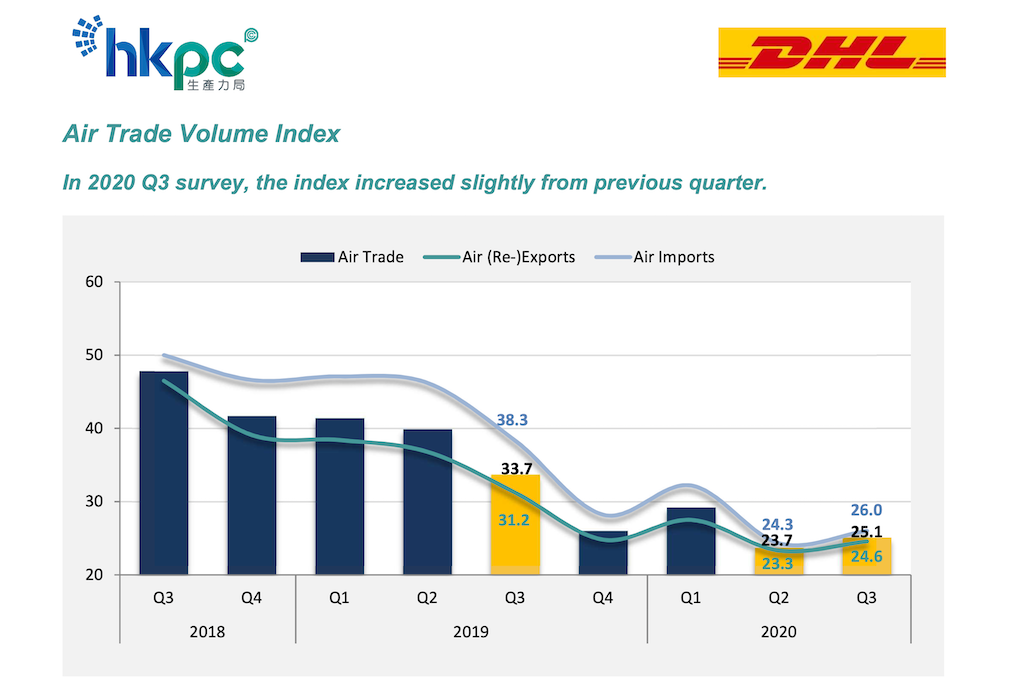

While many markets are still under different levels of lockdown, airfreight shippers expected trading in Q3 to be maintained at a similar level as Q2, led by exports to Europe and Online B2C.

That was one of the key findings from the DHL Hong Kong Air Trade Leading Index (DTI) for Q3 2020.

Amid the continued effects of COVID-19 this quarter, many of the survey’s respondents reported a decline in their operating condition, with more than half of them indicating it to be worse than the previous quarter.

Despite this drop, outlook for overall air trade as well as indices for exports and imports increased positively.

Both product variety and shipment urgency saw lower demand this quarter. However, sales volume increased as air traders become more optimistic on exports and imports.

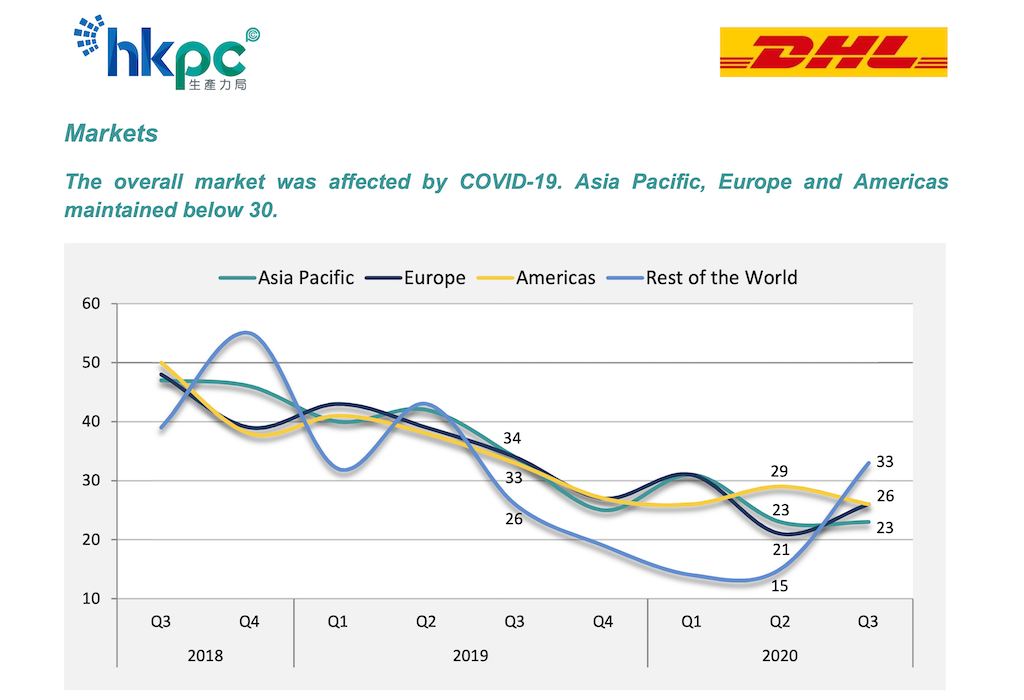

Overall market indices generally remained the same this quarter as with the previous one, but with a relatively positive outlook on Europe and the rest of the world. The Americas index declined as it was significantly dragged down by its air imports.

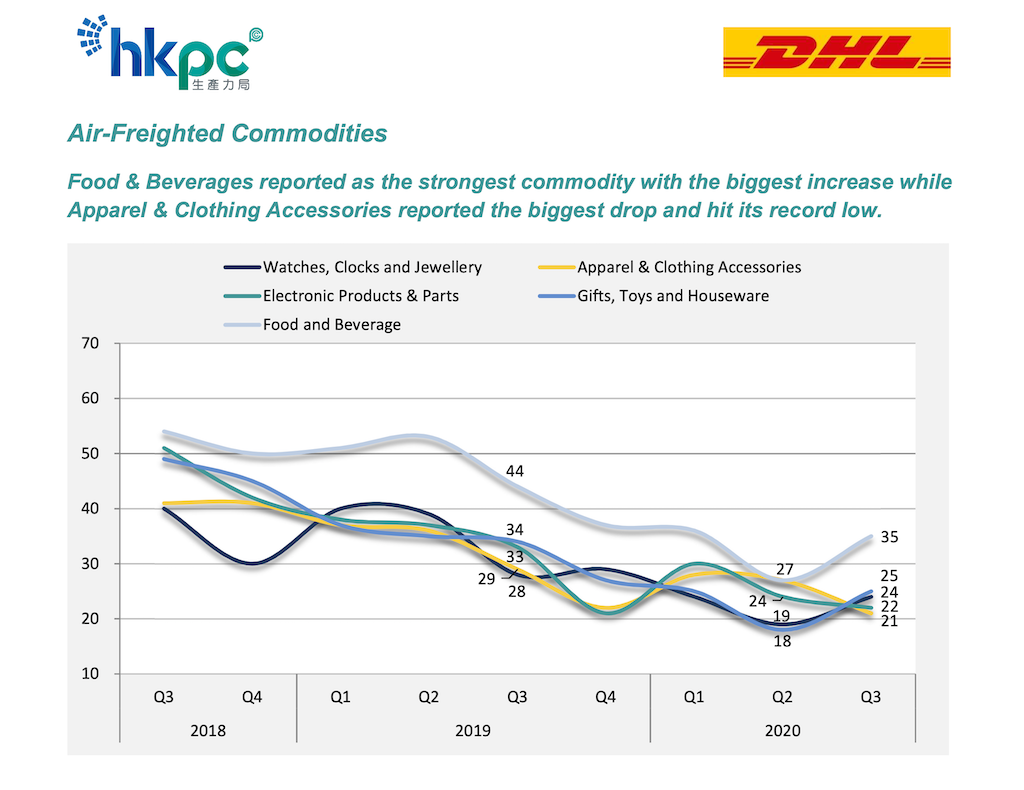

Food & Beverage is this quarter’s strongest commodity, while Apparel & Clothing Accessories saw the biggest drop and has hit a record low.

Watches, Clocks and Jewellery as well as Gifts, Toys and Houseware also saw upward trends, unlike Electronic Products & Parts, which also indicated a drop in this year’s third quarter.

Airfreight shippers have become more optimistic towards an online market, amid global uncertainties brought about by the COVID-19 pandemic and the recent developments on Sino-US relations.

Commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council, the DHL Hong Kong Air Trade Leading Index is the first indicator of its kind in Hong Kong and aims to provide a forward-looking perspective on overall air export and import trade volumes.

The first quarterly DTI was released in Q2 2014 by analyzing the key attributes of business demand based on a survey of more than 600 Hong Kong companies that focus on in- or out-bound air trading.

An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter. The further the reading is from 50, the more positive or negative the outlook is.