Eytan Buchman, CMO at online freight marketplace and SaaS software provider Freightos, has published his latest analysis on sea and air rates.

Key insights:

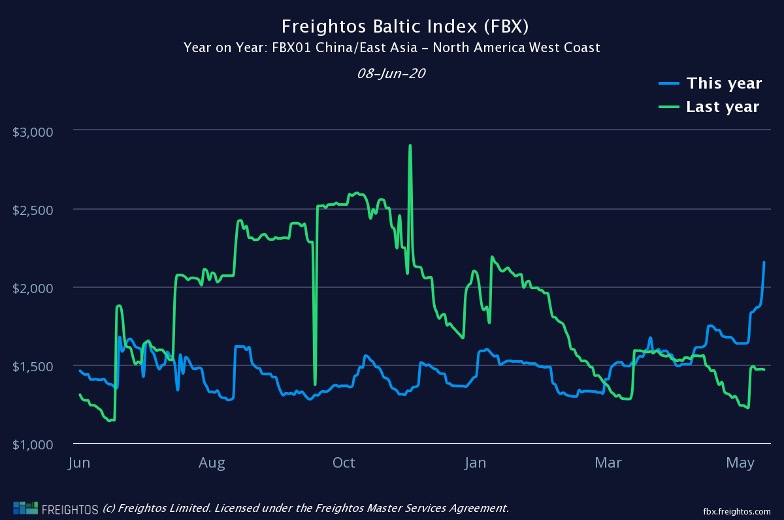

China-US West Coast ocean rates climbed 17% this week due to tight capacity and an unexpected bump in demand. Rates are at their highest level for over one year, dating back to January 2019. Celebrating may be premature – demand is still expected to lag through September, with ocean carriers announcing another rash of cancellations.

Air rates out of China continue to drop towards more standard levels as PPE consumers have been able to build inventory. Passenger capacity is also slowly coming back online.

WebCargo data shows a 63% increase in air cargo eBookings in May compared to April, indicating a reduction in volatility and a slow return to business as usual.

China-US rates:

China-US West Coast prices (FBX01 Daily) jumped 17% since last week to $2160/FEU. Rates are 48% higher than rates in 2019 at this time.

China-US East Coast prices (FBX03 Daily) increased 8% since last week, reaching $2875/FEU, and are 7% higher than rates for this week last year.

Analysis

The unexpected spike in demand over the last few weeks combined with tight capacity to push ocean rates up again this week. China-US West Coast rates climbed 17% to $2155/FEU, its highest level since January 2019.

Summer import projections are better than they were a month ago, but ocean volumes to the US are still expected to be down significantly through September.

And ocean carriers agree, announcing 75 more cancellations this week, with more expected in the coming days.

So far 10-15% of sailings from Asia to Europe have been cancelled through August, and 5-10% have been blanked to the US. The bump in demand has also resulted in some rolled shipments out of China, with some shippers reporting delays of up to two weeks to get on overbooked ships.

But there are some signs of a return to normal: Air rates continued to decline from their near-record highs out of China as PPE demand cools, with Freightos.com marketplace data showing rates falling by 5-15% across lanes out of China since last week.

Data from WebCargo – who announced a new partnership to offer live eBookings and pricing with Air Bridge Cargo this week – shows a 63% increase in air cargo eBookings in May compared to April, as some shippers may be motivated by the recent decline in rates and some commercial cargo returns to the market.

And after being hit hard by travel restrictions, some passenger air travel is also being restored, which will add capacity to the cargo market even as volumes dipped in the last few weeks.

There are also signs of life in US trucking employment, with Wall Street taking note, and eCommerce is still surging. As a result both UPS and FedEx announced rate hikes for high-volume shippers this week, and logistics operators added thousands of jobs in May to keep up with the volume of orders.

Eytan Buchman, CMO, Freightos