Freighter fleet to grow by 80% including new and converted models

Boeing’s 2022 Commercial Market Outlook (CMO) predicts continued robust demand for dedicated freighters over the next 20 years to support global supply chains and growing express networks.

Carriers will need 2,800 additional freighters overall, some 940 new widebody models plus converted narrow-body and widebody freighters over the forecast period to 2041.

With demand rebounding for international passenger air travel following ongoing recovery in many domestic markets, Boeing projected demand for more than 41,000 new airplanes in total through 2041, underscoring aviation industry resilience two years after the pandemic began.

The CMO forecasts a market value of $7.2trn for new airplane deliveries, with the global fleet of passenger and freighter aircraft increasing by 80% through to 2041, compared with 2019 pre-pandemic levels.

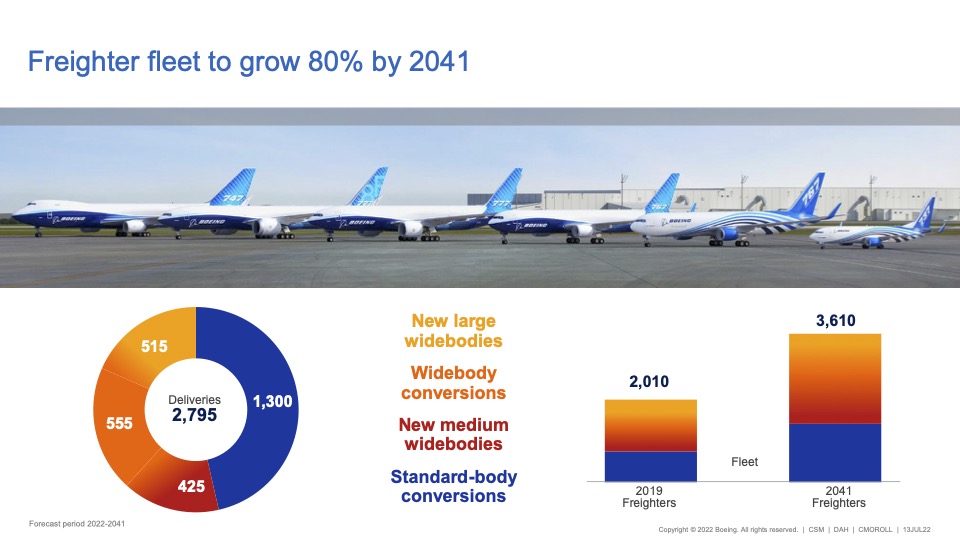

Boeing forecasts that, over the next 20 years, the freighter fleet will grow from pre-pandemic levels by 80%, which represents a 3% average annual fleet growth.

Pre-pandemic, said Boeing, the 2019 world freighter fleet consisted of 2,010 jet airplanes. By the end of 2021, the fleet had grown to 2,250 freighters.

In addition, freighter utilization has been operating at approximately 125% of normal levels, said Boeing. Both parked airplanes returning to the fleet and higher-than-normal operations levels have provided the market with much-needed capacity, and will “bolster replacement needs” throughout the forecast period.

“We forecast approximately 2,800 production-plus-conversion deliveries, with approximately half replacing retiring airplanes, and the remainder expanding the fleet to meet projected traffic growth.

“Roughly two thirds of deliveries will be freighter conversions from passenger airplanes, about 70% of which will be standard-body passenger aircraft.” Reflecting the higher traffic growth outlook, as well as higher replacement needs, this year’s forecast is up nearly 7% over last year, with increases across all segments.

In the standard-body segment, the fleet is projected to grow by 90% over 2021 levels, as viable feedstock becomes more available and e-commerce network growth boosts demand.

Added the CMO: “The segment will continue to see conversions to meet growth and replacement demand, with a projected 1,300 conversions.

“On the replacement side, more efficient airplanes will increase sustainability—and further boost capacity, as today’s conversions are larger than many of the airplanes being replaced. In the widebody segment, the fleet is forecast to grow by nearly 75%.

“Both conversions and production deliveries are higher than last year. Expanding express networks will drive growth in the medium segment. And, in the large widebody freighter category, just over half of the 660 airplanes flying at the end of 2021 are nearing retirement age.

“As a result, projected new widebody demand of 515 units will account for both replacements and future growth. New demand for widebodies will remain robust, as their advantages in unit cost, utilization, and range make them vital to operators for long-haul, general air-cargo service.”

Regionally, Boeing said that the Asia-Pacific market forecast points to the highest traffic growth, as carriers “continue to build out their express networks and supply- chain support needs”.

For the region as a whole, the total freighter fleet is forecast to become roughly the same size as the North American fleet by the end of the forecast period.

This will represent growth of over three times the pre-pandemic fleet. In contrast, the more mature North American fleet is projected to grow by one third, but it will need roughly as many deliveries as Asia-Pacific to efficiently and sustainably replace the existing fleet.

In the CMO, Boeing added that freighter operators responded to the disruption by operating above normal utilization levels, delaying freighter retirements, and bringing new and parked airplanes into the fleet to fill the lower-hold shortfall.

High air-cargo yields and greatly reduced long-haul international networks created “favorable conditions” for many airlines to use widebody passenger fleets for cargo-only operations that both generated much- needed cash flow and bolstered freight capacity.

The CMO observed: “These ‘p-freighters’ balanced part of the capacity shortfall and even, in some cases, generated quarterly profits for carriers despite minimal passenger operations.

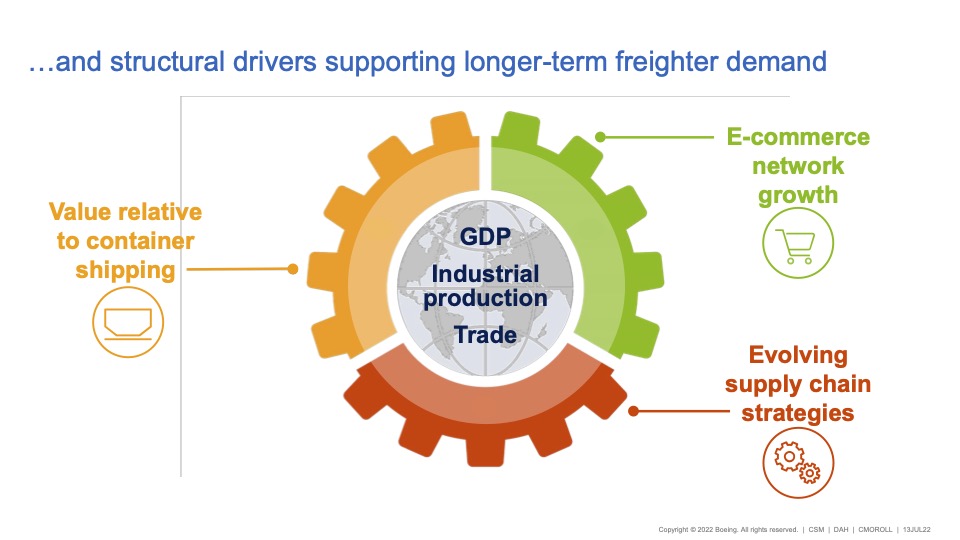

“Today, snarls in global supply chains continue to drive air-cargo market dynamics. Maritime container ship reliability and dependability have degraded markedly, disrupting operations and hampering global supply chains.

“As a result, air cargo’s value proposition — speed and reliability—has been in high demand, driving 2021 full-year traffic levels up 7% and doubling yields relative to 2019 levels.”

The CMO continued: “Meanwhile, overall air-cargo capacity has rebounded to 2019 levels. However, the ratio of main-deck freighter capacity to belly capacity remains high, with dedicated freighters hauling roughly two thirds of all air cargo, while long-haul passenger networks remain constrained by international travel restrictions.

“With the industry still recovering from COVID-19 disruptions, it is too early to definitively confirm structural changes. Yet several trends appear likely to persist, at least into the medium term.”

The CMO added that e-commerce has doubled its share of retail sales over the last five years. COVID accelerated the shift and adoption rates rose during the pandemic, as:

- Consumers embraced online shopping.

- Expectations of fast service climbed.

- Brick-and-mortar inventories lagged and often narrowed.

The CMO continued: “COVID has effectively pulled ahead of pre-pandemic growth expectations, with [deep sea shipping] container speed and reliability less suited (in some cases) to meet demand.

“In addition to accelerated growth, the global impact of the pandemic has boosted plans to develop express networks in emerging markets, particularly China, and has raised expectations for the air cargo segment overall—especially for the standard-body and medium-wide-body freighter categories.”

Turning to a long-term air cargo demand forecast, the CMO said that additional factors,such as GDP growth, industrial production growth, and trade growth remain key inputs and drivers of the 20-year outlook.

For the period 2022–2041, Boeing forecasts that air cargo traffic, in revenue tonne kilometers, or RTKs, will grow at 4.1% annually, an increase from last year’s forecast of 4.0%.