DSV Panalpina has made 3,000 staff redundant, mainly administrative ‘white collar’ workers. as part of a DKK1.4bn cost base reduction plan in response to the Covid-19 pandemic.

Jens Bjørn Andersen, Group CEO told an analysts’ call: “3,000 good, loyal people will have to leave the company and I say this with a heavy heart.”

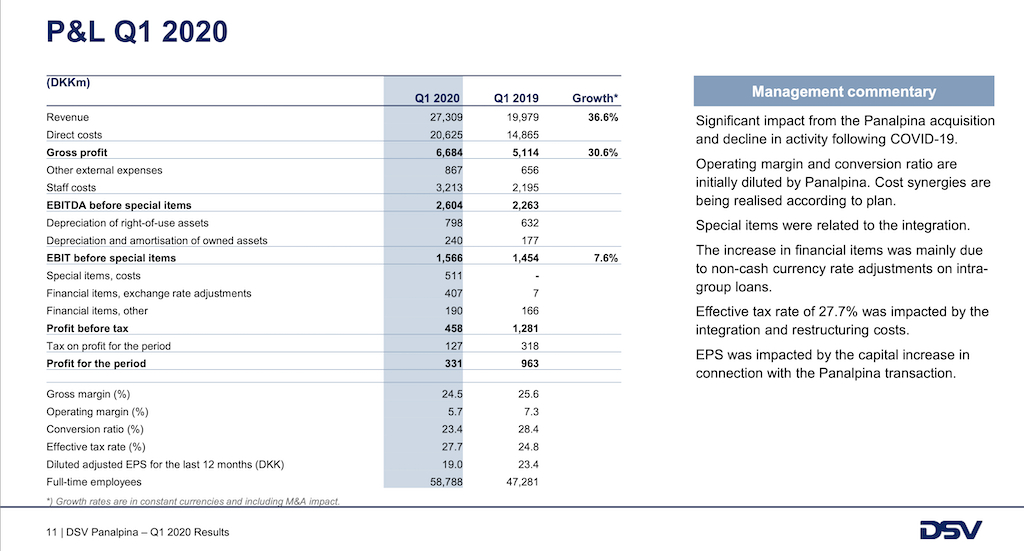

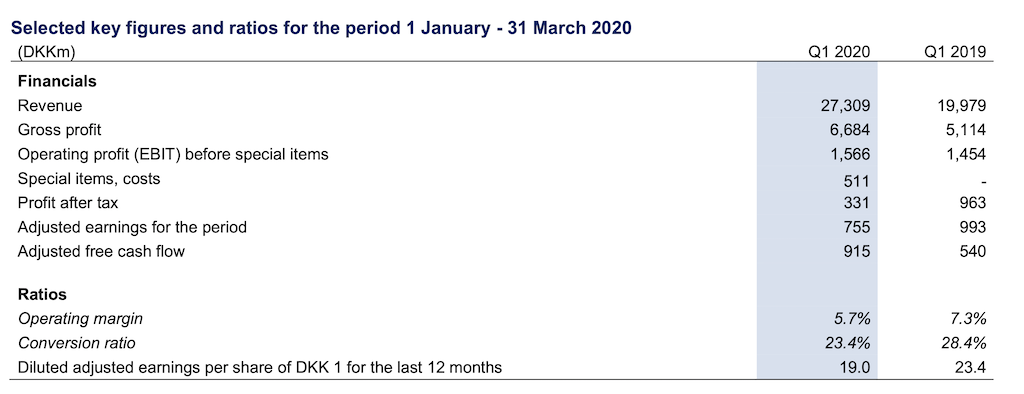

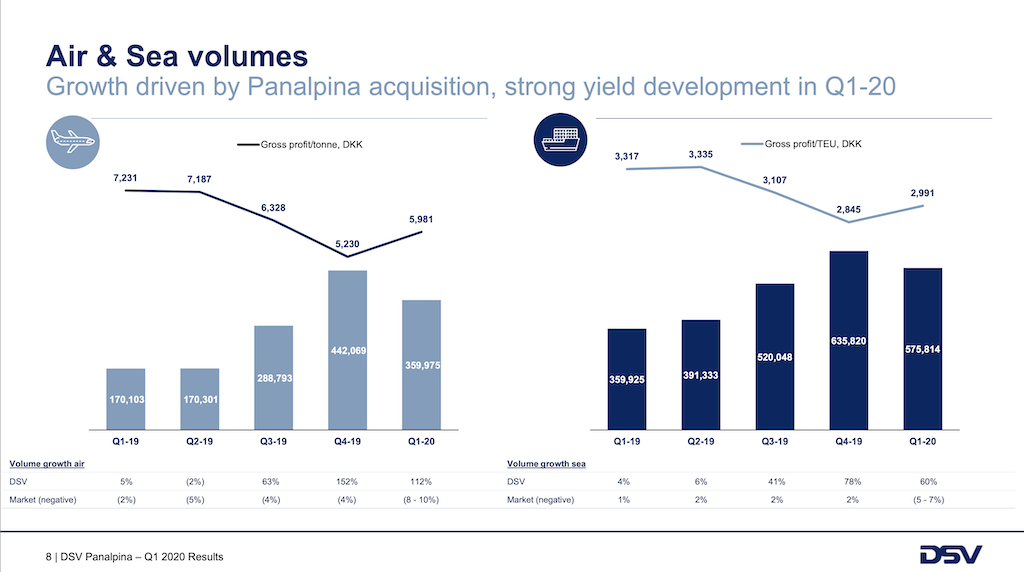

Andersen was speaking as DSV Panalpina revealed its 2020 Q1 results which saw the Air & Sea division achieve an increase in revenue of 76.7%, Road a 2.0% decline and Solutions a 12.6% increase, compared to the same period last year.

The growth was driven by the acquisition of Panalpina. However, activity levels in Q1 2020 were impacted by the COVID-19 situation, which led to a significant drop in freight volumes.

DSV estimates that the se freight market declined by 5%-7% and the air freight market declined by 8%-10% in Q1 2020. The decline in volumes was partly offset by higher freight rates, mainly in airfreight.

The growth in Air & Sea was driven by the Panalpina integration and cost synergies, which have been achieved in line with expectations in the quarter. The synergy impact is expected to increase in the coming quarters.

As part of the need for staff to work from home, DSV Panalpina now has 30,000 people accessing the forwarder’s IT systems remotely, while some 27,000 staff, mainly truck drivers and warehouse employees, are still at work but under strict health authority rules relating to Covid-19.

Commenting in the analysts call, Andersen praised the value of the legacy B747 freighter network which came with the Panalpina merger last year.

He said: “I was not too enthusiastic about it but it has proven really, really great and super attractive to our customers, both our own planes and the commercial airlines.”

The freighter network had made a lost in the final quarter of 2019 but registered a profit in Q1 of this year, due to “better utilisation and better structure of the network”.

DSV Panalpina expects the vast majority of passenger aircraft – supplying around 50% of total airfreight capacity – to remain grounded for the near term future.

This has raised concerns from customers about future airfreight capacity, but Andersen said that DSV, as a large forwarder, would be able to secure air cargo capacity.

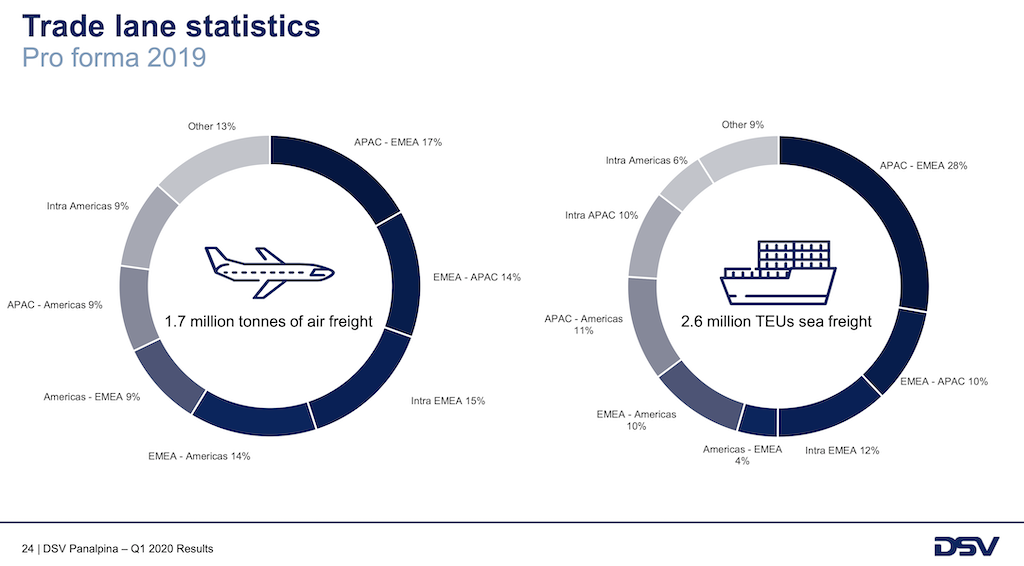

Commenting on the rapid rise of airfreight rates ex-Asia and its effect on fixed-rate pricing agreements with customers, Andersen said: “It is obvious that if you sit on tradelanes where there has been a tenfold increase in rates then you cannot live up to something signed in 2019.

“We have found a solution with our customers around a weekly rate agreement and we will look to see if we can extend it to a slightly longer duration.”

Some freight forwarders have raised the issue of force majeur, but Chief Financial Officer Jens Lund said: “It is a card we would not like to pull, and we would rather talk to the customer about the problem and what are their requirements.”

He said of force majeur: “I am not sure how it will play out in court,” adding: “I am not sure you will have a long term relationship with the customer because they can find another forwarder.”

Asked about potential acquisitions in a market where some competitors are struggling, Andersen said that a major takeover was unlikely until 2021, although DSV was “open to opportunities” particularly if there was “a small, tuck-in in certain verticals were there are competences to be gained,” adding: “They all have our phone number.”

On the prospect of shippers requiring shorter supply chains or near-sourcing in the post Covid-19 world, Andersen said that there would be a lot of discussions about the issue but if doubted if it would cause a major change.

Andersen said in terms of the impact on the forwarding industry, it would cost as much to truck product from Mexico to the US as shipping a container from China to the US.