Customer revenues up 12% to $389.3m

US-based freighter lessor Air Transport Services Group (ATSG), whose clients include Amazon, DHL and UPS, saw first quarter 2020 customer revenues up 12% to $389.3m.

Both of ATSG’s principal business segments, aircraft leasing and air transport, plus its other businesses on a combined basis, generated higher revenues.

ATSG chief executive Joe Hete said: “Despite the pandemic, we remain cautiously optimistic about the rest of 2020, as we deploy more B767 converted freighters for customers responding to expanded e-commerce shopping, and operate passenger aircraft to support the US military’s evolving requirements.”

The Cargo Aircraft Management’s (CAM) division’s first quarter revenues, net of warrant-related lease incentives, increased 5% versus the prior year. Revenues benefited primarily from seven newly converted B767 freighters deployed since March last year, including one as a dry-lease with UPS in January 2020. CAM’s external customer revenues increased 12% during the first quarter.

First-quarter revenues for ACMI Services increased 10% from the prior-year period, stemming mainly from growth in Omni Air and ATI operations.

ATSG’s airlines operated sixty-nine aircraft at March 31, fifteen passenger and fifty-four cargo aircraft. Two of ATSG’s four 757-200 freighters are expected to remain available for service through 2020, although current DHL commitments for ATSG’s 757-200 freighters ended May 1.

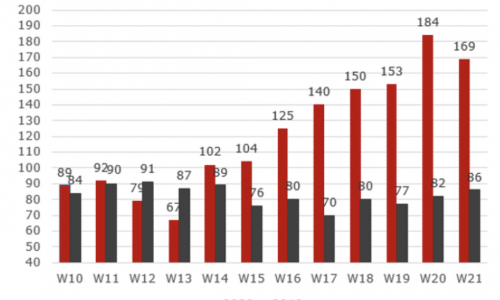

Total block hours increased 31% for the first quarter, principally due to six more aircraft in airline service versus a year ago, and expanded flying for Amazon.

Rich Corrado, President, said: “We are staying in constant contact with our principal customers as the pandemic continues. Today, they are telling us that they intend to continue to use our aircraft and other resources largely in line with their earlier expectations, including plans to lease seven to nine more of our newly converted B767s this year.

“Most of our cargo aircraft continue to operate within expanding time-definite express networks as e-commerce transactions accelerate during the pandemic.

“Demand for our passenger aircraft, however, is expected to remain sensitive to pandemic-driven changes in the US military’s troop deployment and rotation plans, and reductions in operations for Omni commercial customers through 2020.”