Lufthansa Cargo saw record results in 2020 although total revenue at the Germany airline group fell to €13.6bn in 2020 from €36.4bn in the previous year.

In contrast to the groups’ passenger airlines of Lufthansa, Swiss, Brussels Airlines and Eurowings, the cargo division benefited from rising demand over the course of the year. The airline said: “The boom in the cargo sector continues.”

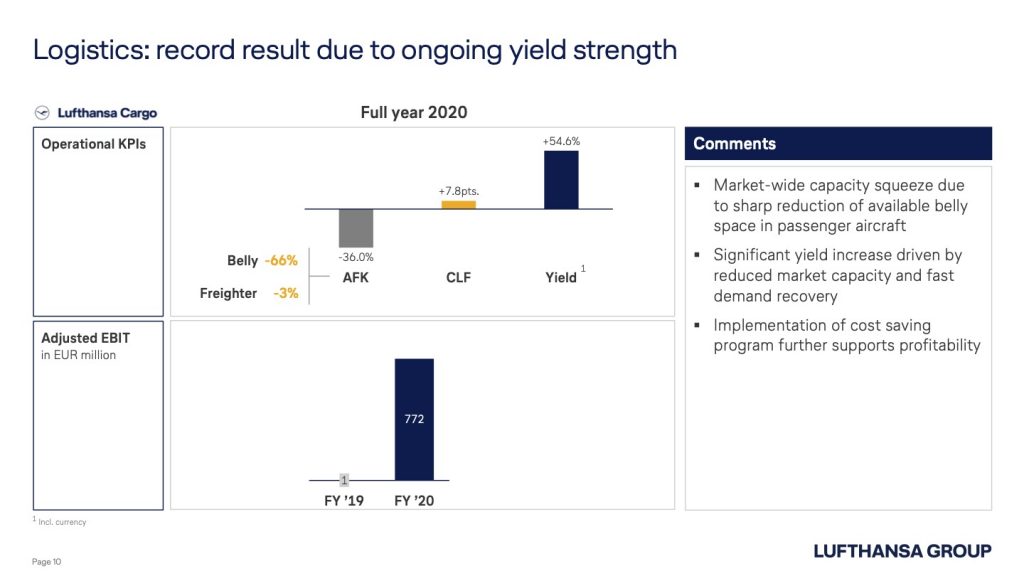

Buoyed by a strong increase in average yields amid persistently high demand, Lufthansa Cargo achieved a record result with an Adjusted EBIT of €772m (previous year: €1m) despite a 36% decline in freight capacity.

Carsten Spohr, CEO of Deutsche Lufthansa AG, said: “The past year was the most challenging in the history of our company – for our customers, our employees and our shareholders.

“Travel restrictions and quarantine have led to a unique slump in demand for air travel. Now internationally recognized, digital vaccination and test certificates must replace travel bans and quarantine so people can once again visit family and friends, meet business partners or learn about other countries and cultures.”

Looking at the future development of the Lufthansa Group, Spohr said: “The unique crisis is accelerating the transformation process in our company. 2021 will be a year of redimensioning and modernization for us. The focus will remain on sustainability: We are examining whether all aircraft older than 25 years will remain on the ground permanently.

“From the summer onwards, we expect demand to pick up again as soon as restrictive travel limits are reduced by a further roll-out of tests and vaccines. We are prepared to offer up to 70% of our pre-crisis capacity again in the short term as demand increases. With a smaller, more agile and more sustainable Lufthansa Group, we want to maintain our leading position worldwide and secure the jobs of around 100,000 employees in the long term.”

In 2020, the airlines of the Lufthansa Group offered around one third of the flights or a capacity (available seat km) of 31% compared to the previous year.

At 36.4m, the number of passengers was 25% of the previous year’s figure, resulting in a load factor of 63%, 19.3% percentage points lower than previous year.

Due to the elimination of belly cargo capacity on passenger aircraft, cargo capacity declined by 39%. Freight kilometers sold fell by 31% to 7,390m metric tons in the same period.

At the same time, the load factor rose by 8.4% percentage points to 69.7%. Average yields rose by around 55% due to the shortage of supply.

Said a spokesperson: “The Lufthansa Group benefited from its hub system. Unlike competitors, who offer only point-to-point connections, the Lufthansa Group airlines were able to bundle the low traffic volumes at their hubs and thus maintain important connections.

“In addition, the close networking between passenger and cargo traffic at the hubs has made it possible to secure global supply chains.”

In its outlook Lufthansa said: “Last year, the number of employees fell by around 28,000. In Germany, a further 10,000 jobs will be reduced or the corresponding personnel costs will have to be compensated. The Group fleet will be reduced to 650 aircraft in 2023.

“By the middle of the decade, the Group expects the capacity level to return to 90%. In addition, the Group is examining the disposal of subsidiaries that offer only minor synergies with the core business.

“Whenever restrictions are eliminated, bookings tend to increase steeply in the respective traffic area. For the full year 2021, the Group expects capacity on offer to increase to 40% to 50% of 2019 levels, and the expectation remains that positive operating cash flows will be generated when capacity on offer is above 50%.

“With the strategic expansion of the tourism business and a continued strong Lufthansa Cargo, the Group is in a position to take advantage of market opportunities in the short term. The boom in the cargo sector continues.”