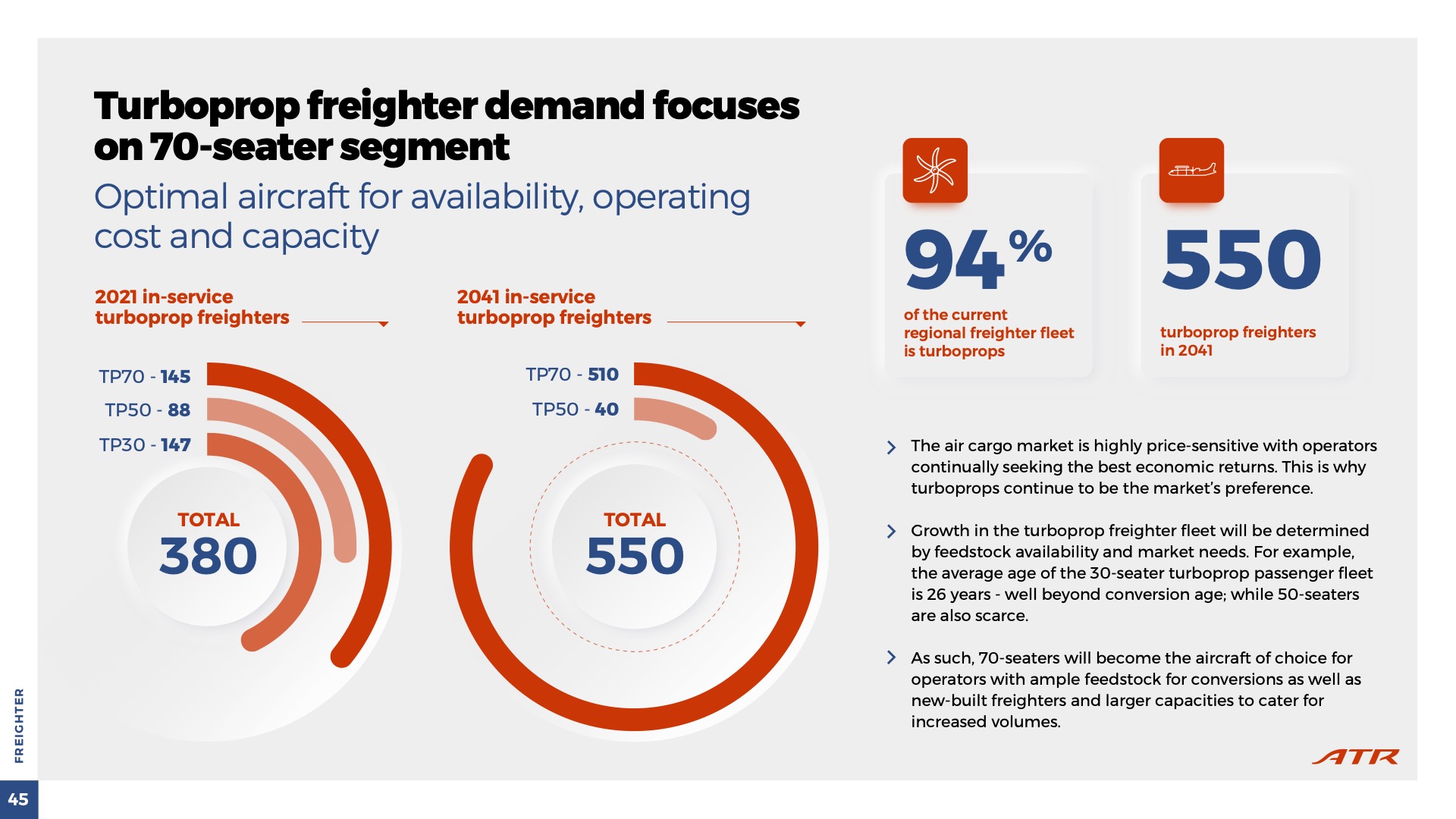

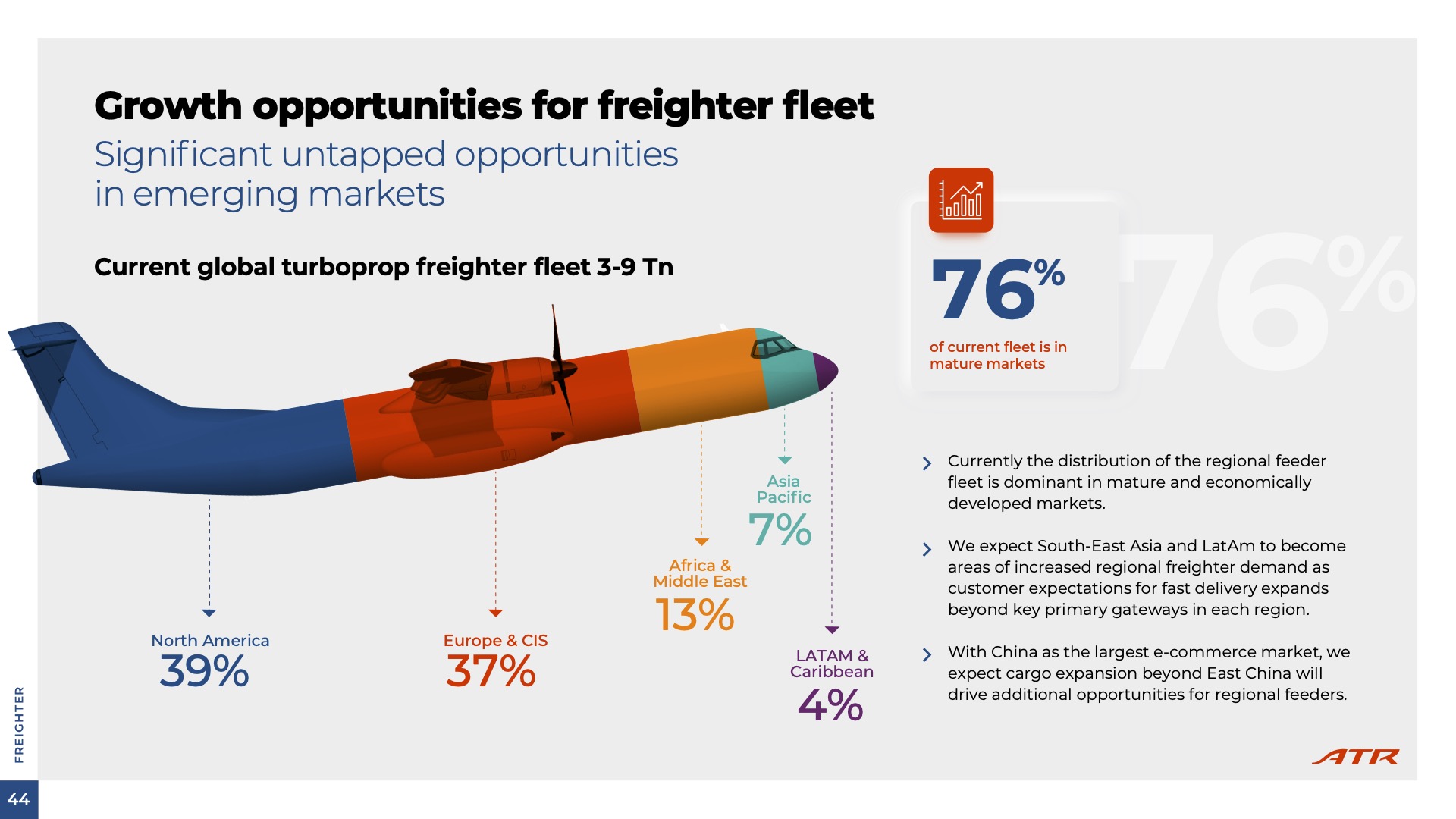

ATR, the regional aircraft manufacturer, predicts that the global fleet of turboprop freighters will grow from 380 in 2021 to 550 in 2041, a 45% increase.

The company’s new market forecast says that demand for at least 2,450 turboprop passenger and cargo aircraft over the next 20 years will meet the increasing role for regional connections and lower emission air transport.

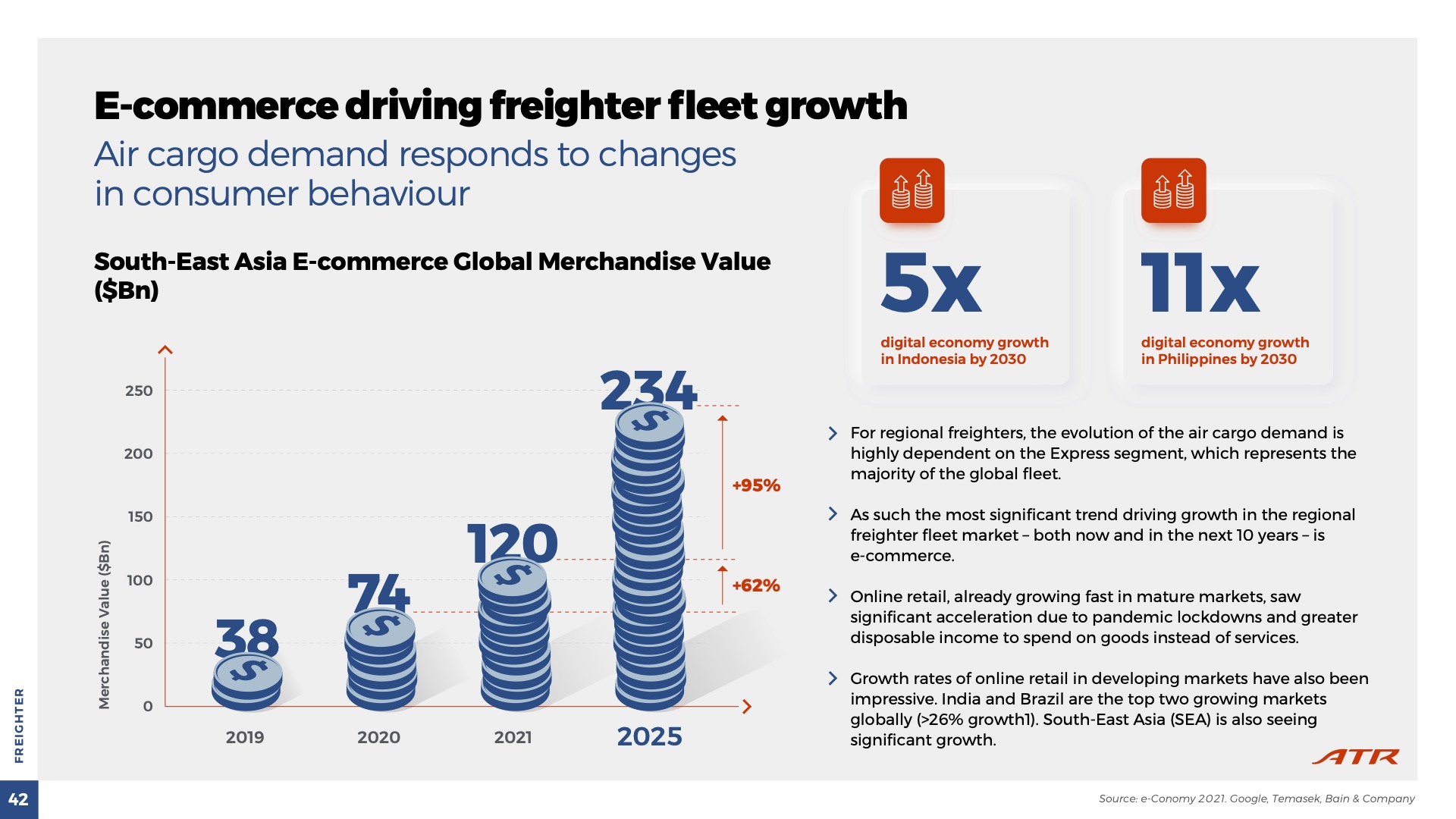

The report observes that freighters have come to play an essential role in supporting regional communities, partly due to the acceleration of the digital economy and ecommerce.

The ATR market report states: “We expect the demand for regional freighters to continue globally, as China, South-East Asia and Latin America see increased demand for fast deliveries expanding beyond key primary gateways in the regions.

“For regional freighters, the evolution of the air cargo demand is highly dependent on the express segment, which represents the majority of the global fleet.

“As such the most significant trend driving growth in the regional freighter fleet market – both now and in the next 10 years – is e-commerce.”

The report notes that online retail, already growing fast in mature markets, saw “significant acceleration” due to pandemic lockdowns and greater disposable income to spend on goods instead of services.

Growth rates of online retail in developing markets have also been “impressive,” says ATR, adding that India and Brazil are the top two growing markets globally (>26% growth). South-East Asia (SEA) is also seeing significant growth.

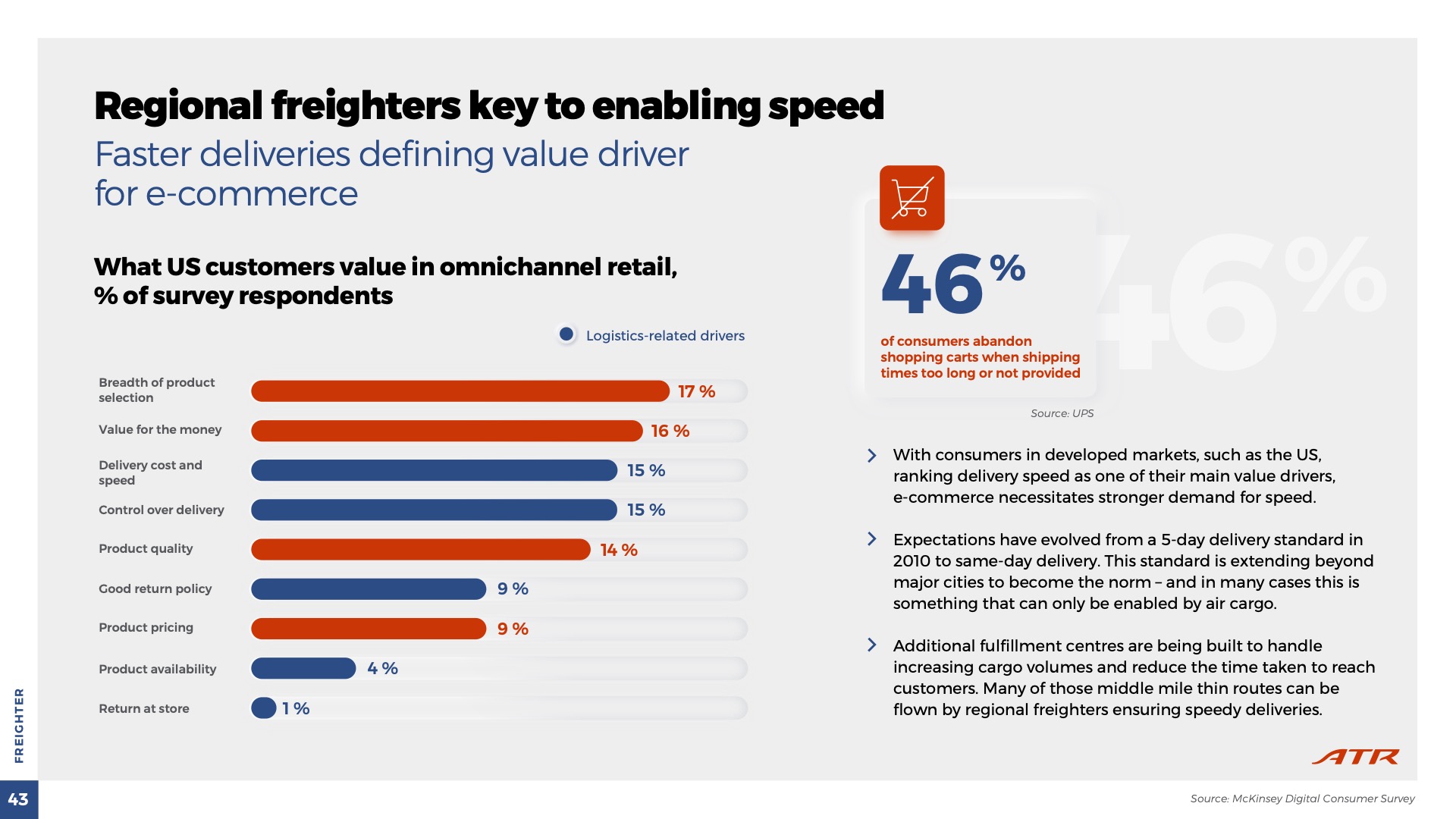

The report states: “With consumers in developed markets, such as the US, ranking delivery speed as one of their main value drivers, e-commerce necessitates stronger demand for speed.”

Expectations have evolved from a 5-day delivery standard in 2010 to same-day delivery, says ATR, adding: “This standard is extending beyond major cities to become the norm – and in many cases this is something that can only be enabled by air cargo.”

As a result, additional fulfillment centres are being built to handle increasing cargo volumes and reduce the time taken to reach customers. “Many of those middle mile thin routes can be flown by regional freighters ensuring speedy deliveries.

“Currently the distribution of the regional feeder fleet is dominant in mature and economically developed markets.

“We expect South-East Asia and LatAm to become areas of increased regional freighter demand as customer expectations for fast delivery expands beyond key primary gateways in each region.”

Identifying China as the largest e-commerce market, ATR expects cargo expansion beyond East China will drive additional opportunities for regional feeders.

An additional factor driving future demand in turboprops is their ability to address the changing regulatory environment created by climate challenge.

Increasing fuel prices, growing carbon taxation, as well as greater passenger demand for lower emission travel all mean that the aviation industry is naturally favouring low-carbon emitting aircraft such as turboprops.

ATR estimates that if all regional jets in Europe were replaced by turboprops, the reduction of CO2 emissions would be equivalent to the amount of CO2 removed by a forest of around 5.000 km2, more or less the size of the Balearic Islands!

The report concludes that new disruptive technologies, likely to be adopted from 2030 onwards, will further bring turboprops to the forefront of the aviation industry, helping play a vital role in connecting people and businesses and driving economic growth around the globe.