Congestion on the ground muted air cargo’s growth in November, with volumes falling by -1.2% versus October, reversing the trend traditionally seen in the peak build-up to Christmas, according to the latest global air cargo market intelligence from industry analysts, CLIVE Data Services.

CLIVE’s analyses of the air cargo market for the full four weeks of November 2021 measures the industry’s performance to the pre-covid 2019 level, as well as providing 2020 year-over-year comparisons, to produce a meaningful assessment of the current operating performance.

Last month’s fall in volumes compared to October 2021 came despite a +0.5% rise in capacity, while overall air cargo rates climbed +8% in November month-on-month.

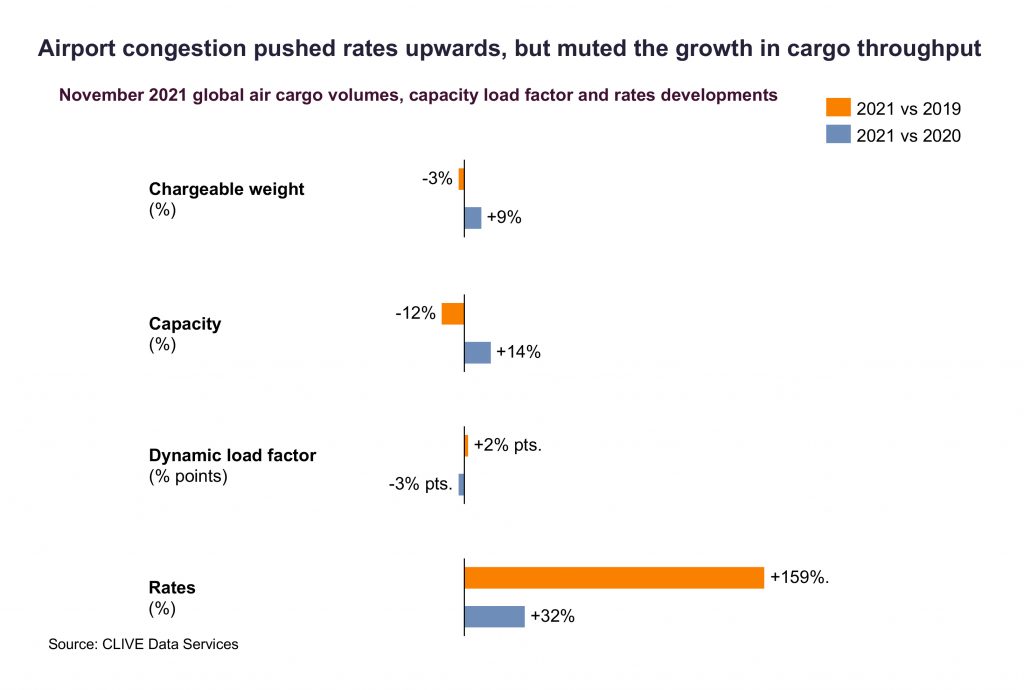

Compared to November 2019, last month recorded a 3% decline in demand, but overall air cargo rates remained buoyant at +159%. Capacity versus two years ago was -12%, lifting CLIVE’s ‘dynamic load factor’ – based on both the volume and weight perspectives of cargo flown and capacity available to produce a true indicator of airline performance – up 2% pts to 66%.

Europe to North America market data for the last week of October versus the third week of November, prior to the Thanksgiving holiday in the US, showed capacity down 7.3% and load factor up 4% pts to 86%.

Airfreight rates for this market consequently saw a 10% increase. Any hope that the opening up of transatlantic services would offer some relief to the cargo market was quickly eradicated by increased volumes of passenger baggage.

“Typically, we would expect November volumes to be higher than October volumes, but that’s not reflected in this latest volume and load factor data. We started to see the growth slowing down at the end of October. The global load factor for November was 2% pts lower than in October, which is quite remarkable,” said Niall van de Wouw, CLIVE’s Managing Director.

“This unexpected month-over-month shift is not due to a lack of demand, it is almost certainly because cargo cannot be pushed efficiently through the system. This is also what we’ve seen reported in the oceanfreight market at US west coast ports.

“Labour shortages are a factor in all sectors, but this is especially having an impact on such a labour-intensive industry as airfreight, especially on the ground. Airport congestion seems to be the price the industry has to pay for the lack of investment in, and appreciation of, cargo handling,” he added.

“The current inefficiencies on the ground must have opportunity costs for airlines, forwarders and shippers alike, because cargo will be missing flights.

“Two months ago, we described the air cargo market as ‘fragile’ heading into the traditional peak season, and this fragility is being visualised on social media through airport movies showing countless pallets and containers waiting on the tarmac.”