Rivals target Swiss giant’s business in Q2 as DSV merger progresses.

Panalpina “stood its ground” in the first half of 2019 despite competitors going “more aggressively” after its business in the second quarter as its prepared for the merger with DSV.

The Swiss forwarder saw airfreight volumes rise 5% and seafreight volumes fall 3% in the first six months of this year compared with same period 2018.

In his outlook, Panalpina chief executive Stefan Karlen described a “highly uncertain macroenomic and political environment,” and added: “Against the backdrop of “contracting air and ocean freight markets, we will continue to provide our sought-after expertise to existing and new customers,”

In the first half of 2019, Panalpina’s gross profit decreased 4% to SFR716.4m, while total operating expenses decreased to SFR585.1m.

Said Karlen: “After it was announced that Panalpina and DSV would join forces, our competitors went more aggressively after our business in the second quarter, but we stood our ground.

“The decrease in gross profit was chiefly the result of lower margins in airfreight and lower volumes from the automotive sector, which shifted into reverse gear.

“Nonetheless, group EBIT and profit almost reached last year’s levels. Given these circumstances, our stable half-year results are a respectable achievement.”

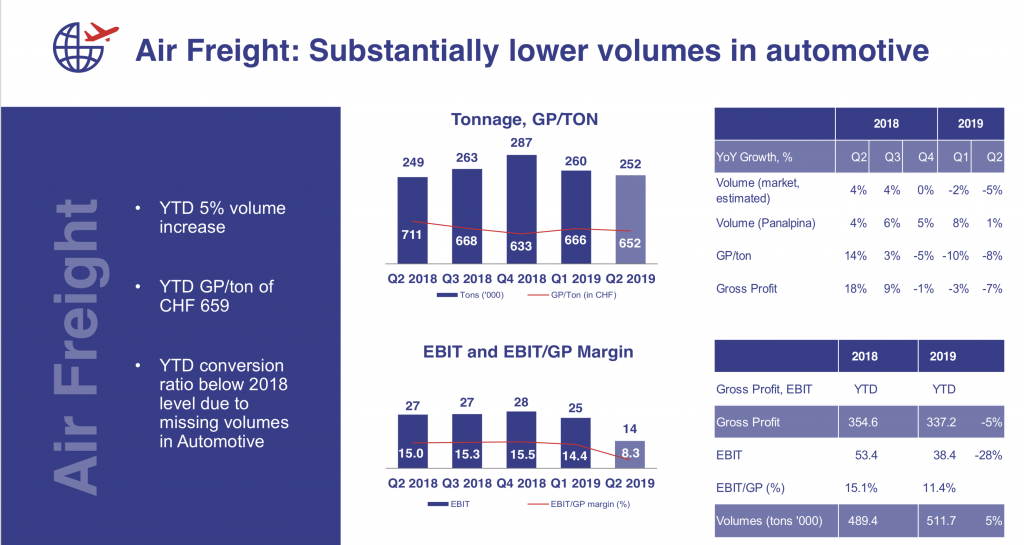

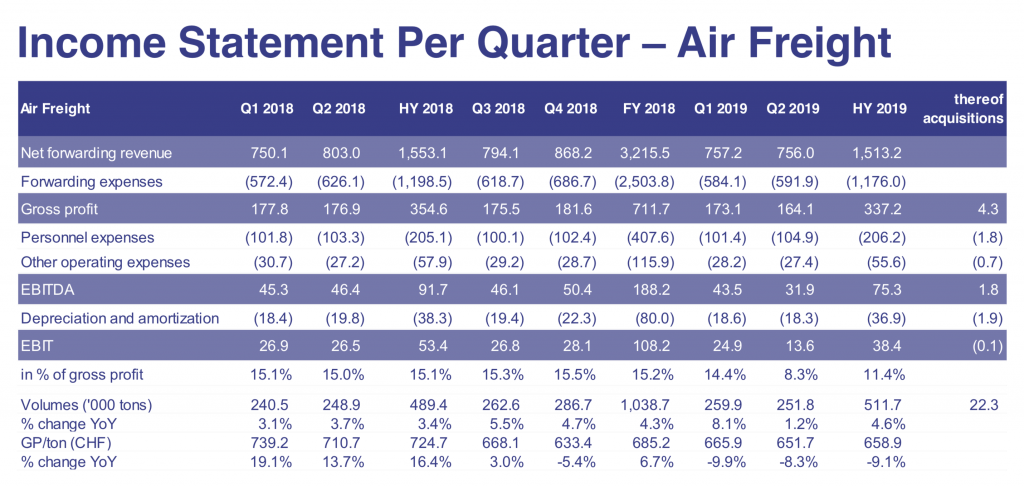

Panalpina’s airfreight volumes increased 5% in the first half of 2019. Compared to the same period last year, gross profit per ton decreased 9% to SFR659, while overall gross profit decreased to SFR337.2 m.

“Substantially lower volumes” in the automotive sector led to the decline in gross profit. EBIT in airfreight decreased from SCF53.4m to SFR38.4m. The EBIT-to-gross-profit margin came in at 11.4%, compared to 15.1% the year before.

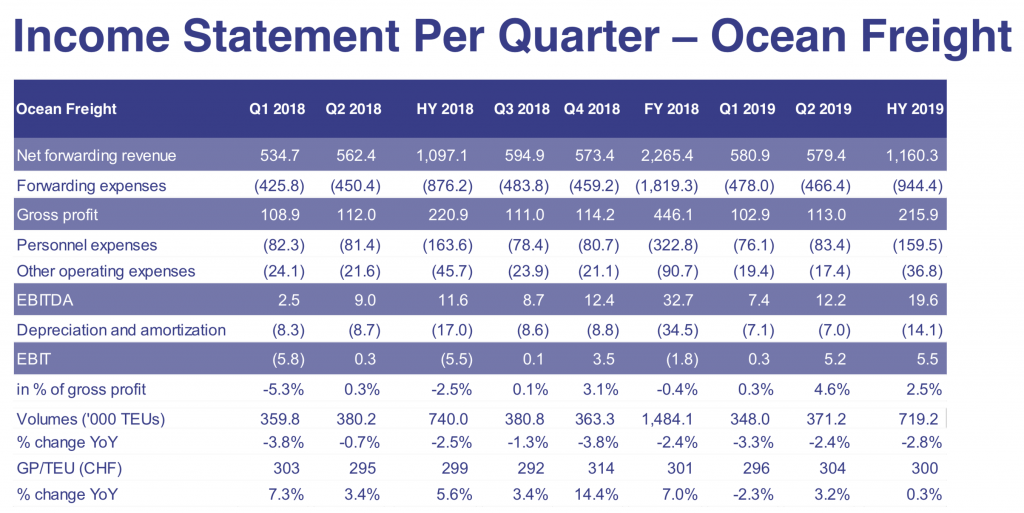

Panalpina’s ocean freight volumes decreased 3% year-on-year and gross profit per TEU increased slightly to SFR300, bringing gross profit to SFR215.9 million versus SFR220.9 m in 2018.For the first half of 2019, ocean freight recorded an EBIT of SFR5.5m, compared to a loss of SFR5.5m the year before.

DSV merger update: 88.3% of Panalpina shares tendered

In a statement today, DSV provided an update on its merger with Panalpina: “Based on preliminary figures, up to the expiration of the Extended Main Offer Period on 17 July 2019 a total of 20,965,054 Panalpina Shares have been tendered into the Offer, corresponding to 88.27% of all Panalpina Shares listed as of 17 July 2019, respectively 88.27% of the 23,750,000 Panalpina Shares that are the object of the Offer (success rate).