Aviation data analyst IBA has issued its latest update on the passenger to freighter (P2F) conversion market and drawn some interesting conclusions, using its InsightIQ aviation database.

IBA states:

With the onset of the COVID-19 pandemic, airlines saw the majority (and in some cases all) of their passenger fleets grounded as various lockdowns came into force around the world.

According to intelligence from IBA’s InsightIQ, the number of parked or stored aircraft has increased by a factor of 2.5 between December 2019 and June 2021*. This accounted for 60 different aircraft types operating in the narrowbody and widebody market.

The grounding of the passenger fleet caused an expected drop in the amount of cargo space available in the hold of those passenger aircraft, and attention inevitably turned to passenger to freighter converted aircraft to cater for the increased demand for transportation of freight.

This grounding represents a substantial decline in the availability of cargo space, and when viewed in relation to the bigger picture, passenger to freighter conversions will likely have a minimal impact on capacity and Available Freight Tonne Kilometres (AFTKs). The issue of lack of capacity has been compounded by the increased volume of global e-commerce trade and demand for PPE supplies brought about by the Coronavirus pandemic.

Reduction in belly capacity leads to record freighter utilisation levels

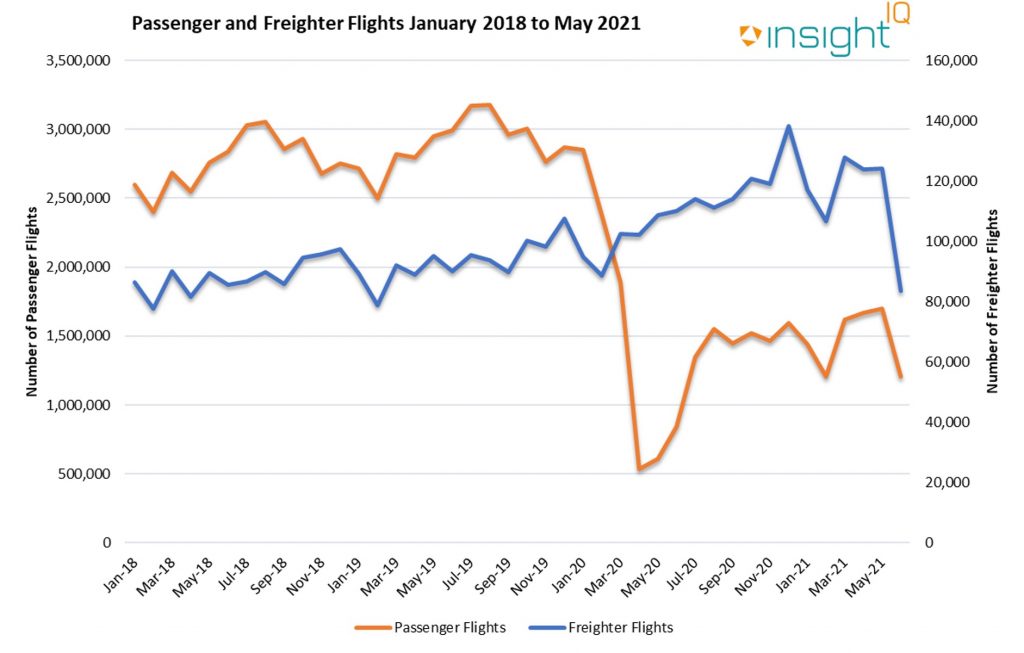

These combined factors have resulted in freighter utilisation increasing to never before seen levels. Prior to COVID-19,InsightIQ recorded around 78,000 freighter flights per month. This had risen to over 138,000 flights per month by December 2020, representing an additional 30,000 flights when compared to December 2019.

More flights for newer freighters, faster retirement for ageing type. Virtually all cargo aircraft types serving within the freighter market have seen an overall increase in the number of flights operated.

The only types which have seen a decline are older generation aircraft such as the Airbus A310-300, Douglas DC-10 and McDonnell Douglas MD-11. These types were typically already in the process of retirement, and are being replaced by newer aircraft models such as the Airbus A330-200/300P2F, Boeing 777F and Boeing 767-300.

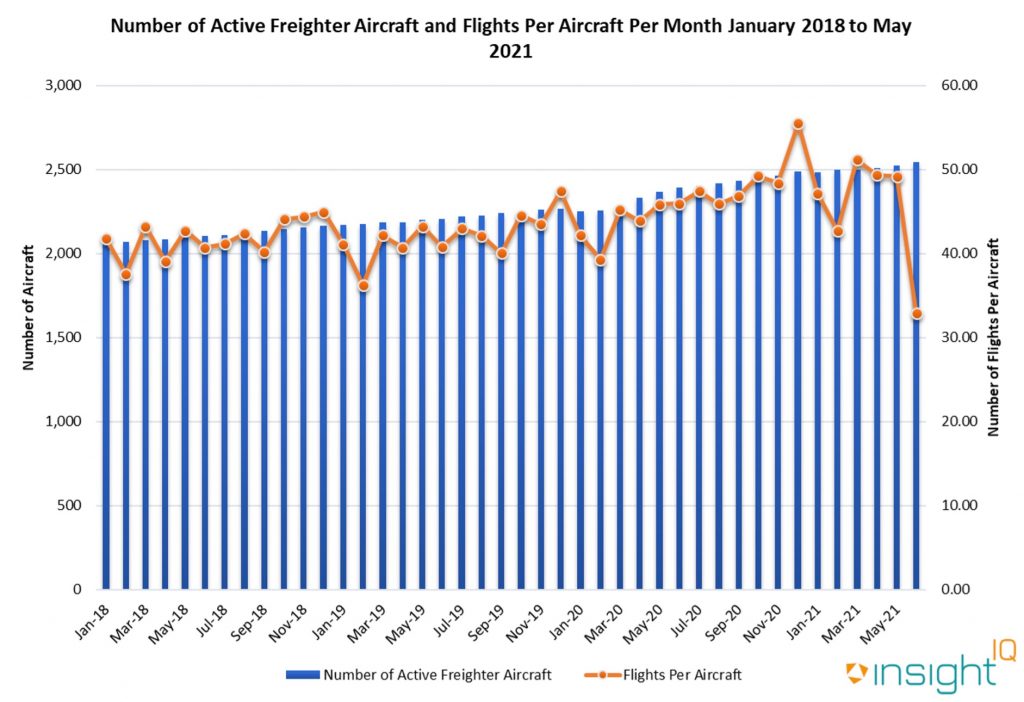

The growth in flights operated by freighter-configured aircraft has been achievable through 3 key initiatives.

- Stored aircraft re-entering service

- New aircraft deliveries

- P2F conversions.

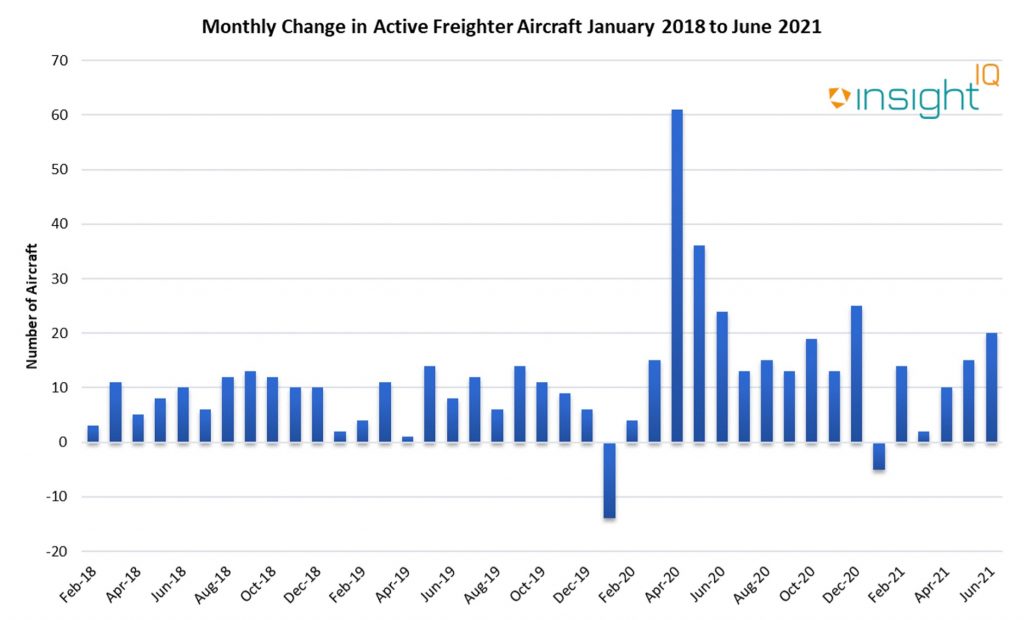

A notable spike in freighter aircraft returning to service was observed in April 2020, when the first wave of the pandemic made its mark on the global landscape. Since then, the overall number of active freighters and number of flights operated by each aircraft has increased.

Despite increased capacity, supply is still falling short of demand, so yields have been driven to new heights. Despite this, as passenger services emerge from the pandemic it is expected that yields will return closer to normal as more capacity is made available. The timescale for this will be dependent on a combination of factors, with vaccine uptake and consumer spending patters proving decisive drivers.

*IBA’s InsightIQ platform recorded 2,645 aircraft as either being parked or stored in December 2019, increasing to 6,707 aircraft in June 2021, representing a factored increase of 2.5.