Ferry freight volumes expected to pick up as European economies reopen but visibility on the speed and strength still very limited

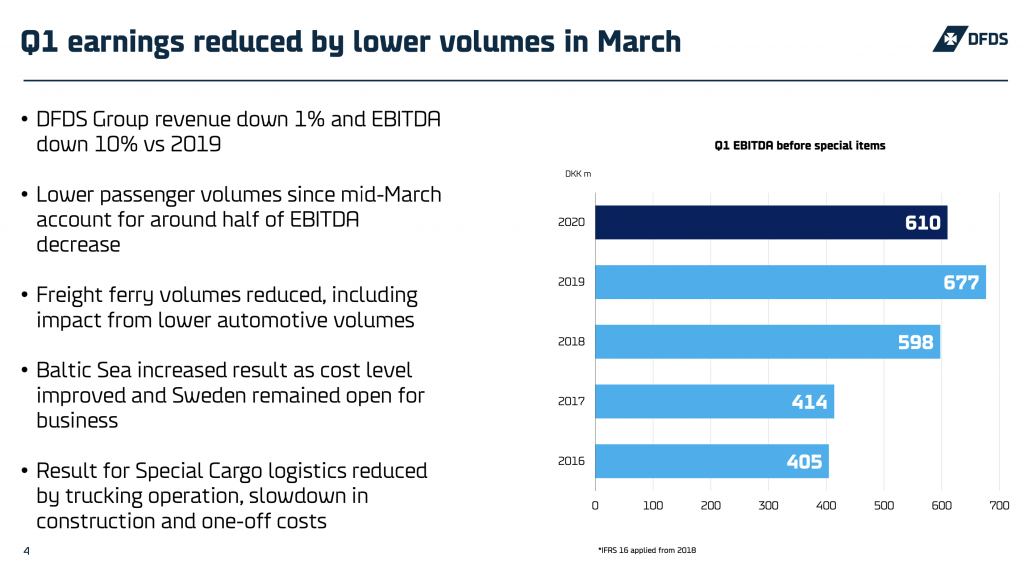

DFDS operational results for the first quarter 2020 were affected by the Covid-19 pandemic that impacted the Danish ferry giant’s European business from March and resulted in a drop in revenues of 1% to DKr3.8bn in Q1.

Operational results were DKr610m, which is 10% down from the first quarter last year.

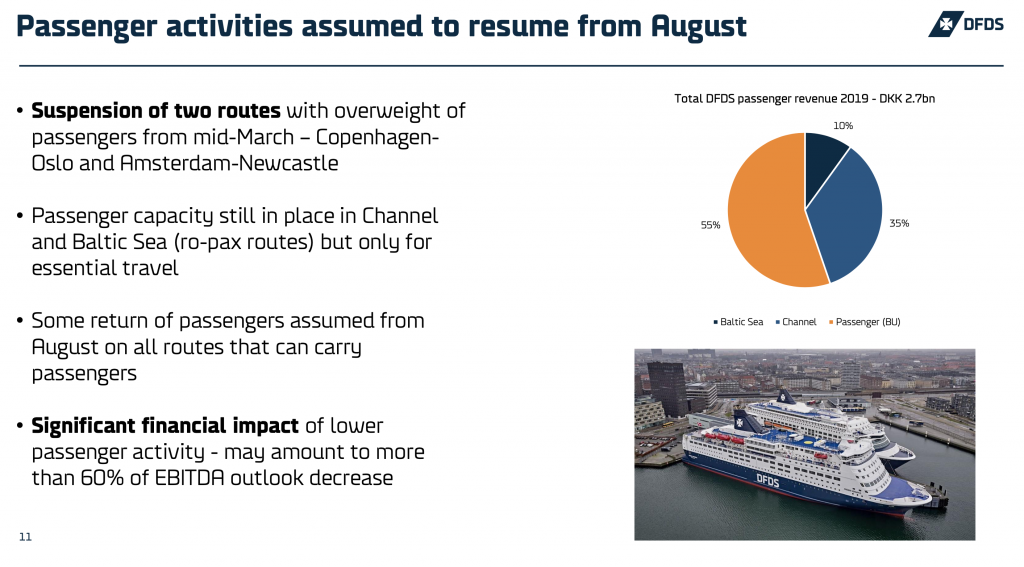

Covid-19 had up until mid-March a “limited impact” on revenue and earnings, particularly on freight. From mid-March, two passenger routes: Copenhagen-Oslo and Amsterdam-Newcastle, were suspended and passenger travel on other routes was reduced to only essential travel. Freight activities were also negatively impacted from mid-March.

In a statement DFDS said that the outlook – “significantly more uncertain than usual” – builds on a number of assumptions of which key elements are freight volumes and the impact of travel restrictions on passenger route operations and volumes.

The current suspension of passenger activity has a significant financial impact that may amount to up to around 60% of the potential decrease in EBITDA in 2020 compared to 2019.

Market overview

Added the statement: “European trade and travel markets became increasingly impacted by Covid-19 as Q1 progressed and lockdowns were introduced in most countries during March.”

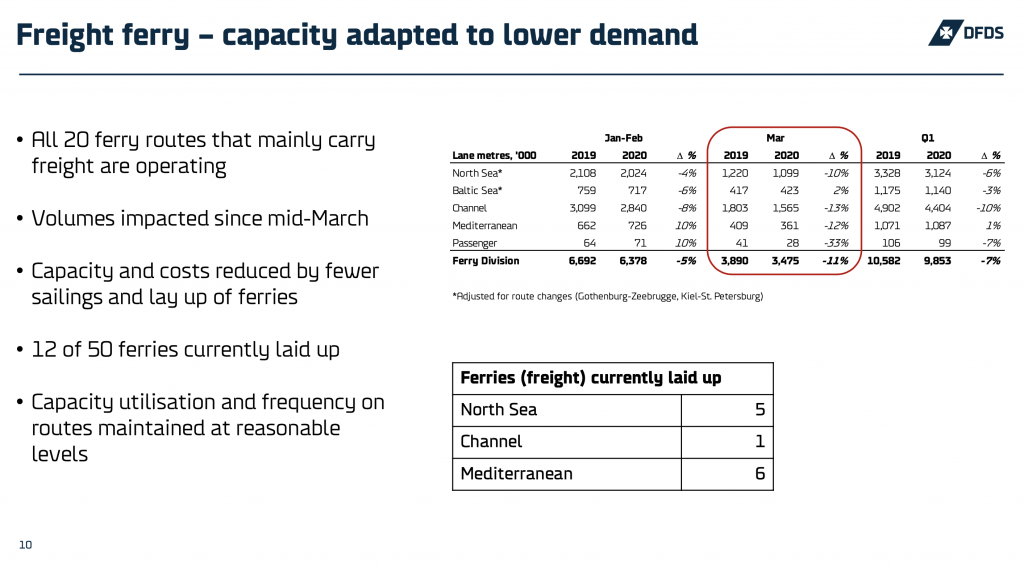

Intra-European freight volumes began declining due to the lock-downs during March as demand in general decreased and manufacturers in some industry sectors temporarily closed plants, notably the automotive industry.

These events led in Q1 to “varying degrees of impact” on freight ferry volumes across European markets.

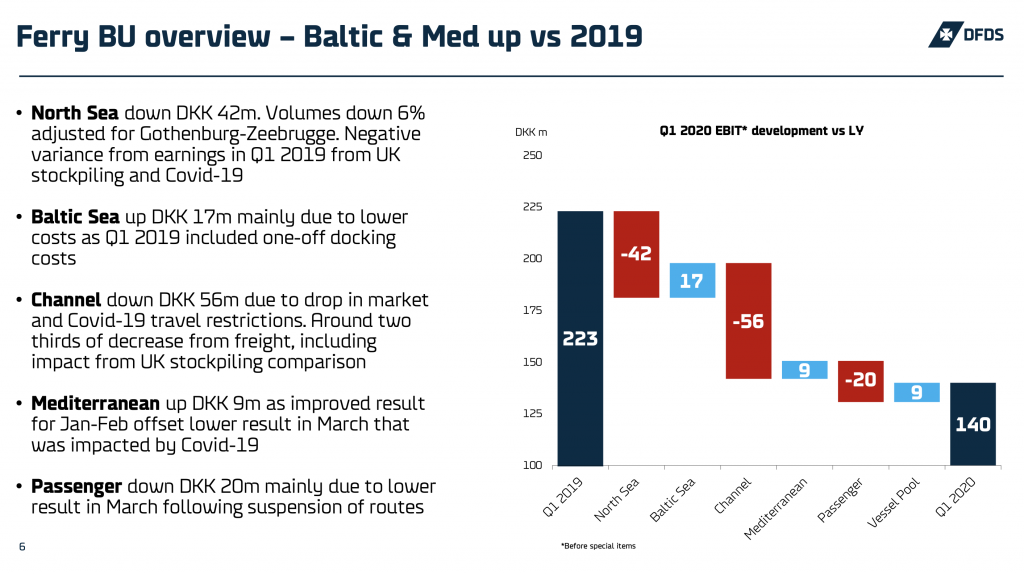

The “least impacted” region was the Baltic Sea where freight volumes have remained “robust”. UK volumes have, as expected, declined through Q1 2020 as Q1 2019 volumes were boosted by UK stockpiling related to Brexit.

The UK decline has, however, exceeded the expected decline due to a negative impact from Covid-19, most significantly on the English Channel (Dover Strait) where freight volumes were down 13% for the quarter and down 17% in March.

Freight volumes between Turkey and Europe increased until mid-March whereafter generally lower demand, plant closures and travel restrictions for truck drivers reduced volumes.

Travel markets became increasingly restricted during March and only essential travel is currently permitted which has led to suspension of several ferry routes carrying an overweight of passengers.

As the number of cases of Covid-19 has peaked in most European countries, the focus is now shifting to strategies for rolling back lockdowns.

Visibility on the duration of lockdowns for travel and how travel markets will react to a reopening is very limited as preferences and behaviours may have been impacted by Covid-19.

Freight volumes are expected to pick up as economies are reopened but visibility on the speed and strength of such a pick-up is likewise still very limited.

DFDS said that due to the current exceptionally high uncertainty, the outlook for 2020 and its assumptions “may change significantly” as the year progresses.

The result for 2020 is going to be “negatively impacted” by varying degrees of lower activity in markets for both freight and passengers.

In view of the current exceptionally high uncertainty, the outlook is solely focused on EBITDA for the DFDS Group as a whole and on investments. EBITDA before special items for 2020 is likely to be reduced towards DKr2bn.

The outlook – that is significantly more uncertain than usual – builds on a number of assumptions. A “key element” is freight ferry and logistics volumes that in March 2020, on a comparable basis, were down 11% and on level compared to 2019, respectively.

In April 2020, freight ferry volumes were down 24% and logistics volumes were down 38%, both on a comparable basis.

“A gradual recovery is expected from June until the end of 2020. Volume growth rates are expected to remain negative through this period and for the full-year 2020, freight ferry volumes are currently assumed to decrease by around 15%. Logistics volumes are assumed to decrease around the same level.

“The two suspended passenger routes are currently assumed to resume operations in August with a slow, gradual ramp-up of capacity. Passenger volumes on the Channel are likewise assumed to slowly ramp-up from August.”