Online freight marketplace and SaaS software provider Freightos has pubished its latest global freight overview, with a core focus on COVID-19’s sweeping impact. Analysis by Eytan Buchman, CMO, Freightos.

Here are the latest China-US container rates, which are heavily impacted by the ongoing developments:

- China-US West Coast prices (FBX01 Daily) rose 5% since last week to $1,604/FEU. Rates are 1% higher than last year’s prices for this week.

- China-US East Coast prices (FBX03 Daily) stayed level at $2,825/FEU. This rate outpaces last year’s by 7%.

Key insights below:

- The capacity crunch and demand for critical supplies are keeping air cargo from China and Europe high.

- Pent-up demand still being alleviated, blank sailings and mode shifts due to high air cargo rates have kept ocean rates level or climbing moderately. Rates are now on par with April 2019.

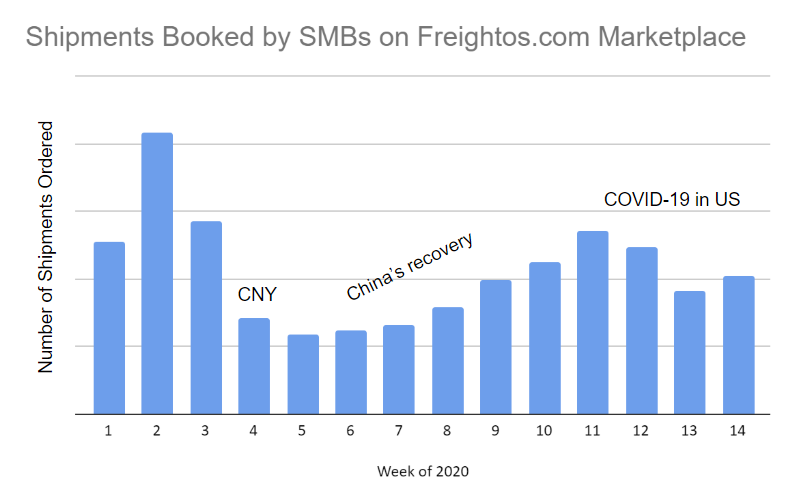

- Despite larger importer cancelling orders, many SMBs still appear active and unaffected (yet…) by reduced demand. SMBs using the Freightos.com freight marketplace continued to ship goods, with last week’s number of shipments up 11% from the previous week and down only 2% over the same period last year.

Analysis

The US and much of Europe are bracing for what could be the peak weeks of the outbreak. But, despite a focus on essential goods, some delays and disruptions, and new measures to protect its own workforce, the logistics industry has continued to function and keep goods moving.

The next expected hurdle is how to handle the wave of ocean freight ordered by US businesses several weeks ago after manufacturing had recovered in China but before the outbreak in the West had begun to impact demand.

These ships are on their way and expected to arrive on US shores for the next few weeks. But many importers – particularly larger ones – are wary of now accruing more inventory than demanded, and refusing shipments, delaying delivery, or not accepting them due to warehouses being closed.

To avoid bottlenecks and delays at ports, the Federal Maritime Commission and others are working on solutions, carriers are offering storage at origins or alternate ports, and alternate off-port container storage is also being explored.

While shipments of most goods are trying to be slowed down – some carriers are even sailing around Africa to Europe to extend sailing times and cut costs on canal fees – shipments of critical goods like masks and other personal protective equipment need to be expedited, usually by air.

This demand, together with the shortage of passenger jet cargo capacity, are keeping air cargo rates extremely high.

Air cargo rates from Europe to the US remain high, though WebCargo dynamic air rates data indicate that prices have remained stable over the past week. China’s additional restrictions on passenger flights have contributed to more volatility, with Freightos.com marketplace data indicating between 25% and 35% increases in air rates out of China this week.

High air rates have some shippers looking to switch to ocean shipping. This shift, along with carriers continuing to blank large numbers of sailings for the coming weeks as demand slumps, have kept ocean rates stable this week, with China-US West Coast rates even climbing by 5% to $1604.

Even with this climb, though, ocean rates are still only on par with the same period last year. On a positive note, though enterprise shippers in non-essential industries like retail are doing their best to cancel orders, many SMBs with much smaller inventory needs seem to still be active and unaffected yet by the shift in demand.

Despite a lull during the shutdown of Chinese manufacturing and being below typical levels, US SMB importers using the Freightos.com marketplace continued to ship goods, with last week’s number of shipments up 11% from the previous week and down only 2% over the same period last year.

Eytan Buchman, CMO, Freightos