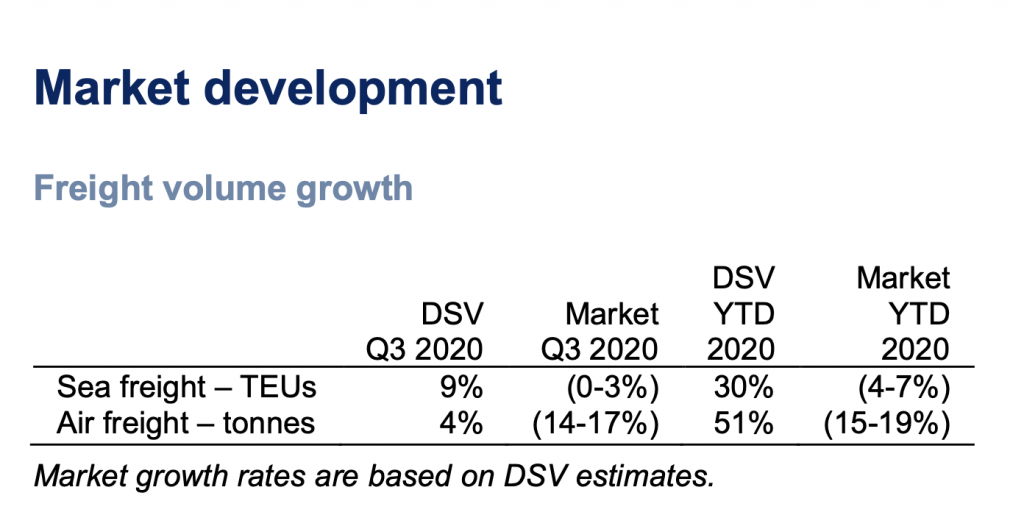

DSV Panalpina, announcing its Q3 2020 interim report, said that the negative impact from the COVID-19 crisis “eased off” during Q3 2020, and it estimates that the activity levels on most logistics markets – except for air freight – are close to the level in the same period last year.

The Denmark-based acquisitive freight forwarder said that the demand for air freight exceeds available capacity on most trade lanes, leading to higher-than-normal freight rates. The sea freight market has recovered faster than the air freight market.

Jens Bjørn Andersen, Group CEO: “In the third quarter of 2020, all three divisions delivered results above our expectations. Market conditions have been better than anticipated across most of our markets, and at the same time we benefit from efficient cost management.

“We are happy to announce that all material aspects of the Panalpina integration have now been successfully completed and we can now intensify the focus on organic growth.”

A separate company announcement about the launch of a new share buyback programme of up to DKK 6,000 million will be issued today. The programme will run until 30 April 2021 or earlier if finalised.

In its report, DSV Panalpina stated: “The air freight market is still impacted by the crisis and remains on index 80-85, as the available cargo capacity is reduced due to grounded passenger planes resulting in less belly space for cargo. This means that capacity is tight and air freight rates are significantly higher than last year.

“Since the beginning of the crisis, all our business units have been able to operate through lockdowns and other restrictions. So far, the financial impact from the crisis has been less severe than we originally anticipated.

“Currently, the situation continues to develop, and the number of COVID-19 infections is increasing in several countries. We are following the development closely and continue to follow public health procedures and guidelines to protect the health of employees and ensure safe and reliable operations.

“So far, we have not realised any material credit losses, and we continue to closely monitor trade receivables. As part of our normal credit policy, trade receivables are covered by credit insurance unless the customer is classified as a blue-chip company with low credit risk.”

DSV Air & Sea

Based on a successful integration of Panalpina and strong cost management, the division achieved 56% growth in gross profit and 62% growth in EBIT before special items for the first nine months of 2020. Freight volumes were negatively impacted by the COVID-19 crisis, but this was compensated by strong gross profit per shipment, especially in air freight.

DSV’s volume growth in 2020 was driven by the acquisition of Panalpina, which was included from 19 August 2019. The integration entails a gradual move of Panalpina volumes to the DSV transport management system. By the end of Q3 2020, close to 100% of Panalpina’s volumes had been transferred, and we are no longer able to separate organic growth from acquired growth.

With effect from 1 July 2020, DSV Air & Sea sold Airflo, which was part of the legacy Panalpina perishables activities. The Airflo activities represented approximately 5% of total air freight volumes, but less than 2% of air freight revenue and gross profit.

The air freight market is still significantly impacted by the COVID-19 crisis, with market volumes still 15-20% below last year. As most passenger planes are grounded, the belly-hold capacity is missing and total available capacity is more than 20% below pre-COVID-19 levels. The demand for air freight exceeds available capacity on most trade lanes, leading to higher-than-normal freight rates.

We expect that the air freight market will remain challenging in the foreseeable future. It may take 2-3 years before intercontinental passenger traffic is back at 2019 levels, and the market will continue to rely on freighter aircraft capacity. Currently, the demand is strongest for exports out of Asia, but other trade lanes are also picking up. When a COVID-19 vaccine is ready for distribution, this is likely to create further pressure on the air freight market.

The sea freight market has recovered faster than the air freight market, and in Q3 2020 volumes were close to Q3 2019 levels. Due to the relatively strong demand and efficient capacity management by the carriers, container rates are at record-high levels on several trade lanes.

The sea freight market saw the strongest development on the Trans-Pacific trade lane, where volumes were higher than same period last year. However, volumes on the Trans-Atlantic trade lane remains below last year. Due to the Group’s European footprint, DSV Air & Sea has a relatively high exposure to European imports and exports and less exposure to the Trans- Pacific and Intra-Asia traffics.

Group outlook for 2020

Based on the financial performance for the first nine months of 2020, guidance for full-year 2020 is updated as follows:

- Operating profit before special items is expected to be above DKK 9,250 million (in line with trading update of 9 October 2020)

- Special items, costs for 2020 are expected in the level of DKK 2,100 million (previously DKK 2,300 million)

- The effective tax rate is expected in the level of 25%

The guidance is based on assumptions of a continued gradual improvement of the freight markets with no further material disruptions of global supply chains.

Integration of Panalpina

The acquisition of Panalpina Welttransport (Holding) AG (Panalpina) was closed on 19 August 2019, as of which date Panalpina was included in the consolidated financial statements. The combination had a significant impact on the consolidated balance sheet and income statement for the Group in the first nine months of 2020 compared to the same period of 2019.

The operational and legal integration of Panalpina is now close to complete and has progressed slightly faster than originally expected.

The Panalpina acquisition has the largest impact on the Air & Sea division and only limited impact on Road and Solutions.

As Panalpina’s activities have been integrated into DSV’s network, it is not possible to separate organic growth from acquired growth.

DSV Air & Sea Divisional revenue and group

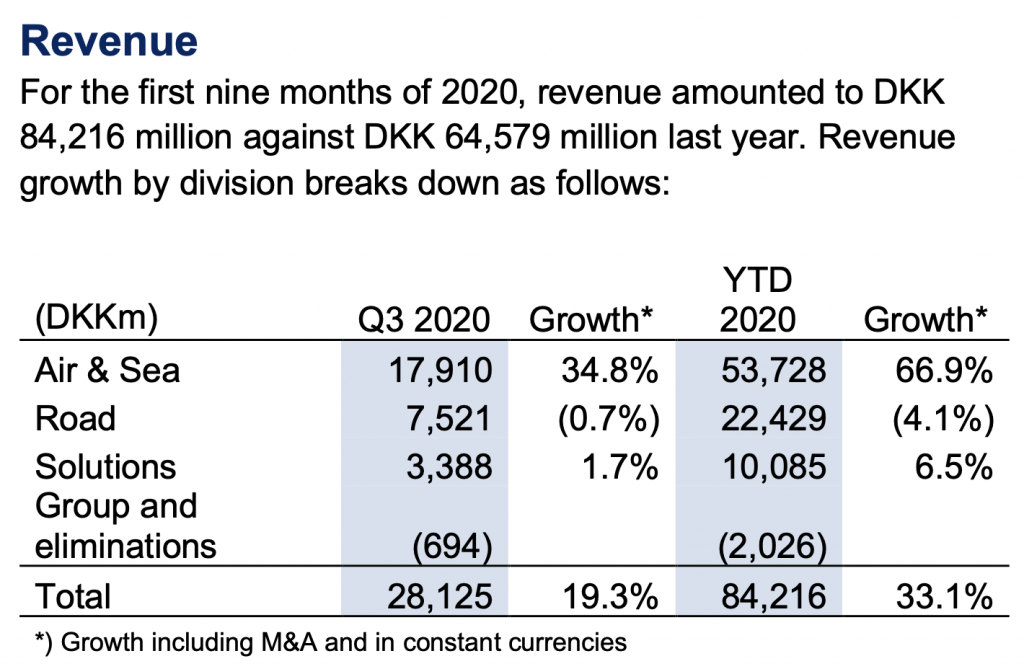

The DSV Air & Sea division’s revenue amounted to DKK 53,728 million for the first nine months of 2020, compared to DKK 33,074 million for the same period last year. The growth in revenue for the first nine months was 66.9%.

For Q3 2020, revenue amounted to DKK 17,910 million, compared to DKK 13,981 million for the same period last year. Growth for the quarter was 34.8%.

The increase in revenue was mainly attributable to the acquisition of Panalpina. Revenue was negatively impacted by lower volumes following COVID-19, but this was partly compensated by higher freight rates.

The division achieved the highest growth rate in the APAC region, reflecting that both volumes and freight rates have been strongest on trade lanes related to export from this region.

We have seen the best development within consumer goods and in the pharmaceutical sector, whereas industrial cargo, especially automotive, picked up during Q3 2020 but remains below 2019 levels.

DSV Air & Sea gross profit, divisional and group

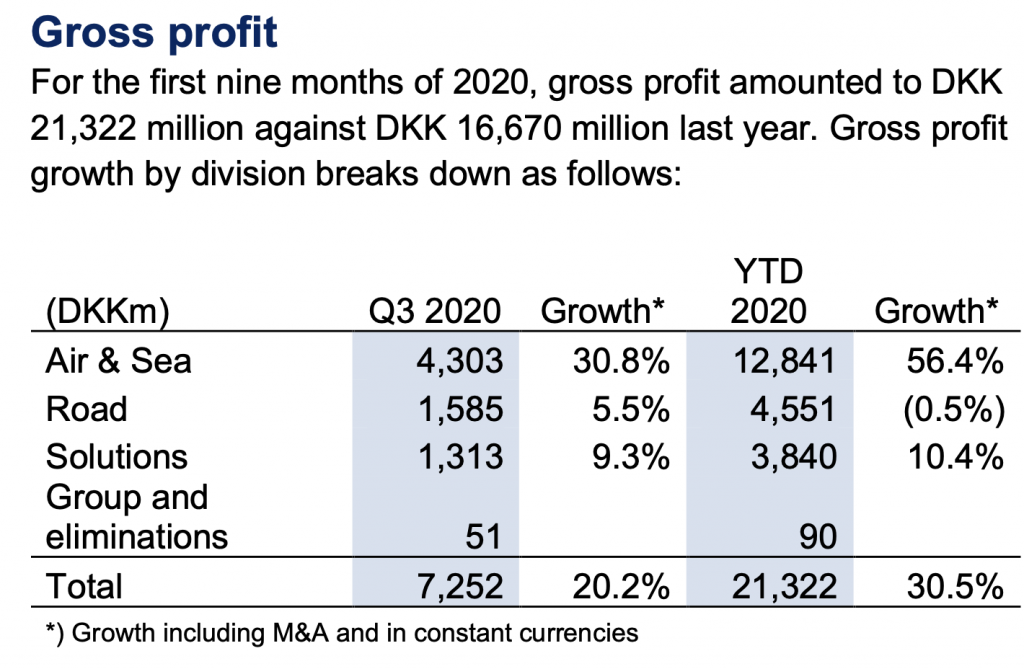

DSV Air & Sea gross profit was DKK 12,841 million for the first nine months of 2020, compared to DKK 8,396 million for the same period last year. This corresponds to a growth of 56.4% for the period.

For Q3 2020, gross profit amounted to DKK 4,303 million, compared to DKK 3,443 million for the same period last year, which corresponds to a growth of 30.8%.

Similar to revenue, the growth in gross profit for the first nine months of 2020 was mainly driven by the acquisition of Panalpina.

The negative volume impact from COVID-19 was compensated by strong air freight yields. The air freight yields declined from the extraordinary high level in Q2 2020, but are still above the

2019 level. This development can be attributed to the high rates and improved profitability of our air charter network. Furthermore, the disposal of Airflo in Q3 2020 led to a better activity mix with less low-margin perishables volumes.

The legacy Panalpina air charter network consists of longer-term charters (typically 12 months) of air freight capacity. The air charter network represents a relatively small part of the total volume handled, but DSV Air & Sea has increased the capacity and number of destinations in the network.

As the integration of Panalpina has progressed during the last 12 months, yields for both air and sea have gradually improved. This is due to scale benefits, optimised planning and better combinations of cargo.

The division’s gross margin was 23.9% for the first nine months of 2020, compared to 25.4% last year. The decline is due mainly to the difference in activity mix between legacy DSV and Panalpina and, secondly, a negative impact from pass-through revenue where higher freight rates cause lower gross margin.

DSV Air & Sea EBIT before special items

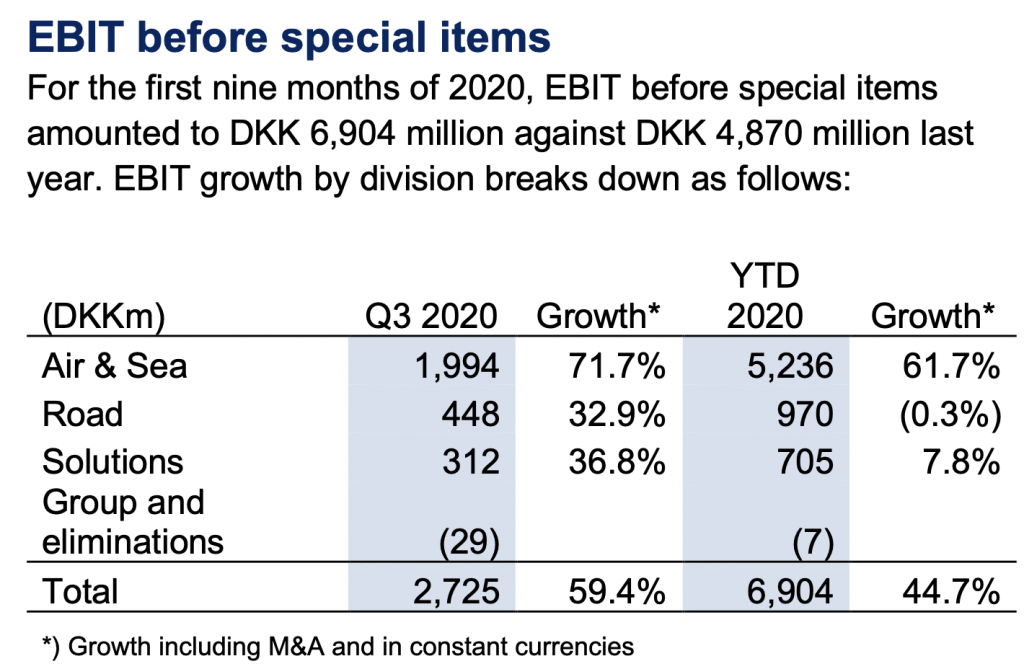

DSV Air & Sea EBIT before special items came to DKK 5,236 million for the first nine months of 2020, compared to DKK 3,311 million for the same period last year. This corresponds to a growth for the period of 61.7%.

For Q3 2020, EBIT before special items was DKK 1,994 million, compared to DKK 1,220 million for the same period last year, which corresponds to a growth of 71.7%.

The positive development was mainly a result of the inclusion of Panalpina, the realisation of synergies and the impact from the COVID-19 cost savings. Furthermore, the high gross profit in air freight had a direct impact on EBIT before special items.

All regions achieved growth in EBIT before special items, but, driven by strong gross profit, the APAC region achieved the highest growth both in Q3 and the first nine months of 2020.

The conversion ratio was 40.8% for the first nine months of 2020 (2019: 39.4%). The conversion ratio has steadily improved during 2020 as integration synergies and cost savings are realised.

For the first nine months of 2020, amortisation of customer relationships was DKK 135 million (2019: DKK 23.0 million).

Net working capital

The Air & Sea division’s net working capital came to DKK 3,612 million on 30 September 2020, compared to DKK 3,117 million on 30 September 2019. The increase is mainly due to increased activity with large key accounts with long credit terms.