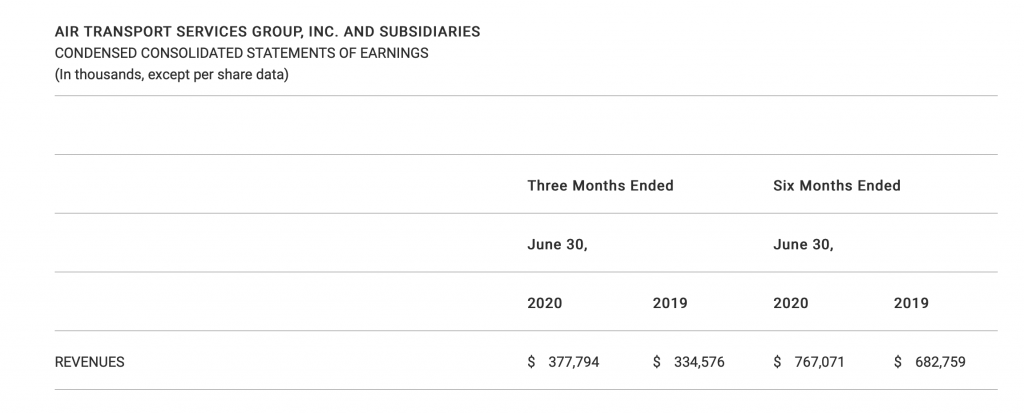

US-based freighter aircraft lessor Air Transport Services Group (ATSG) saw second quarter 2020 customer revenues up 13% to $377.8m.

ATSG’s principal business segments, aircraft leasing and air transport, increased revenues by 8% and 13%, respectively, before eliminations. Revenues from other businesses increased 8% on the same basis.

GAAP Earnings from Continuing Operations were a loss of $105.2m, or $1.78 per share basic, versus a loss of $26.6m, or $0.45 per share.

A second-quarter 2020 impairment charge reduced earnings by $30.2m, principally as a result of management’s decision to retire CAM’s four Boeing 757 freighters.

Rich Corrado, president and chief executive officer of ATSG, said: “ATSG’s airlines leveraged short-term charter and ACMI opportunities to mitigate substantial pandemic-related reductions in regular operations for the US Department of Defense and commercial passenger customers to achieve strong revenue and earnings growth on an adjusted basis for the second quarter.

“Air cargo operations expanded with the deployment of one Boeing 767-300 freighter leased to Amazon and operated by Air Transport International, the first under a new order for twelve with the remaining eleven scheduled for lease to Amazon during 2021.

“We now expect to lease twelve 767-300 freighters in 2020 to external customers, up from the previous guidance of eight to ten. Near-term pandemic effects aside, ATSG remains a growing, thriving air transport business with substantial growth potential in the coming years.”

Outlook

Due in part to robust demand for its cargo aircraft and related airline services, as well as stronger than expected demand from governmental agencies for passenger charter flights in the second quarter, ATSG now expects Adjusted EBITDA for 2020 to be at least $470m.

Said a spokesperson: “This updated projection reflects ATSG’s assumption about the level and duration of pandemic impacts on its commercial and military passenger flying, and a reduced likelihood of continued passenger charter opportunities to mitigate those effects in the second half.

The spokesperson added: “The pandemic’s effects on the global economy and on military operations have proven to be difficult to predict. In the event those effects impact ATSG’s business later this year in ways not currently foreseen, ATSG may revise its Adjusted EBITDA guidance prior to year-end.

Corrado said: “Overall, ATSG’s long-term outlook is very bright, with especially strong demand for our cargo aircraft from lease and ACMI customers around the globe. Our order book calls for us to modify and dry-lease at least twenty additional 767 freighters through 2021, while redeploying others to new customers.

“Our business model’s emphasis on long-term cash flow streams from dry-leasing midsize cargo aircraft and focused passenger operations provides a solid financial foundation. When the pandemic fades, we expect to deliver even stronger results from our leasing, airline, aircraft maintenance and logistics operations.”

ATSG’s capital expenditures for 2020 are projected to be approximately $465m. That includes purchases of eleven Boeing 767-300s this year for lease deployments.

Currently, ATSG expects to purchase three to five Boeing 767-300 aircraft in 2021. As a result, ATSG anticipates that capital spending in 2021 will decline by at least $115m to approximately $350m.

At the same time, ATSG projects continued growth in Adjusted EBITDA over the next two years, stemming from its fleet investments and expanding airline, MRO and logistics operations.

“Our continuing focus on providing capacity and value-added services for express air-networks of global e-commerce companies, and on the passenger transport requirements of U.S. government customers, leaves us well positioned for growth and has helped protect us from economic volatility,” Corrado said.

“With the growing cash generating power of our businesses, we look forward to expanded opportunities to allocate capital among a wide range of value-enhancing alternatives to increase shareholder value.”