Lufthansa Cargo had a strong second quarter despite the collapse in demand for air travel due to the Corona pandemic which led to an 80% drop in revenue for the Lufthansa Group in the second quarter to €1.9bn versus €9.6bn in 2019.

Most of the revenue (€1.5bn euros) was generated by Lufthansa Cargo and Lufthansa Technik.

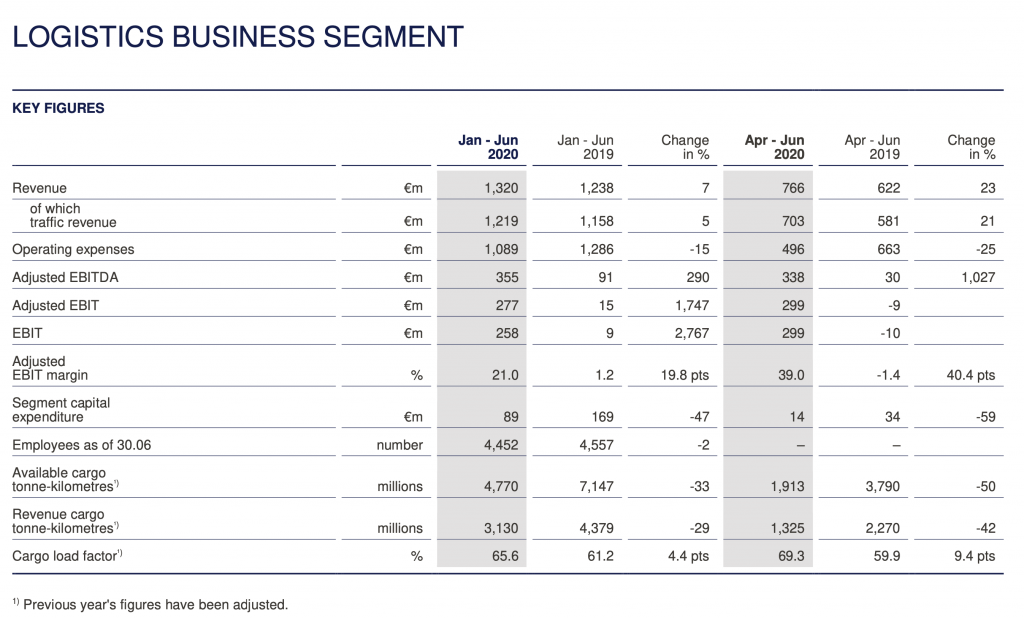

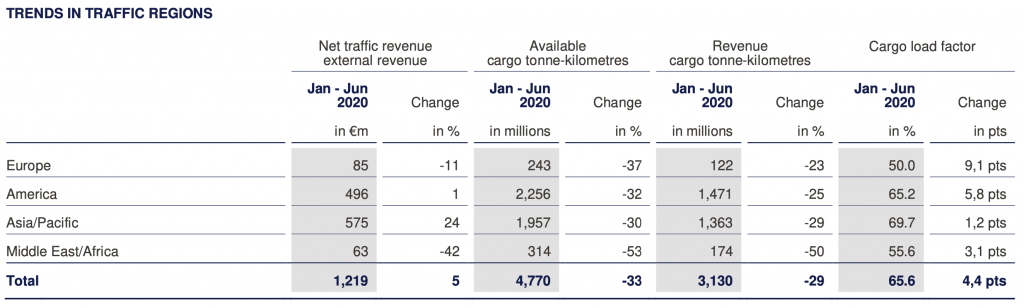

In the first six months, freight capacity offered by the German flag carrier fell by 36% and cargo kilometres sold by 32%. This resulted in an increase in the cargo load factor of. four percentage points to 66%.

The logistics division benefited from stable demand. The loss of cargo bellyhold capacity in passenger aircraft led to a significant increase in yields. Lufthansa Cargo’s adjusted EBIT rose to €299m (previous year: minus €9m).

Said an airline spokesperson: “Demand for the remaining cargo capacities went up during the first half-year of 2020, with the transportation of personal protective equipment in particular being in strong demand; to cope with the increased demand and to compensate for the loss of belly capacities, passenger aircraft were refitted and used to carry freight.”

As yields were higher, traffic revenue in the first half- year of 2020 rose by 5% year-on-year to €1,219m across all traffic regions. Revenue increased by 7% to €1,320m.

Operating expenses fell by 15% to €1,089m, due to a volume and price-related decline in fuel expenses, lower belly expenses paid to Group companies and decreased expenses for handling services, additional staff and operating costs were also reduced as a result of the cost-cutting programme ProFlex launched in 2019.

Adjusted EBIT increased to €277m accordingly for the logistics segment (previous year: €15m); EBIT rose to €258m (previous year: €9m), the difference compared with Adjusted EBIT was essentially due to write-downs of €19m on two MD11 freighters.

Carsten Spohr, chairman of the executive board and CEO of Deutsche Lufthansa, said: “We are experiencing a caesura in global air traffic. We do not expect demand to return to pre-crisis levels before 2024. Especially for long-haul routes there will be no quick recovery.

“We were able to counteract the effects of the coronavirus pandemic in the first half of the year with strict cost management as well as with the revenues from Lufthansa Technik and Lufthansa Cargo.

“And we are benefitting from the first signs of recovery on tourist routes, especially with our leisure travel offers of the Eurowings and Edelweiss brands. Nevertheless, we will not be spared a far-reaching restructuring of our business.”

Spohr continued: “We are convinced that the entire aviation industry must adapt to a new normal. The pandemic offers our industry a unique opportunity to recalibrate: to question the status quo and, instead of striving for ‘growth at any price’, to create value in a sustainable and responsible way.”

In the third quarter, Lufthansa group capacity offered is planned to increase to an average of around 40% of the prior year capacity on short- and medium-haul routes and to around 20% on long-haul routes.

In the fourth quarter, capacity is planned to further increase to an average of around 55% (short- and medium-haul) and around 50% (long-haul).

With this, the Group plans to return to 95% of the short- and medium-haul and 70% of the long-haul destinations by the end of the year. Thanks to a high degree of flexibility in supply and capacity planning, this figure can also vary at short notice.

Swiss WorldCargo, part of the Swiss carrier owned by Lufthansa group, performed just under 600 dedicated cargo flights until the end of June, transporting over 15,000 tonnes of goods (primarily medicines and further medical items).