Overall CO2 emissions reduced by -2.1% from 2020 to 2021

IBA, the aviation advisory and analytics company, has revealed its latest monthly Aviation Carbon Emissions Index in association with KPMG.

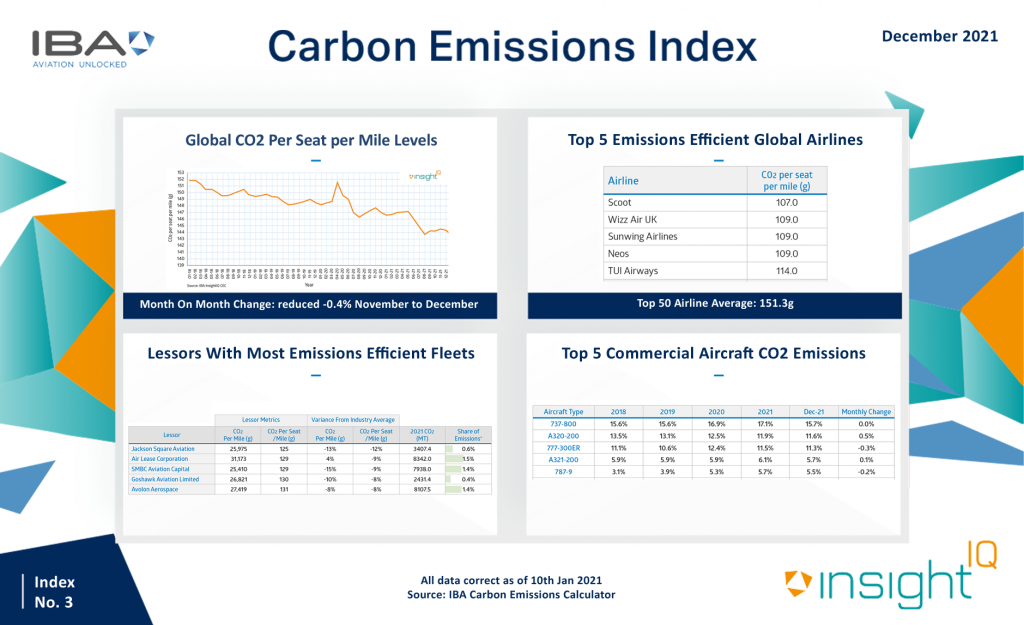

CO2 emissions in the commercial aviation industry averaged 143.7 grams of CO2 per-seat-per mile in December 2021. Overall carbon intensity per-seat reduced by -0.4% month on month from November to December 2021, and -2.1% year on year from 2020 to 2021.

2021 proved to be a challenging year for a sector reeling from the pandemic, but the industry is following a positive trend, with improving overall efficiency.

Whilst deliveries of new generation aircraft continue, the pandemic has hampered the pace at which they can enter service in airline fleets. As the recovery begins to ramp up through 2022 and beyond, IBA expects operators will continue to reactivate their dormant fleets as the requirement for capacity increases. This is likely to result in the global emissions figure creeping up slightly, before plateauing in the next 2-3 years as demand returns and stabilises.

Aircraft Efficiency Spotlight

The global share of emissions remains relatively unchanged for December with a broad increase of flights growing linearly for most types. This is with the exception of some newer generation narrowbodies such as the Boeing 737 MAX 200 that show a sharp uptick in month-on-month utilisation in December 2021 of 27%. However, the types overall contribution towards global emissions stands at less than 0.5%.

Looking ahead, there will likely be significant evolution of the fleet emissions share, with some of the biggest losers being the Airbus A319 (in favour of the Airbus A220-300) and the Boeing 777-200ER, which is likely to be phased out faster than expected.

The share in emissions for the Boeing 787 family is likely to stall for at least the next six months as Boeing indicates deliveries are unlikely to resume until deep into Q1 2022. This picture will change significantly over the coming years with the Boeing order book for the type standing at over 500 aircraft.

Lessor Efficiency Spotlight

Jackson Square Aviation ranked at the top of the lessor efficiency index with an average of 125g CO2 per-seat per-mile in December 2021. This was helped by a large portion of their portfolio consisting of Airbus A320-200neo and Boeing 737 MAX 8 aircraft at an average fleet age of just 5.7 years. However, with only just over 24 aircraft on the order books, Jackson Square Aviation may gradually slip down the ranking as Avolon Aerospace as an order book exceeding 220 aircraft.

Air Lease Corporation will experience a similar shift on an already positive efficiency figure, with over 300 aircraft currently on order consisting of predominantly Boeing MAX jets and Airbus A220-300s.

Airline Efficiency Spotlight

December 2021 sees the exit of Air Transat and the addition of TUI Airways to IBA’s airline efficiency ranking. TUI joins the ranking largely due to an uptick in 737 MAX 8 utilisation. As per IBA’s previous index release, Scoot remains high in the ranking due to a large portion of its Airbus A320-200ceo fleet remaining stored throughout 2020 and 2021.

IBA expects to see Wizz Air UK and its parent company remain at the top of the rankings in the coming years as Wizz Air gradually takes delivery of more Airbus A320neo family aircraft. The table below spotlights airline efficiency in the month of December 2021.

IBA Forecasts Major US Carriers’ CO2 Emissions for 2025

IBA used the unique scenario modelling capabilities of its Carbon Emissions Calculator to forecast the future CO2 emissions of these major US carriers. This exclusive feature allows users to compare the performance of portfolios, lessors and operators to provide actionable insights on current and future fleet composition and route improvements.

IBA predicts that Delta Air Lines, American Airlines, United Airlines and Southwest Airlines, the top four largest airlines in the US (also the top four largest airlines globally), will experience a significant downward shift in carbon intensity over the next 3 years.

Kieran O’Brien, Partner in Management Consulting and Lead Advisory Partner in the Aviation Finance and Leasing Practice at KPMG Ireland, affirms the importance of this month’s index and what it means for the future of the industry: “With 2% expected annual reduction with incremental engine improvements and their gradual roll-out through the global fleet, as opposed to the 5%+ type CAGRs needed to achieve the 2050 net neutral targets. This points to the need for SAF in short to mid-term and then wider portfolio definitions long-term.

“In terms of ESG and industry we expect 2022 to bring increased scrutiny over ‘greenwashing’. SEC has not released any mandatory climate risk disclosure rules, but we expect to anticipate further developments in early 2022. It is crucial any ESG strategy is underpinned by data and analytics, which is why we expect external data sources to develop significantly with ESG scoring tools and international standardisation leading the way – similar to the IBA’s platform.”