Particularly dynamic development in Parcel, Express and eCommerce Solutions business

Deutsche Post DHL Group benefitted from the surge in global e-commerce activities to record strong growth in the third quarter of 2020.

In an economic climate dominated by COVID-19, the Group grew its revenue by 4.4% to €16.2bn. Organic revenue – after adjusting for portfolio and currency effects – was up by even 9.0%. With its broad range of logistics services, Deutsche Post DHL Group has benefitted from the surge in global e-commerce activities.

The Group’s Post & Parcel Germany and DHL eCommerce Solutions divisions reported especially pronounced growth in shipment volumes. Volumes also surged in the time-definite international Express business across all regions, which allowed the Group to utilize its network very well.

Deutsche Post DHL Group increased operating profit (EBIT) by approximately 50% compared with the prior year to €1.4bn. With this, the Group confirmed its preliminary figures issued in October.

The EBIT margin rose from 6.1% to 8.5%. The free cash flow increased by more than €750m to around €1.3bn compared with the prior year.

Frank Appel, CEO of Deutsche Post DHL Group, said: “We had a successful third quarter and achieved improvements in revenue, EBIT and cash flow – thanks to our 550,000 employees worldwide and our outstanding portfolio of e-commerce logistics solutions benefitting both small and large customers globally.

With our global services, we keep the world economy running even during the crisis. Every day, our employees perform exceptionally well under challenging conditions to provide our customers with the best possible service.”

Group confirms raised 2020 EBIT guidance and further increases free cash flow guidance for 2020

Against the backdrop of its successful third-quarter earnings performance, the Group raised its full- year earnings forecast in October. Deutsche Post DHL Group now expects operating profit to reach between €4.1 and €4.4bn in 2020. That figure includes non-recurring effects of approximately €-610m.

In anticipation of a very strong peak season in particular driven by the dynamic e-commerce growth, the company is focused on securing all necessary resources required to maintain a high quality service level. Achieving the upper end of the guidance will mainly depend on whether the volume development will allow for an efficient utilization of the networks.

In October, the Group raised its forecast for free cash flow in 2020 from around €1.4bn to more than €1.8bn and has raised this expectation to more than €2.0bn today. Furthermore, Deutsche Post DHL Group continues to expect to invest around €2.9bn for the full year.

The medium-term earnings guidance updated in July, which projects Group EBIT of between approximately €4.7bn and more than €5.3bn in 2022, depending on the shape of the macroeconomic recovery, remains unchanged.

Free cash flow remains strong while investment activities continue

In line with earnings, the Group’s free cash flow rose to €1.26bn in the third quarter

(2019: €507m). After the first nine months, free cash flow thus amounts to €1.46bn (2019: €-296m).

“We have not only significantly increased our profitability, but also our cash flow. This is particularly important in the current uncertain economic environment. We are thus very well positioned to continue to invest consistently in profitable growth and the implementation of our Strategy 2025,” commented CFO Melanie Kreis.

Post & Parcel Germany: Parcel business volumes up by 11.6% thanks to sustained boom in e-commerce

Revenue in the Post & Parcel Germany division rose by 3.4% year-on-year to more than €3.8bn. Operating profit improved to €320m (2019: €304m) despite the special bonus and an additional non-recurring payment granted to employees in a total amount of €93m. In addition to the strong parcel growth, earnings were positively impacted by the cost and pricing adjustments made in both the letter mail and parcel business.

In the third quarter, the pandemic significantly accelerated the long-term trend of rising parcel volumes and decreasing mail volumes. Dialogue Marketing business remained restrained, whereas the e-commerce boom in the German parcel business enabled volume growth of 11.6%. This was considerably above the growth forecast of 0% to 5% given at the beginning of the year.

Express:

Very good network utilization brings record quarter for EBIT and EBIT margin

The Express division increased third-quarter revenue by 14.6% year-on-year to approximately €4.9bn. Operating profit rose by 65.9% over the prior-year level to reach a record €753m – despite one-time special bonus expenses of €33m.

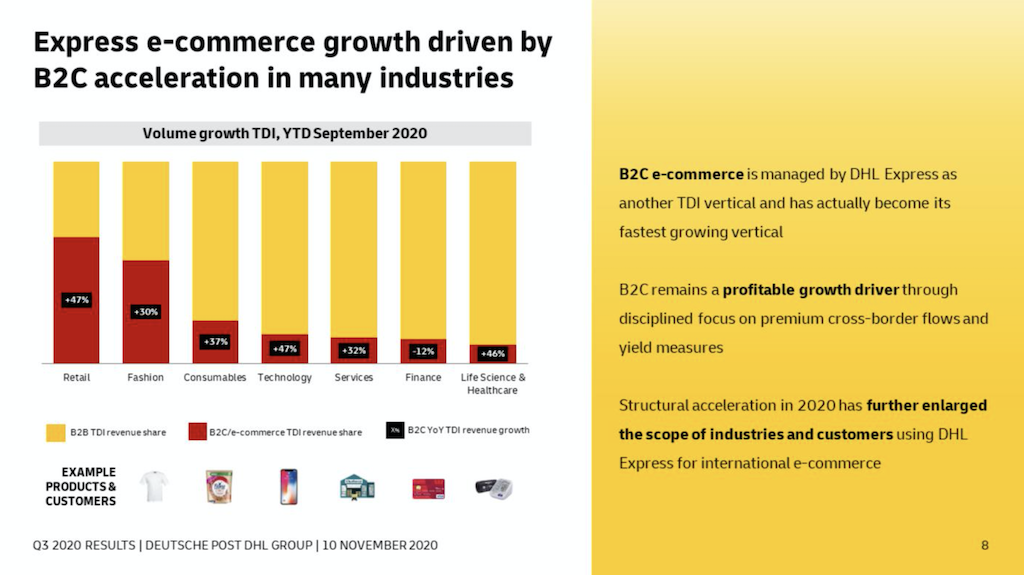

This outstanding performance was driven by growth of 15.8% in the time-definite international Express shipments. Volumes were significantly higher in all regions of the world during the entire third quarter.

The network was adapted in response to the increased share of B2C business across all industries and the simultaneous return of volumes in B2B business. In doing so the Express division succeeded in further increasing shipment processing efficiency as well as in achieving a very good utilization of its flight capacity in its network spanning the globe, leading to a record margin of 15.5%. This represents a significant increase over the prior-year figure (2019: 10.7%).

Global Forwarding, Freight:

Efficient response to a changed market environment

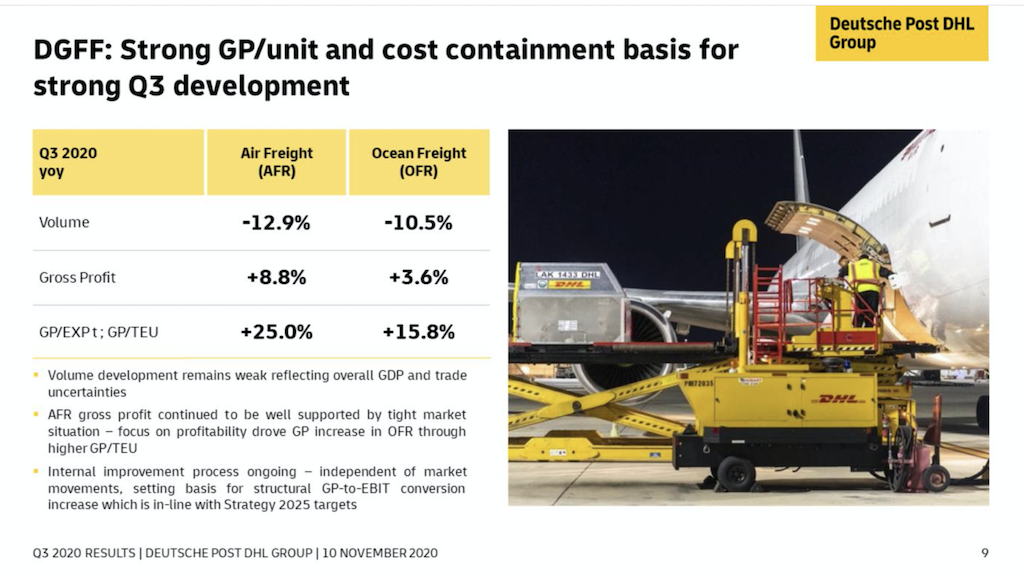

Despite ongoing capacity shortage in the international transport markets, the Global Forwarding, Freight division increased third-quarter revenue to around €3.8bn (2019: €3.7bn). Operating profit rose by 25.0 percent to €155m, including one-time special bonus expenses of €13m. The positive year-on-year margin development in the airfreight business had a notable effect on earnings and compensated declining volumes.

In addition to the continued lack of cargo capacity on international passenger flights, the division was confronted with a further shortage of ocean freight capacity.

Supply Chain:

Increasing customer activity led to higher revenue and earnings in the course of the quarter.

Customer activity in contract logistics picked up over the course of the third quarter as the division increasingly recovered from the weak, pandemic-related momentum of the previous quarter. At around €3.1bn, however, revenue was still below the previous year’s level (2019: €3.4bn).

Operating profit for the Supply Chain division came to €111m in the third quarter, including one-time special bonus expenses of €52m. Adjusted for the bonuses, earnings were nearly at the previous year’s level of €162m. The division achieved this good performance in a volatile market environment thanks to its high cost discipline and its flexibility in finding new solutions for customers.

eCommerce Solutions: Growth trajectory continues; EBIT sees significant increase

Revenue in the eCommerce Solutions division increased by 26.1% in the third quarter to more than €1.2bn. The division’s operating profit also rose considerably to €76m (2019: €6m) as a result of strong volume growth in the private consumer business in Europe and the Americas.

The realignment of the Group’s international parcel activities is paying off: In addition to the good revenue trend, improvements in cost management also led to efficiency increases. The third-quarter operating margin came to 6.3%, which is well above the prior-year level (2019: 0.6%). The increase would have been even more pronounced without the one-time special bonus expenses of €10m.