Port of Hamburg third quarter cargo volumes: Container throughput of 2.3m TEU (-4.9%), total throughput 32m tons (-8%).

Port of Hamburg saw an 8% decline in seaborne cargo during the third quarter of 2020, but an improvement on the 16.2% fall in the previous quarter for the German maritime hub.

The negative effects of the worldwide coronavirus pandemic are still affecting developments in the Port of Hamburg’s cargo throughput said a spokesperson.

However, according to Port of Hamburg Marketing’s (HHM) assessment, the results in the third quarter “give reason to be optimistic that the double-digit decrease in turnover has ended”.

It resulted in particular from a downswing in numerous economic sectors and lower demand for consumer goods. In HHM’s opinion, the third quarter showed signs of a beginning in a recovery.

Axel Mattern, joint CEO of Port of Hamburg Marketing, explained: “We have seen a stabilization in the development of throughput since July and with it a lower overall decrease in seaborne cargo handling in the Port of Hamburg.

“The reasons can be found in the lower rate of infections during the summer and the resulting easing of measures to check the pandemic, along with shipping to fill up stockpiles for the Christmas trade.”

He emphasized that the Port of Hamburg continues to provide its cargo handling and logistics services 24/7: “Reliable supply of goods and raw materials for consumers and industry is ensured even under these difficult economic conditions,” he stressed, adding: “The port with its terminals and logistics and service providers as well as its transport connections to the hinterland is fully functional.”

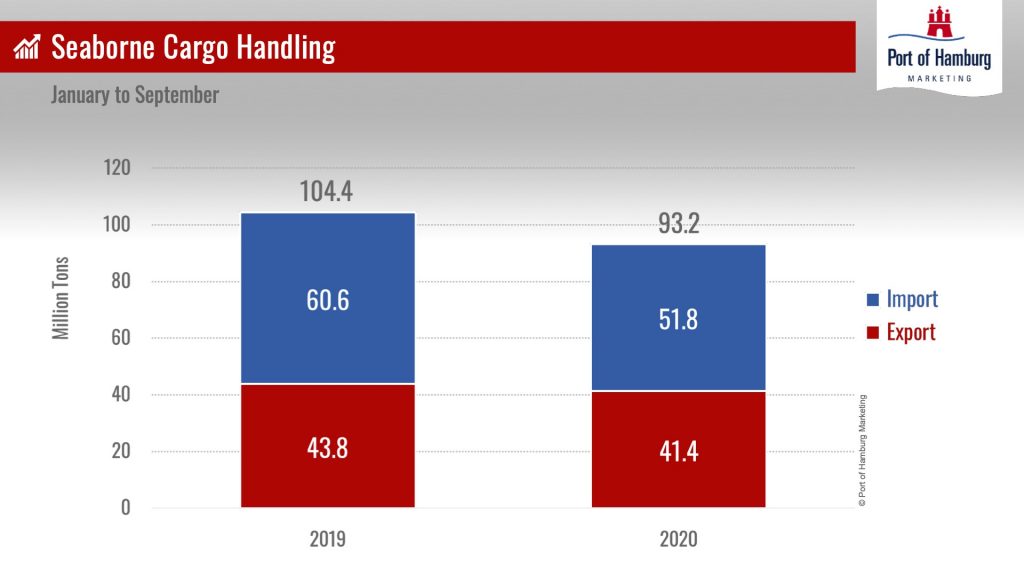

In the first three quarters of the year, 93.2 million metric tons of seaborne cargo were loaded or discharged in the Port of Hamburg’s terminals. That marks a drop of 10.7 percent compared to the previous year. Both major segments of cargo throughput were affected and remained significantly below the levels reached a year earlier.

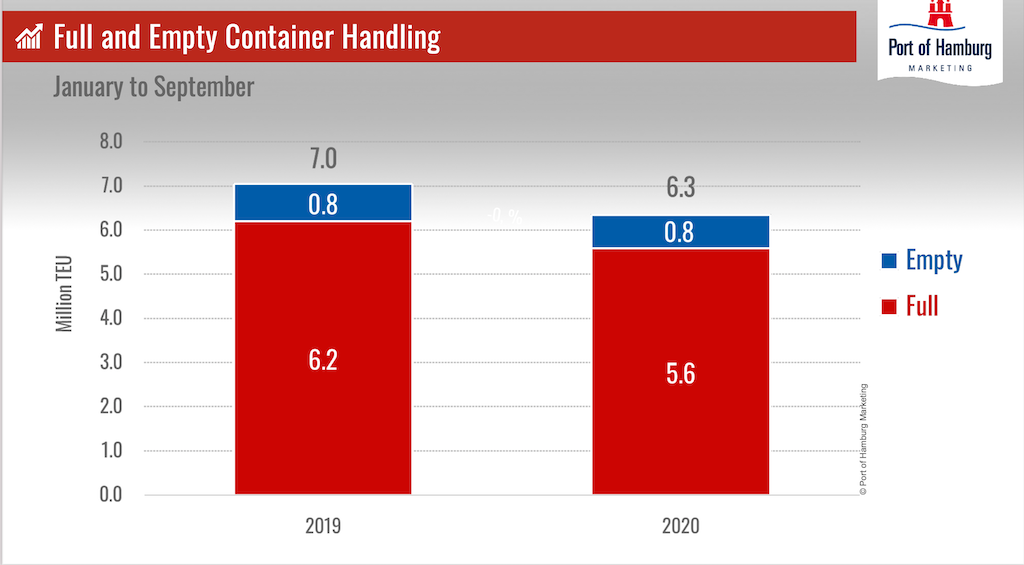

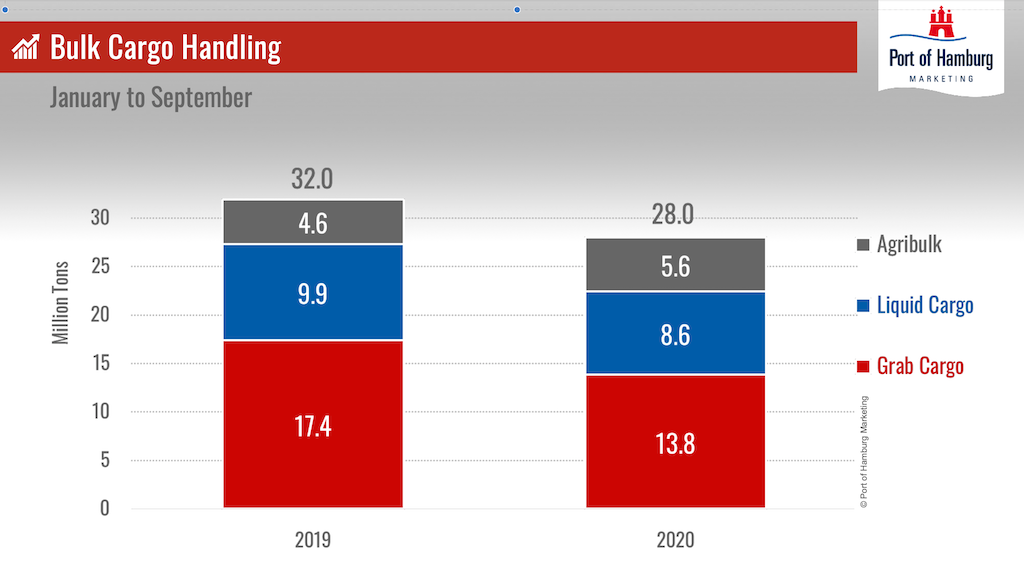

General cargo declined 9.9 percent to 65.2 million tons and bulk cargo was down 12.4 percent to 28 million tons. In container throughput, 6.3 million TEU (20-foot standard container units) were handled on Hamburg’s quays in the first three quarters. That represents an annualized decrease of 9.9 percent.

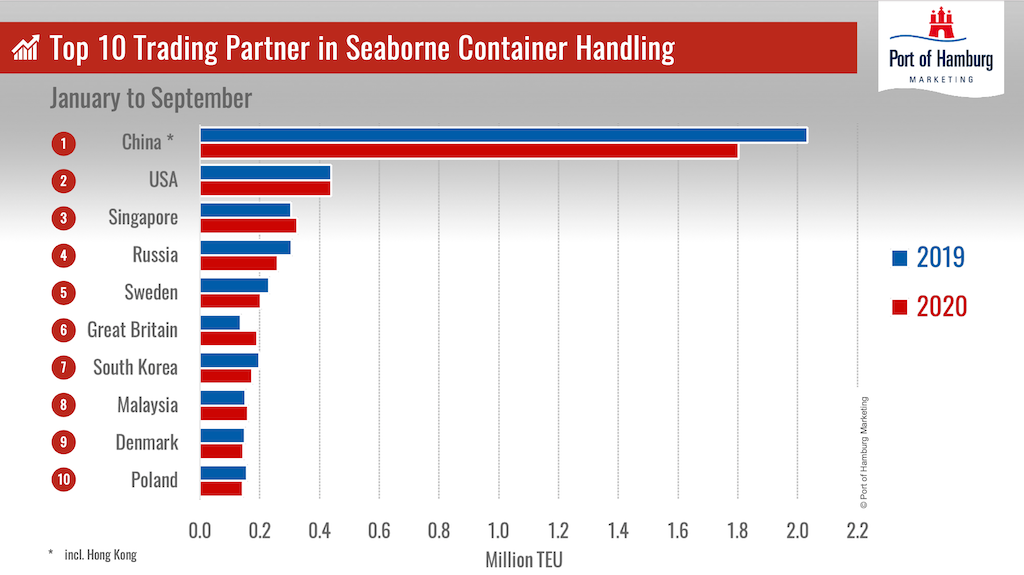

Developments in container traffic in the first three quarters varied among the Port of Hamburg’s ten most important trade partners. Positive developments in trade with other countries could not make up for the 11.3 percent drop in seaborne container shipping with China, which is Hamburg’s most important trade partner by far.

Furthermore, Hamburg’s seaborne container throughput for other countries besides China also showed up to double-digit decreases: Russia (-15.1 percent), Sweden (-11.8 percent), South Korea (-11.8 percent), Denmark (-3.4 percent), and Poland (-9.6 percent).

Countries among the Port of Hamburg’s top ten trade partners that showed growth in container traffic were Singapore (up 7.1 percent), the UK (up 41.0 percent), and Malaysia (up 5.5 percent), along with the USA (up 0.1 percent).

The USA ranks second for container throughput in Hamburg and still showed growth in the first three quarters of the year with a total of 439,000 TEU. “The ongoing positive development in container traffic for the USA is surprising in light of the economy, which is suffering from the effects of the pandemic and the decline in demand.

The growth in container shipping for Great Britain is based on an upswing in inbound empty containers for the German market and increased shipments to Great Britain in advance of the impending Brexit,” Ingo Egloff, joint CEO with Alex Mattern, explained.

All in all, imports via the Port of Hamburg decreased by 14.4 percent, while exports were down by 5.5 percent. A drop in steel production was responsible for lower volumes in ore and coal imports. On the other hand, agribulk showed positive growth during the first three quarters, reaching a volume of 5.6 million tons, an increase of 20.1 percent.

Significantly higher exports of grain and fertilizers were the main causes of this very favorable development in cargo throughput.

“Despite the ongoing recovery since mid-year, we will not be able to reach the high level achieved last year,” Egloff summed up. “But developments since July give reason to hope that we will show just single-digit losses at the end of the year.”