longer-term impact remains uncertain

The aviation-finance sector is bracing itself for Covid-19 turbulence as aircraft market values and lease rental factors fall amid subdued demand for air transport even though the long-term impact of the pandemic is hard to discern for now.

Scope Ratings says that any prolonged decline in aircraft values and leasing costs – represented by lease rental factors – could benefit surviving airlines when acquiring new aircraft.

However, until that happens, low aircraft values and lease rentals will remain a burden for airlines and aircraft lessors, respectively.

“Take the sale and lease back of unencumbered aircraft which is one way that airlines can cope with some of the extra debt they have taken on to get through the crisis,” says Helene Spro, aviation finance analyst at Scope.

“The catch is that the level of financial benefit from a sale and lease back is directly correlated to the sales price the airlines can obtain for the aircraft,” Spro says.

Lessors face a similar dilemma, said Spro. They will benefit from low aircraft values in a sale and lease back transaction if they have the financial capabilities to finance new acquisitions right now.

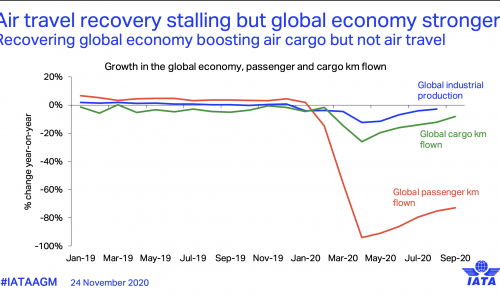

Yet demand from airlines for leasing new aircraft will be subdued at best as the industry faces a period of slack growth in air travel, assuming world economic growth recovers only slowly from the Covid-19 shock (See Scope’s latest airlines sector outlook).

“For aircraft lessors, the fall in residual values and renegotiation of lease rentals will substantially squeeze profitability,” said Spro.

The dramatic impact to date of the pandemic on the airline sector could accelerate the long-running trend toward leasing rather than owning passenger planes – more than half of airlines’ fleets were leased in 2018, according to consultancy CAPA – which is not necessarily an unhealthy development, Spro said.

The growing importance of aircraft lessors in the aviation market has increasingly helped distribute risk more evenly in the sector given how high the residual-value risk of a passenger jet is for airlines.

Added Spro: “Avoiding this risk is one of the reasons airlines enter leasing contracts instead of owning their whole fleet, leaving lessors holding the residual value risk of the aircraft in their possession.

“If the crisis continues, many airlines are likely to use unencumbered aircraft to secure capital through sale-and-leaseback transactions.

“Considering a leasing contract is normally signed for between six and 12 years, the impact on the aviation market could be felt well into the next decade.”

That said, there is still plenty of uncertainty for the outlook for aviation finance.

“Much depends on whether lenders and lessors remain willing to enter aircraft transactions without a strong rebound in demand for air travel – and the extent to which carriers retire planes from existing fleets,” Spro said.

If the crisis leads to a large oversupply in the market, it could be that many aircraft models will be retired and sold for parts, known as “parting out.”

“This could, of course, lead to an even balance between aircraft being parted out and new lease contracts which would mean that the level of leased aircraft will remain similar to today’s in the future,” she added.

But if the current crisis leads to the parting out of a much larger proportion of airlines’ fleets, then lessors would be hit hard.

Airlines would seek to operate their older models for as long as the economic value of doing so is greater than parting the planes out, thereby depriving lessors of new business and putting pressure on them to part out aircraft in their own possession.

Shifts in airlines’ strategy will also determine the future of aviation finance. Many airlines – such as low-fare, long-haul specialist Norwegian Air Shuttle which has preferred to lease rather than own planes – are reshaping their fleet and strategy by decreasing the number of aircraft in service and re-evaluating which destinations they will fly to after the crisis, suggesting a drop in demand for lessors and aircraft manufacturers.

Norwegian – which has agreed to a package of financial support from government as it prepares to put its business into “hibernation” until the air travel market starts to recover – is an example of the pressure lessors are currently under from carriers.

The airline has negotiated a deal with several of them which will involve only paying lease rentals for aircraft that are flying, with rentals waived for those planes grounded due to coronavirus.

Said pro: “For Norwegian, this is a credit positive as it decreases their liabilities and fixed costs in the coming months. However, this will seriously hit the lessors’ financial position if the same lessors see a necessity to enter similar agreements with other airlines.”

When the crisis is over, according to Scope, there could potentially be a large increase in leasing contracts because the fall in lease rental costs will have made it relatively economically attractive for the surviving airlines to lease rather than own aircraft.

For aircraft investors, aircraft oversupply is a looming threat though it is also hard to quantify right now. The extent of the problem for aircraft investors depends on whether airlines default due to the crisis, the size of the fleets flown by those carriers and which aircraft models airlines decide to retire first as they streamline operations.