Substantial demand for long-haul widebody services, both near- and long-term, at attractive yields

US freighter lessor Atlas Air Worldwide Holdings announced third-quarter 2020 net income of $74.1m, compared with net income of $60.0m in the third quarter of 2019.

On an adjusted basis, EBITDA totaled $196.3m in the third quarter this year compared with $95.6m in the third quarter of 2019. Adjusted net income in the third quarter of 2020 totaled $82.7m compared with $9.5m.

“The positive momentum of our business continued in the third quarter, despite a more complex, costly and challenging operating environment caused by the COVID-19 pandemic.” said chief executive Officer John Dietrich.

“Our performance is the result of our entire team pulling together to increase utilization of our aircraft and execute on strong market demand and higher yields.

“We continue to broaden our customer base and grow with existing customers to maximize market opportunities. We further increased our roster of long-term charter customers, including the addition of Cainiao, the logistics arm of Alibaba, as well as expanding with HP Inc. and several large global freight forwarders.

“We also expanded operations for Amazon, where we began CMI flying three additional 737 freighters since September. We are now operating eight 737s for Amazon, complementing the large fleet of 767s that we have with them.

“Importantly, these long-term customer agreements provide secure and attractive earnings streams and deepen our strategic position in the fast-growing e-commerce sector, as well as in important global markets like China and South America.

“We are seeing substantial demand for our long-haul widebody services, both near- and long-term, at attractive yields. We are leveraging the agility of our business model and the scale of our fleet and global operations to serve this increased customer demand.

“We are also excited to announce that Titan Aircraft Investments, the joint venture between our Titan subsidiary and Bain Capital Credit, has arranged $500m in financing facilities. The funds are available for the acquisition of freighter aircraft on lease and passenger aircraft for conversion to freighters. This important step will enable the joint venture to serve the strong market demand for leasing freighters.

“I am proud of the important role Atlas is playing in responding to this pandemic globally, and thank our crew and ground staff for their dedication in delivering safe and reliable service. We are taking wide-ranging precautions to safeguard our employees, while navigating through this complex operating backdrop.

“Air cargo has always been a vital component in the global supply chain as it provides speed, security and reliability that are unmatched by other modes of transportation.

“We remain committed to moving goods the world needs most, including medical equipment, pharmaceuticals, personal protective equipment, e-commerce, and other manufacturing and consumer products. We are also actively preparing for our expected role in the timely distribution of vaccines.”

Dietrich continued: “Looking to the fourth quarter, and subject to any material COVID-19 developments, we anticipate solid volumes and yields driven by continued e-commerce growth and end-of-the-year airfreight demand, coupled with the reduction of available cargo capacity in the market. To meet customer demand, we are reactivating our fourth 747 freighter that had been previously parked. This will add to the three 747 freighters and the 777 we placed back into service during the second quarter of 2020.

“As a result, we anticipate fourth-quarter revenue of about $850m and adjusted EBITDA of approximately $215m.*

“We also expect fourth-quarter 2020 adjusted net income to grow approximately 25% compared with adjusted net income of $82.7m in the third quarter of this year.

“On a full-year basis, we now anticipate revenue of approximately $3.1 billion and adjusted EBITDA of about $780m in 2020.”

He concluded: “Atlas is continuing to adapt and navigate through the challenges of 2020. With our talented team, world-class fleet, strong balance sheet and agile business model, we will continue to serve the demand for airfreight and deliver high-quality service for our customers – in these uncertain times and beyond.”

Third-Quarter Results

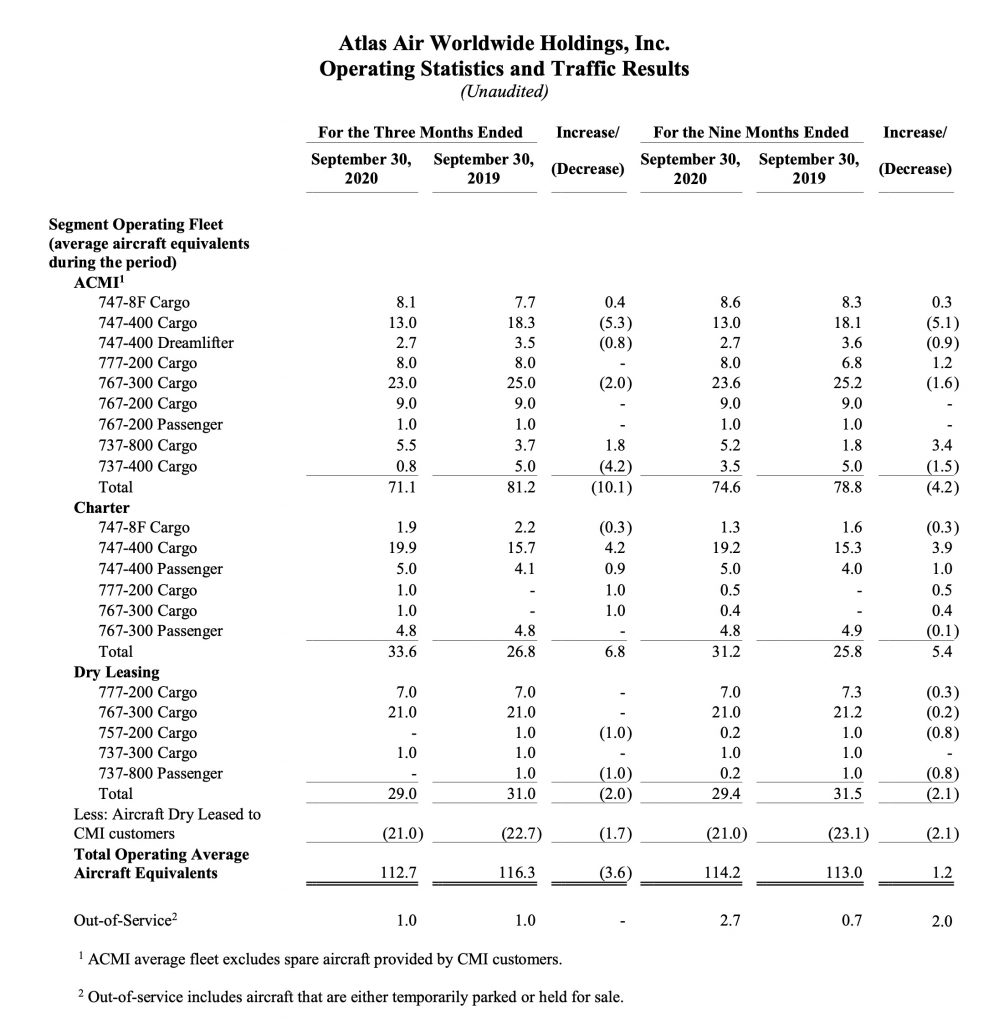

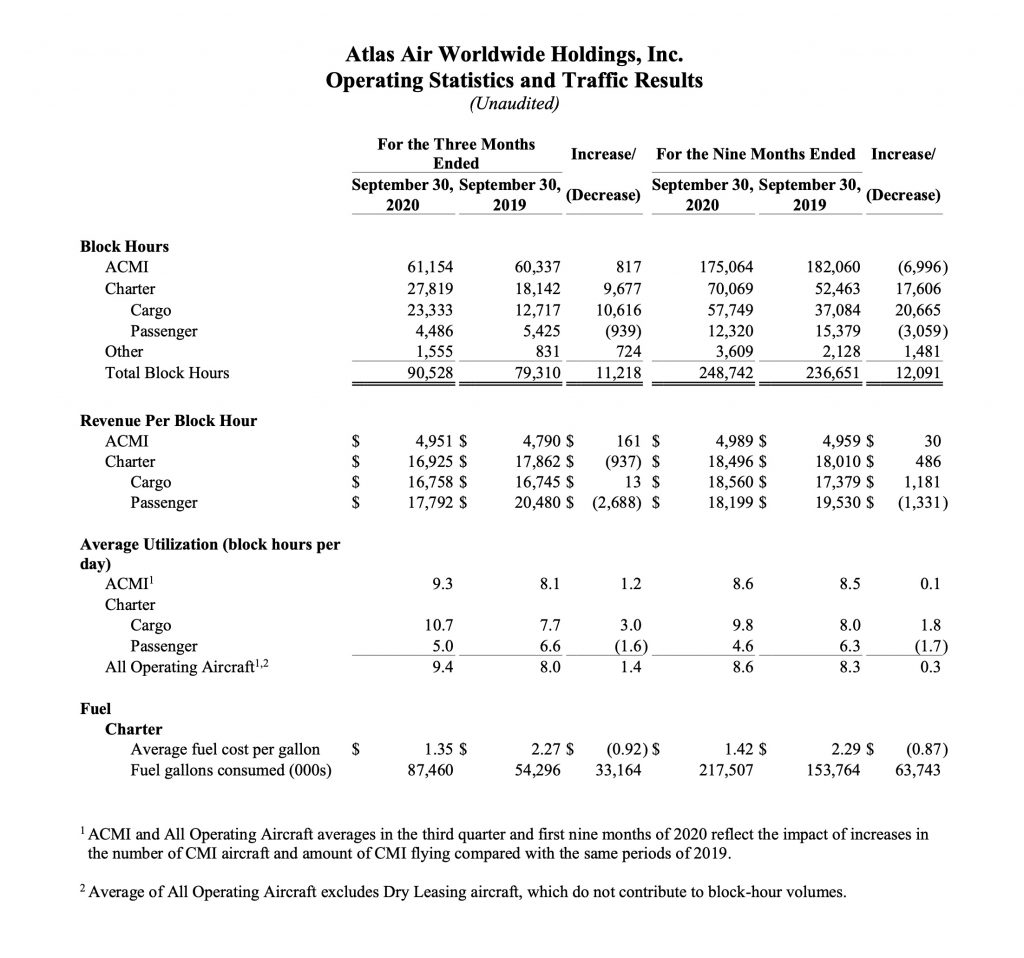

Volumes in the third quarter of 2020 increased to 90,528 block hours compared with 79,310 in the third quarter of 2019, with revenue rising to $809.9m compared with $648.5m in the prior-year quarter.

Higher ACMI segment revenue during the period primarily reflected an increase in the average revenue per block hour and increased flying, partially offset by the redeployment of 747-400 aircraft to the Charter segment. ACMI segment contribution during the quarter was primarily driven by increased aircraft utilization, reflecting strong demand from our customers, and a reduction in aircraft rent and depreciation.

Partially offsetting these improvements were higher pilot costs related to premium pay for pilots operating in certain areas significantly impacted by COVID-19 and increased pay rates resulting from our recent interim agreement with our pilots.

In addition, ACMI segment contribution reflected higher heavy maintenance, including additional engine overhauls to take advantage of slot availability and opportunities for vendor pricing discounts, and the redeployment of 747-400 aircraft to the Charter segment to support long-term charter programs.

Higher Charter segment revenue during the quarter was primarily due to an increase in flying, partially offset by a decrease in the average revenue per block hour due to lower fuel costs.

Charter segment contribution was primarily driven by the increase in commercial cargo yields (excluding fuel) and demand for freighter aircraft, reflecting a reduction of available capacity in the market, the disruption of global supply chains due to the pandemic and our ability to increase utilization.

In addition, segment contribution benefited from a reduction in aircraft rent and depreciation, and the redeployment of 747-400 aircraft from ACMI and the operation of a 777-200 freighter from Dry Leasing. These improvements were partially offset by: higher heavy maintenance expense, including additional engine overhauls to take advantage of slot availability and opportunities for vendor pricing discounts; higher pilot costs related to premium pay for pilots operating in certain areas significantly impacted by COVID-19; and increased pay rates resulting from our recent interim agreement with our pilots.

In Dry Leasing, lower segment revenue and contribution in the third quarter of 2020 primarily related to changes in leases and the disposition of certain nonessential Dry Leased aircraft during the first quarter of 2020.

Lower unallocated income and expenses, net, during the quarter primarily reflected CARES Act grant income of $64.2m.

Reported earnings in the third quarter of 2020 included an unrealized loss on outstanding warrants of $43.6m, compared with an unrealized gain on outstanding warrants of $83.2m in the year-ago period.

Reported earnings in the third quarter of 2020 also included an effective income tax rate of 32.8%, due mainly to nondeductible changes in the value of outstanding warrants. On an adjusted basis, our results reflected an effective income tax rate of 22.8%.

Nine-Month Results

Reported results for the nine months ended September 30, 2020 reflected net income of $176.3m, or $6.72 per diluted share, which included a $73.4m unrealized loss on financial instruments. Results compared with net income of $117.1m, or $1.34 per diluted share, which included an unrealized gain on financial instruments of $78.9m, for the nine months ended September 30, 2019.

On an adjusted basis, EBITDA totaled $564.5m in the first nine months of 2020 compared with $300.1m in the first nine months of 2019. For the nine months ended September 30, 2020, adjusted net income totaled $235.8m, or $8.71 per diluted share, compared with $41.4m, or $1.54 per diluted share, in the first nine months of 2019.

Cash

At September 30, 2020, our cash and cash equivalents, restricted cash and short-term investments totaled $729.3m, compared with $114.3m at December 31, 2019.

Our improved cash balance primarily reflected cash provided by operating activities, and also included the funds we received through the Payroll Support Program available to air cargo carriers under the CARES Act, partially offset by cash used for investing and financing activities.

Net cash used for investing activities during the first nine months of 2020 primarily related to capital expenditures and payments for flight equipment and modifications, including spare engines and GEnx engine performance upgrade kits, partially offset by proceeds from the disposal of aircraft.

Net cash used for financing activities during the first nine months of 2020 primarily related to payments on debt obligations, including our revolving credit facility, partially offset by debt issuances.

To mitigate the impact of any continuation or worsening of the pandemic, we have implemented a number of cost-reduction initiatives, including a significant reduction in nonessential employee travel and the use of contractors.

We have also taken actions to increase liquidity and strengthen our financial position, such as the sale of certain nonessential assets and our participation in the Payroll Support Program under the CARES Act.

Amazon Warrants

On October 9, 2020, Amazon elected a cashless exercise with respect to 3,607,477 shares vested under a Warrant issued in 2016. As a result, Amazon acquired 1,375,421 shares of AAWW common stock, representing approximately 4.99% (after the exercise) of our outstanding common shares.

2020 Outlook

Looking to the fourth quarter, and subject to any material COVID-19 developments, we anticipate solid volumes and yields driven by continued e-commerce growth and end-of-the-year airfreight demand, coupled with the reduction of available cargo capacity in the market.

To meet customer demand, we are reactivating our fourth 747 freighter that had been previously parked. This will add to the three 747 freighters and the 777 we placed back into service during the second quarter of 2020.

As a result, we expect to fly approximately 95,000 block hours in the fourth quarter of 2020, with about 65% of the hours in ACMI and the remainder in Charter.

We also anticipate revenue of about $850m and adjusted EBITDA of approximately $215m. In addition, we expect fourth-quarter 2020 adjusted net income to grow approximately 25% compared with adjusted net income of $82.7m in the third quarter of this year.*

Aircraft maintenance expense in the fourth quarter of 2020 is expected to total about $116m, with depreciation and amortization totaling around $65m. Core capital expenditures, which exclude aircraft and engine purchases, are projected to total approximately $25 to $35m, mainly for parts and components for our fleet.

We also now anticipate full-year 2020 revenue of approximately $3.1 billion and adjusted EBITDA of about $780m.

We estimate our full-year 2020 adjusted effective income tax rate will be approximately 23%.

We provide guidance on an adjusted basis because we are unable to predict, with reasonable certainty, the effects of outstanding warrants and other items that could be material to our reported results.