AP Moller-Maersk (Maersk) has reached an agreement to acquire LF Logistics, a Hong Kong-based contract logistics company with capabilities within omnichannel fulfilment services, e-commerce, and inland transport in the Asia-Pacific region.

The value of the all-cash transaction is US$3.6bn (enterprise value) and will “further strengthen Maersk’s capabilities as an integrated container logistics company, offering global end-to-end supply chain solutions to its customers”.

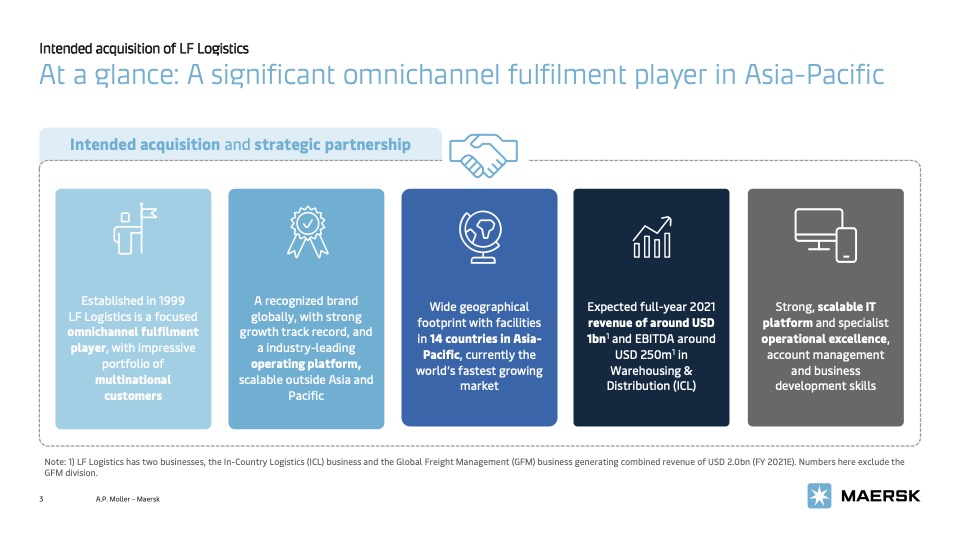

LF Logistics is a private company owned by Li & Fung (78.3%) and Singapore’s Temasek Holdings (21.7%) that focuses on providing contract logistics solutions to customers in Asia-Pacific organized through two key business units: In-Country Logistics (ICL) and Global Freight Management (GFM).

Said Soren Skou, CEO of Maersk: “The acquisition of LF Logistics is an important and truly strategic milestone on our journey to become the global integrator of container logistics; a global logistics company that provide digitally enabled end-to-end logistics solutions based on control of critical assets.

“With the acquisition of LF Logistics, we add critical capabilities in Asia Pacific to support our customers long term growth in Asia Pacific as well as capabilities and technology we can scale in our contract logistics business globally.”

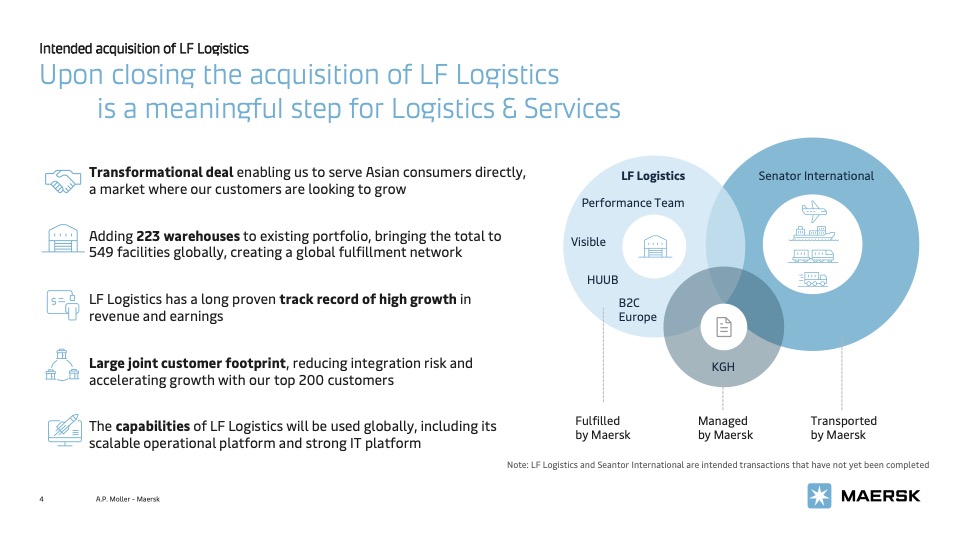

With the intended acquisition, Maersk will add 223 warehouses to the existing portfolio, bringing the total number of facilities to 549 globally, spread across a total of 9.5 m sq m.

Said Vincent Clerc, CEO of Ocean & Logistics at Maersk: “With this move, we will boost our warehousing and distribution offering and respond to the rapidly growing needs of our customers for contract logistics.

“Guided by a customer-centric culture and well-executed operations, LF Logistics has built an unparalleled track record of executing a superior omni-channel strategy for customers, which is a unique position we can use to build and operate fulfilment to customers across our network.”

As part of the agreement to acquire LF Logistics, Maersk will enter a strategic partnership with Li & Fung to develop logistics solutions.

LF Logistics operates an extensive Pan-Asian network and specialises in B2B and B2C distribution solutions within retail, wholesale, and e-commerce.

Said Joseph Phi, CEO of Li & Fung and CEO of LF Logistics: “We recognize that for LF Logistics to be a global leader in the industry, achieving scale is of paramount importance. Maersk provides the ideal fit for our people and our customers.

“It has a substantial presence around the world and will utilize LF Logistics’ talent base and operational platform across Asia to build out its logistics and fulfillment offering globally. This is testament to the strength of our team, our unique operations-centric culture, and superb growth potential.

“Together we will deliver a compelling value proposition that allows our people to attain their full potential and our customers to achieve sustainable competitive advantage.”

An earn-out with a total value of up to US$160m related to future financial performance has been agreed as part of the transaction. The acquisition is subject to regulatory approvals and is expected to close in 2022. Until obtaining all required regulatory approvals and closing of thetransaction, Maersk and LF Logistics remain two separate companies and thus will do their business as usual.

Over the last 22 years, LF Logistics has significantly expanded its geographic presence, with an intention of providing integrated logistics solutions to customers across Asia-Pacific. LF Logistics employs 10,000 people and has 223 warehouses and fulfilment centres in 14 countries totalling 2.7m sq m.

In the full-year 2020 LF Logistics reported a revenue of around US$1.3bn and a post-IFRS 16 adjusted EBITDA of USD around 235m, with the ICL business generating a revenue of around USD 850m and a post-IFRS 16 adjusted EBITDA of around USD 230m.

For the full-year 2021 the ICL business is expected to report a revenue around US$1bn with an adjusted post-IFRS 16 EBITDA around US$250m.