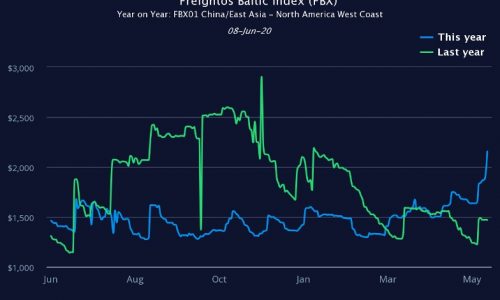

Importers and exporters around the world are experiencing rising container shipping rates on most routes, despite the costs of vessel operation falling, due to lower fuel costs and better utilisation of capacity.

Available capacity continues to lag growth in demand as global trade recovers from the Covid-19 induced shocks of the first half of 2020.

These are the headline conclusions of a new periodic report on the container shipping market produced by logistics research consultancy MDS Transmodal (MDST) and the Global Shippers Forum (GSF) that represents cargo owners’ interests worldwide.

The Container Shipping Market Quarterly Review will be produced every three months and will report, interpret and comment on trends and developments in the container shipping market as experienced and understood by shippers – the importers and exporting businesses that own the cargo carried and contract with container shipping lines for the transport of their containerised goods.

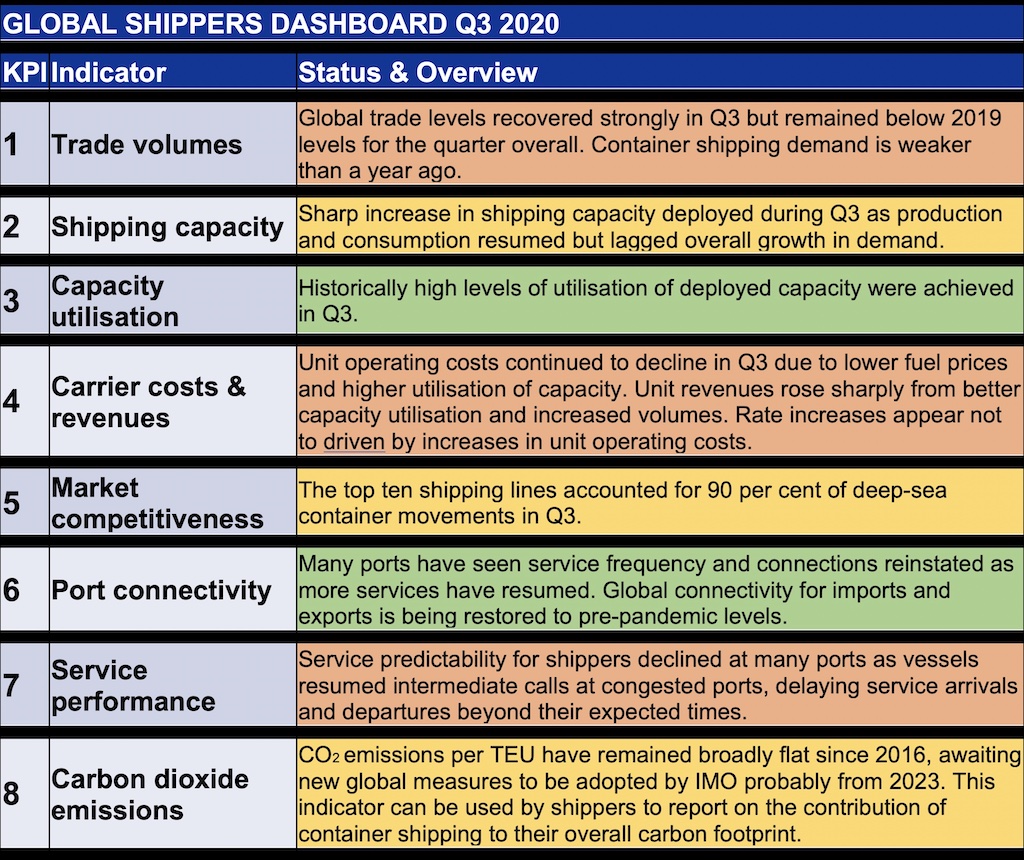

The Review collates and reports outputs from MDST’s established and respected Container Business Modal and other tools that are relied upon by governments and international agencies around the world. Working with GSF, MDST has generated eight new indicators showing how the market is performing in terms that are relevant and applicable to shippers as users and customers of these services.

The colour-coded summary findings how the past quarter’s developments have impacted shippers. The Dashboard for Q3 2020 is shown above.

The eight indicators will be updated each quarter as new data becomes available All data is derived from publicly available sources but MDST and GSF believe this the first time they have been used to provide a ‘customer’ perspective on container shipping developments.

Mike Garratt, Chairman of MDS Transmodal, commented: “The global economy depends very heavily upon the effective connectivity, capacity, reliability and cost effectiveness of the container industry.

“It is served by a fleet of around 5,000 container ships with a combined deployed service capacity of 200m TEU p.a. where 90% of the capacity on deep-sea services is controlled by the leading 10 shipping lines.

“The value of goods they transport, around $6-7trn p.a., equates to the combined GDP of Germany and the UK. This quarterly review seeks to bring together and analyse supply, demand, performance and economic data that uses common coding definitions to facilitate cross referencing to provide a coherent description of this industry.”

Garratt continued: “The data sources are (effectively) in the public domain. The Review is based upon data that MDST has been collating (on supply and demand) for 25 years. We are very interested in any feedback. In future editions, we will extend the richness of the data and analysis including for example shipping lines’ capacity shares and the logistic performance indicators.

“We are delighted to collaborate with the Global Shippers Forum in this venture, representing as it does the widest possible grouping of users of the container network. We trust it will be of interest to shippers, ports, lines, regulators, governments and international institutions alike”.

James Hookham, Secretary General of Global Shippers Forum, commented: “Shippers are experiencing massive fluctuations in global trading patterns, erratic service levels and runaway spot rates. The Container Shipping Market Review aims to give them an insight to what’s going on and allow them to put numbers to the changes they are experiencing.

“MDST’s unique data modelling capabilities will help shippers explain their experience of shipping services and costs to their internal audiences.

“It will also allow GSF and its member associations to provide a reliable evidence base in our work to inform national governments and international agencies of the behaviour of a sector which is vital to the economies of every trading nation on the planet.”