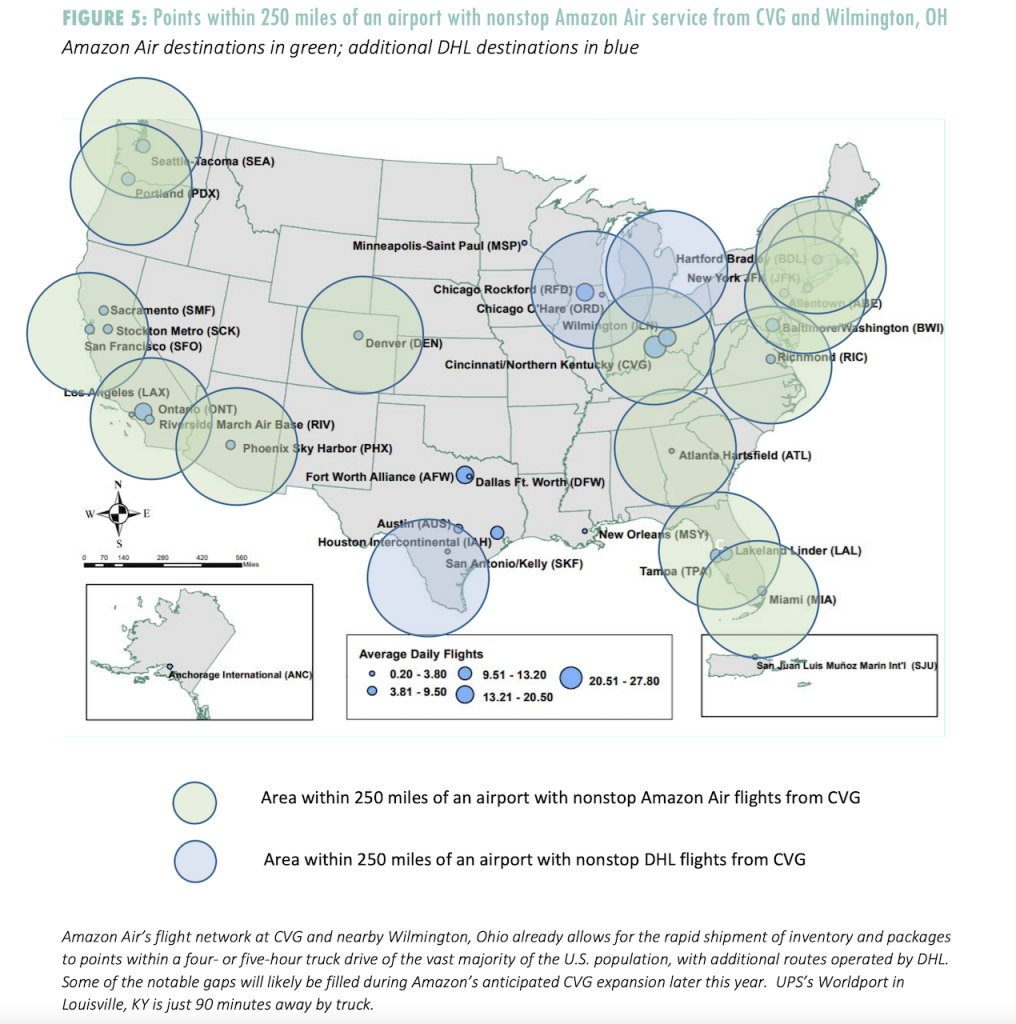

FINDING 4. Expanding hubs at Cincinnati-Northern Kentucky International (CVG) and Ohio’s Wilmington Air Park (ILN) position Amazon to move assertively into third-party delivery at the time of its choosing. The growing density of flight operations and warehouses around these airports, and the investments being made by other retailers and logistic providers in this area, give Amazon newfound capacity to provide expedited business-to-consumer deliveries for purchases not made on the Amazon platform. Flights from CVG and ILN already connect Amazon to most of the US population, and much more expansion appears imminent.

FINDING 5. Amazon Air is putting more emphasis on major commercial airports having extensive passenger traffic than in the past. The airline has markedly expanded at Portland International, Phoenix Sky Harbor International, San Francisco International, Seattle-Tacoma International, and Tampa International airports in recent months.

FINDING 6. Amazon now has a balanced network of airports in the Northeast that places more emphasis on Connecticut’s Hartford Bradley International and New York’s John F. Kennedy International airports and less on Pennsylvania’s Allentown Lehigh Valley International Airport. Amazon is also making a concerted push at Virginia’s Richmond International Airport, which relieves pressure on Baltimore-Washington International Airport and positions the company to better serve the Mid-Atlantic region.

FINDING 7. Amazon Air has reduced transpacific flights and appears to be relying almost entirely on charters and other contractual arrangements to support its supply chain across the Pacific. Offseason transoceanic international flying has been largely reduced to a semi-regular roundtrip between Amsterdam and Chicago.

Short-term outlook and predictions

The remainder of 2021 promises to bring more strategic moves by Amazon Air and likely a gradual “densification” of its network as well. Such initiatives will advance its push to expand overnight package delivery options. We anticipate several general moves by late May 2021:

- Amazon will push daily flight operations upward another 15% over the next five months so that it regularly tops 160 daily flights by late June 2021. Such growth will be critical to Amazon’s expansion of next-day delivery options. This growth will likely take the form of perhaps 7 – 8 more planes added to its fleet

- Amazon Air’s expanding operations will allow for significant expansion in next-day delivery of packages throughout the United States, a process abetted by new 767 freighters coming online

- Amazon will grow the intra-Europe network significantly, starting with the addition of a third plane operated under contract by ASL. This will likely continue with more 737s and the addition of new routes beyond the existing countries served, possibly in the Republic of Ireland, the United Kingdom, the Benelux countries, and Eastern Europe

- Amazon Air will increasingly position itself to support the delivery requirements of third parties, who need to ship packages and parcels for goods not purchased on the Amazon platform. The CVG hub, together with nearby Wilmington, will allow Amazon to increasingly handle third-party business-to-consumer shipments. Amazon’s interest in, and timetable for, third-party delivery is unclear, although we expect it will make a move within 18 months.

Prof Schwieterman anticipate activities at particular airports to include:

- Growth at Cincinnati CVG that will push its activity from fewer than 30 flights per day today to around 50 flights per day by year’s end, made possible by the opening of its massive new facilities anticipated for this autumn

- The introduction of significant flight operations at Southern California’s San Bernardino International Airport, with some activity possibly shifting from Ontario International, within the next few months

- Expansion at both Cologne and Leipzig, Germany, as it lays the groundwork for significant expansion in Europe, that will include the addition of new airports in countries not yet served

- Expansion to airports that fill gaps in its coverage, such as possible service to Upstate New York, the Carolinas, and Salt Lake City, which will give it improved coverage in areas where travel times from its airports are presently six hours or more.