The global air cargo market continued its catching up with pre-pandemic levels in February as freight volumes, capacity and load factors stabilised close to 2019’s performance, with rates also slowly trending downwards, according to the latest data from industry analysts CLIVE Data Services.

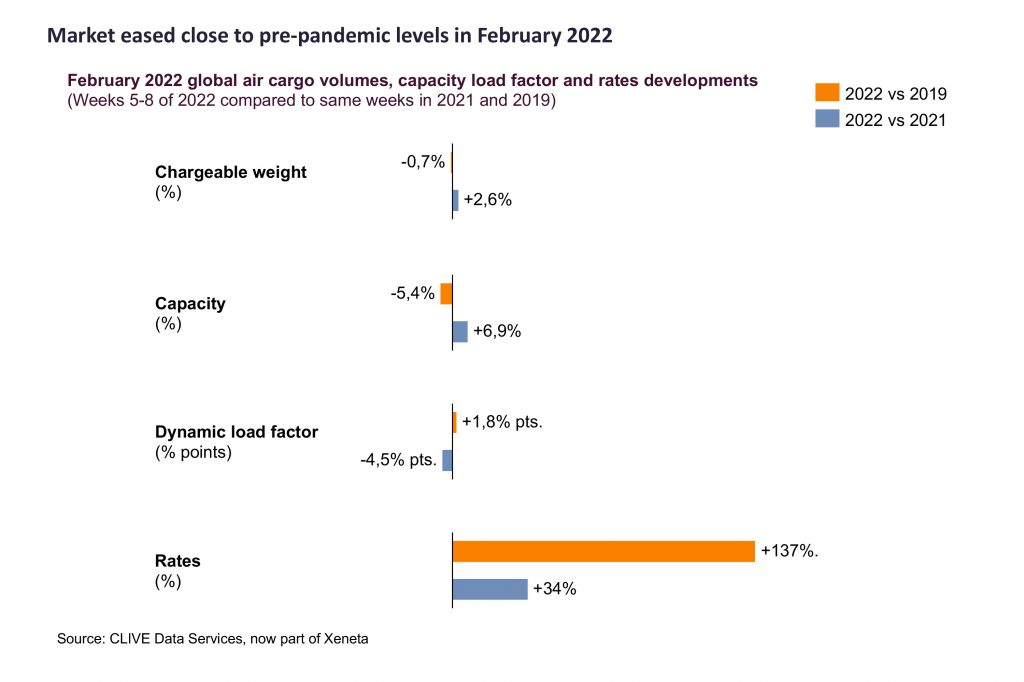

Chargeable weight in February was at -0.7% to the pre-Covid level in 2019, and +2.6% compared to February 2021, with capacity in the market standing at -5.4% and +6.9% to the respective 2019 and 2021 figures. CLIVE’s weekly and monthly analyses of the general air cargo market continues to measure performance to the pre-covid 2019 level, as well as giving 2021 year-over-year comparisons, to provide a meaningful assessment of its current performance.

Consequently, CLIVE’s ‘dynamic load factor’ – which considers both the volume and weight perspectives of cargo flown and capacity available to produce a true indicator of airline performance – of 65% was 4.5% pts lower than in 2021 and close to 2% pts higher than in 2019.

After the peak season pressures placed on supply chains in November and December, which saw average airfreight rates increase by as much as 168% in the final month of 2021, the quieter market conditions at the start of the year saw overall rates ease for a second consecutive month. Rates, while still very high, were seen to be slowly winding down in February +137% versus 2019 as capacity returned to the market and the stress on supply chains seen over the past two years began to ease.

The war in Ukraine, however, means the air cargo market is heading into another period of significant uncertainty.

“Airfreight market conditions feel insignificant when you see what is happening in Ukraine and the suffering of the Ukrainian people since Russia’s invasion,” said Niall van de Wouw, Managing Director of CLIVE Data Services.

“The war in Ukraine is another example of an external event of which the air cargo industry has no control over, but which is having a profound impact, as happened with Covid. When we consider the recovery of the aviation industry from the pandemic, the return of passengers is still a big question mark. The war in Ukraine presents another big question mark, particularly over Europe-Asia trade flows. It is difficult to overestimate what this could mean down the line.”

The sudden drop in capacity on Europe-Asia routes and overflight issues were already having an effect into North East Asia routes in the closing days of February, he said. CLIVE is closely monitoring the situation on a daily basis. Rising oil prices are also expected to significantly impact global airfreight rates.

“Whilst we were seeing some clear signs of normality returning, there is still so little slack in the global air cargo system. It is quite unlikely that the trend of slowly declining rates will continue in March. The war in Ukraine causes immediate capacity issues to North East Asia and, therefore, will likely cause push up rates even more for these particular markets.

“Air cargo trucking services might also be affected as numerous Ukrainian drivers – which form an important share of the truck drivers in Europe – have decided to go back to their home country. A fragile global air cargo supply chain is already sensitive to minor shocks. War in Europe and its resulting sanctions could turn the industry upside down once again, just at the time when the covid impact was looking more under control. We remain in volatile and uncertain times,” he added.