Industry-wide cargo tonne-kilometres (CTKs) declined by 17.6% year-on-year in June, after falling 20.1% in May, according to the latest data from Iata.

Seasonally adjusted global CTKs also lifted moderately for the second consecutive month.

Cargo demand in June was softer than would normally be suggested by manufacturing output and newexport orders, which were stabilizing in most parts of the world in June.

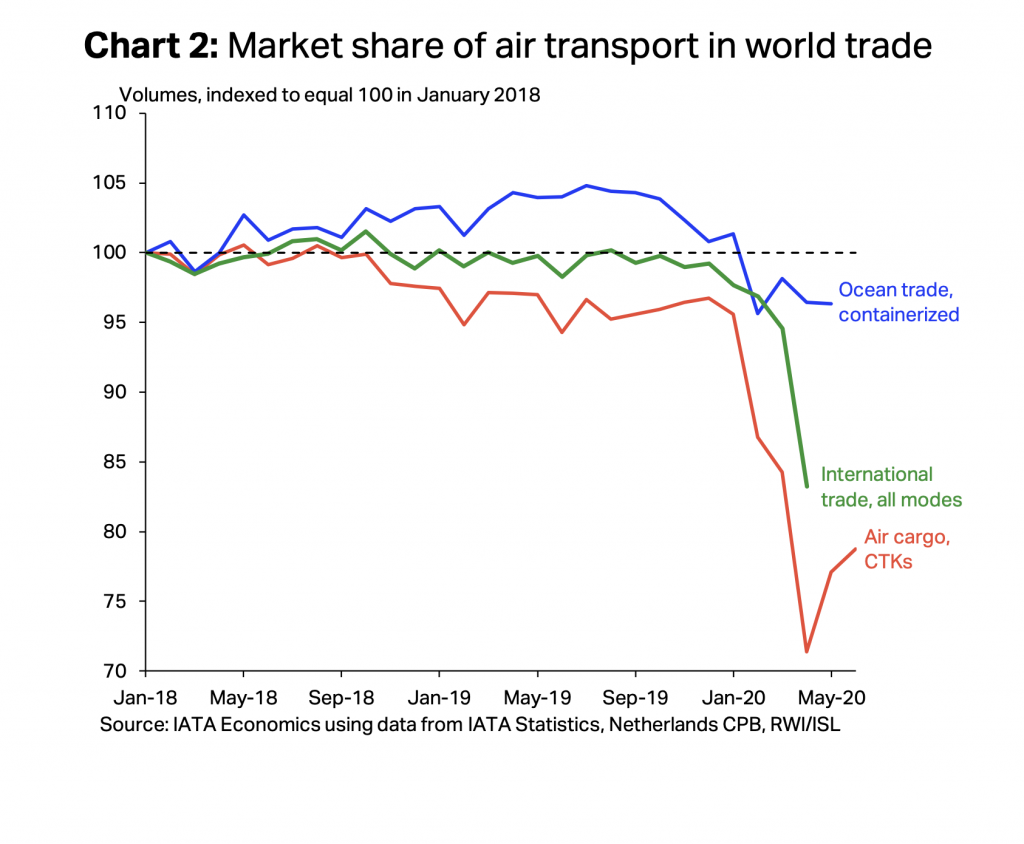

That relative underperformance was driven by air freight losing market share of total world trade in recent months, as buyers are turning to cheaper but slower means of transport.

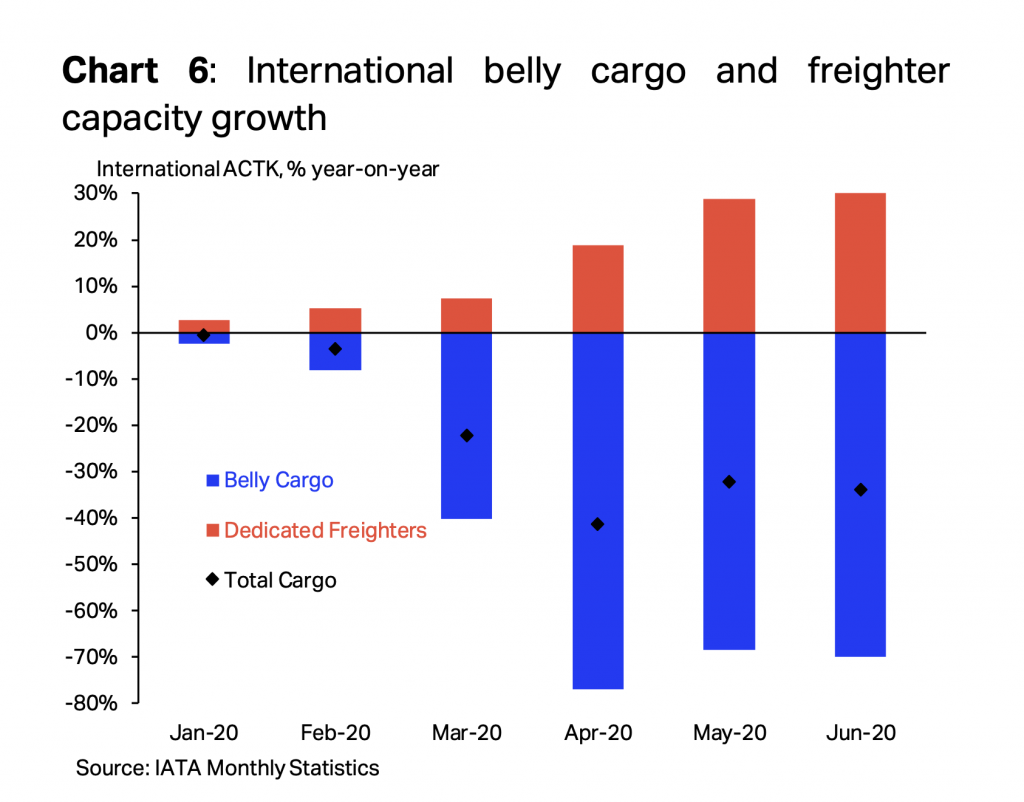

Available cargo tonne-kilometres (ACTKs) fell 34.1% year-on-year in June) resulting in the cargo load factor rising 11.5ppts year-on-year. As for April and May, the industry-wide load factor is close to record high levels.

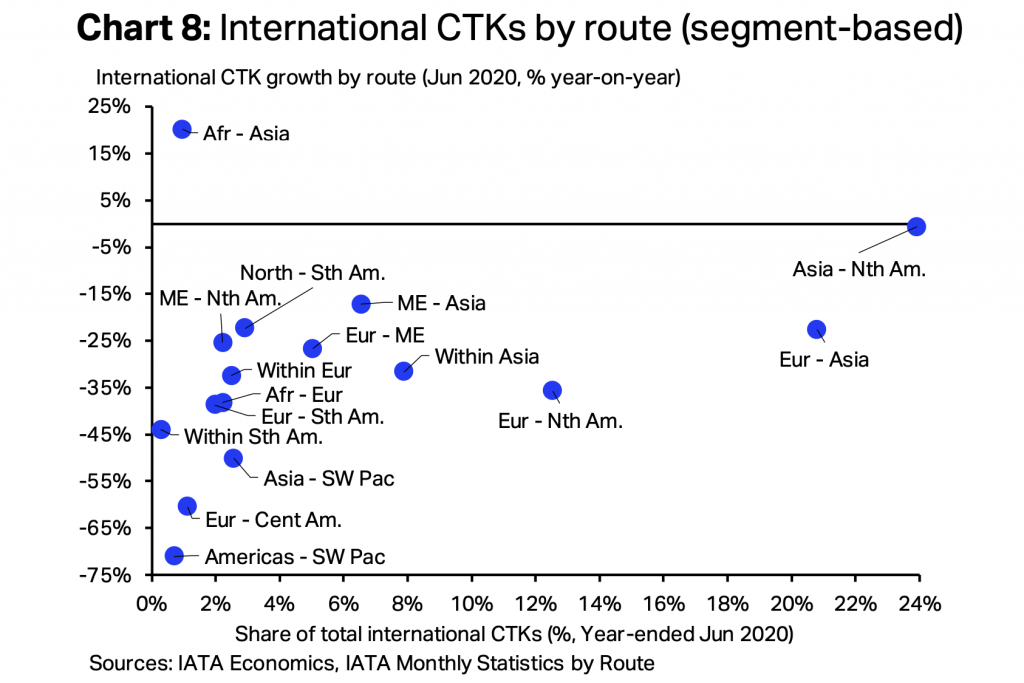

North America led the recovery this month, with international CTKs down 8.8% annually, versus 13.2% in May. Europe and the Middle East also posted improvements, but the decline in CTKs accelerated in the other regions.

The year-on-year fall continues to be driven by Asia Pacific, Europe, and to a lesser extent, the Middle East. In total, these regions accounted for 16.4ppts of the 17.6% year-on-year decline.

While the improvement in air cargo volumes seen in May continued into June, its pace appears slightly slower than expected. Some of the relevant drivers are exhibiting stronger recoveries, and strict lockdowns have ended in most parts of the world, reducing supply chain congestion.

This relative softness is consistent with air transport losing world trade market share to ocean and rail transport, a typical pattern during downturns.

Despite an initial rush towards air freight for urgent PPE and medical shipments, buyers have generally turned to cheaper but slower means of transport.

This pattern is expected to revert as global demand for goods recovers, with firms turning to air transport to rapidly refill their inventories.